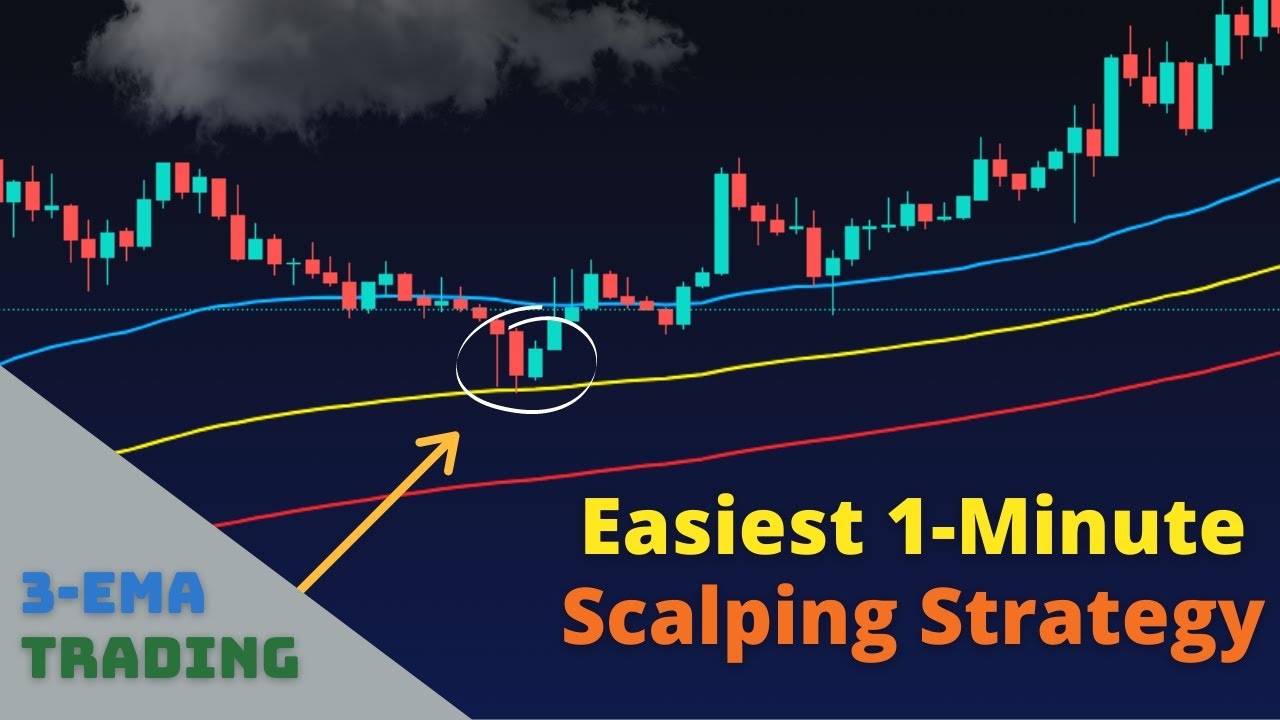

The Easiest 1-Minute Scalping Strategy: 3-EMA Trading Strategy

New clips about Swing Trading Ranges, Forex Traading System, Trading Rules, and Stochastic Settings For Day Trading, The Easiest 1-Minute Scalping Strategy: 3-EMA Trading Strategy.

In today’s video, I reveal one of the easiest scalping strategies ever. We will use just 3 moving averages. I hope that at the end of the video, even a beginner …

Stochastic Settings For Day Trading, The Easiest 1-Minute Scalping Strategy: 3-EMA Trading Strategy.

Financiers Check Out Technical Analysis

Emotions are like springs, they stretch and agreement, both for only so long. Forex swing trading is one of the very best methods for amateurs to seek big gains. The external bands can be utilized for contrary positions or to bank profits.

The Easiest 1-Minute Scalping Strategy: 3-EMA Trading Strategy, Explore most shared full length videos related to Stochastic Settings For Day Trading.

3 Most Convenient Methods To Become A Successful Forex Swing Trader Fast

When a rate is rising strongly. momentum will be increasing. Let’s look at the logic behind Forex swing trading and how to make regular profits. The trader should be ready to acknowledge how much they are prepared to lose.

Here we are going to look at currency trading essentials from the perspective of getting a currency trading system for revenues. The one confined is basic to understand and will enable you to seek big gains.

If the break occurs you go with it, you require to have the Stochastic Trading frame of mind that. Sure, you have actually missed out on the first little bit of revenue but history reveals there is generally plenty more to follow.

Them significant problem for a lot of traders who use forex technical analysis or forex charts is they have no understanding of how to deal with volatility from a entry, or stop viewpoint.

Many signs are readily available in order to recognize Stochastic Trading the trends of the marketplace. The most efficient indicator is the ‘moving average’. 2 moving average signs must be used one fast and another sluggish. Traders wait till the quick one crosses over or listed below the slower one. This system is likewise referred to as the “moving average crossover” system.

A few of the stock signals traders take a look at are: volume, moving averages, MACD, and the Stochastic Trading. They also ought to try to find floorings and ceilings in a stock chart. This can show a trader about where to get in and about where to get out. I say “about” because it is quite hard to guess an “specific” bottom or an “exact” top. That is why locking in profits is so so vital. , if you don’t lock in earnings you are really running the danger of making a worthless trade.. Some traders become actually greedy and it just harms them.

The Stochastic Indication – this has actually been around because the 1950’s. It is a momentum indication which determines over purchased (readings above 80) and over offered (readings listed below 20), it compares today’s closing cost of a stocks cost variety over a current period of time.

Yes and it will constantly make cash as long as markets trend breakouts will happen and if you are selective on the ones you choose and validate the relocations, you might enjoy magnificent currency trading success.

In an uptrend each new peak that is formed is greater than the previous ones. The Stochastic – is a really powerful trade indication. His work and research study are first class and parallel his character as an individual.

If you are looking more entertaining comparisons about Stochastic Settings For Day Trading, and Forex Success, Turtle Trading System you are requested to list your email address for newsletter totally free.