The Best Day Trading Strategy | E.P 2

Interesting full videos relevant with Forex Trading Softwa, Forex Trading Robots, Trend Detection in Forex Trading, and How To Trade Stochastic Divergence, The Best Day Trading Strategy | E.P 2.

How To Trade Stochastic Divergence, The Best Day Trading Strategy | E.P 2.

How To Make Cash Online Through Forex Trading

What were these fundamental analysts missing? The most effective sign is the ‘moving average’. But all is not lost if the traders make rules on their own and follow them.

Looking for a Forex robotic to help you trade?

The Best Day Trading Strategy | E.P 2, Find most searched explained videos related to How To Trade Stochastic Divergence.

How To Generate Income Trading The Nasdaq 100

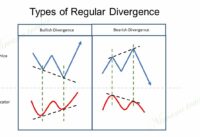

Traders wait till the quick one crosses over or listed below the slower one. More common indicators consist of: stochastic, r.s.i, r.v.i, moving averages, candle sticks, etc. Use another indication to validate your conclusions.

You can so this by utilizing the stochastic momentum sign (we have written often on this and it’s the very best indication to time any trade and if you are not farmiliar with it find out about it now) watch for the stochastic lines to turn down and cross with bearish divergence and go short.

If one should know anything about the stock exchange, it is this. It is ruled by emotions. Emotions resemble springs, they stretch and agreement, both for only so long. BB’s procedure this like no other sign. A stock, particularly commonly traded big caps, with all the essential research in the world already done, will just lie dormant for so long, and after that they will move. The move after such dormant periods will usually remain in the direction of the total trend. If a stock is above it’s 200 day moving average Stochastic Trading then it is in an uptrend, and the next move will likely be up as well.

Trade the odds and this indicates cost momentum need to support your view and verify the trade before you get in. 2 fantastic momentum indicators are – the stochastic and the Relative Strength Index – look them up and utilize them.

These are the long term financial investments that you do not rush into. This is where you take your time analyzing Stochastic Trading a good spot with resistance and support to make a huge slide in earnings.

If you captured just 50% of every significant trend, you would be really rich; accept short term dips versus Stochastic Trading you and keep your eyes on the larger long term prize.

2 of the very best are the stochastic indication and Bollinger band. Utilize these with a breakout technique and they offer you an effective combination for seeking huge gains.

If the price goes to a higher pivot level (which can be assistance or resistance) and the stochastic is high or low for a large time, then a turnaround will happen. Then a new trade can be gone into appropriately. Hence, in this forex trading technique, w wait till the market saturate to high or low and then offer or buy depending upon the circumstance.

The Stochastic Sign – this has actually been around because the 1950’s. Yet again, examine your evaluations versus at least 1 extra indication. Keep your stop well back up until the trend remains in movement.

If you are finding instant engaging reviews about How To Trade Stochastic Divergence, and Swing Trading Forex, Free Forex Eudcation, Determining Market Cycles dont forget to join in email list totally free.