The 3X3 Swing Trading Strategy – Meir Barak

Trending vids top searched Currency Trading Method, Forex Trading Robots, Best Forex Tradsing Strategies, and What’s Swing Trading, The 3X3 Swing Trading Strategy – Meir Barak.

Learn how to master the 3X3 Swing Trading Strategy for successful swing trading in just two hours a week. SKIP AHEAD: The 3X3 …

What’s Swing Trading, The 3X3 Swing Trading Strategy – Meir Barak.

Forex Online Trading – Generating Income In A Week Or Two

Feelings are like springs, they extend and agreement, both for only so long. Forex swing trading is one of the finest ways for novices to look for big gains. The external bands can be utilized for contrary positions or to bank profits.

The 3X3 Swing Trading Strategy – Meir Barak, Play interesting videos relevant with What’s Swing Trading.

The Advantages Of Utilizing Technical Analysis In Forex Trading

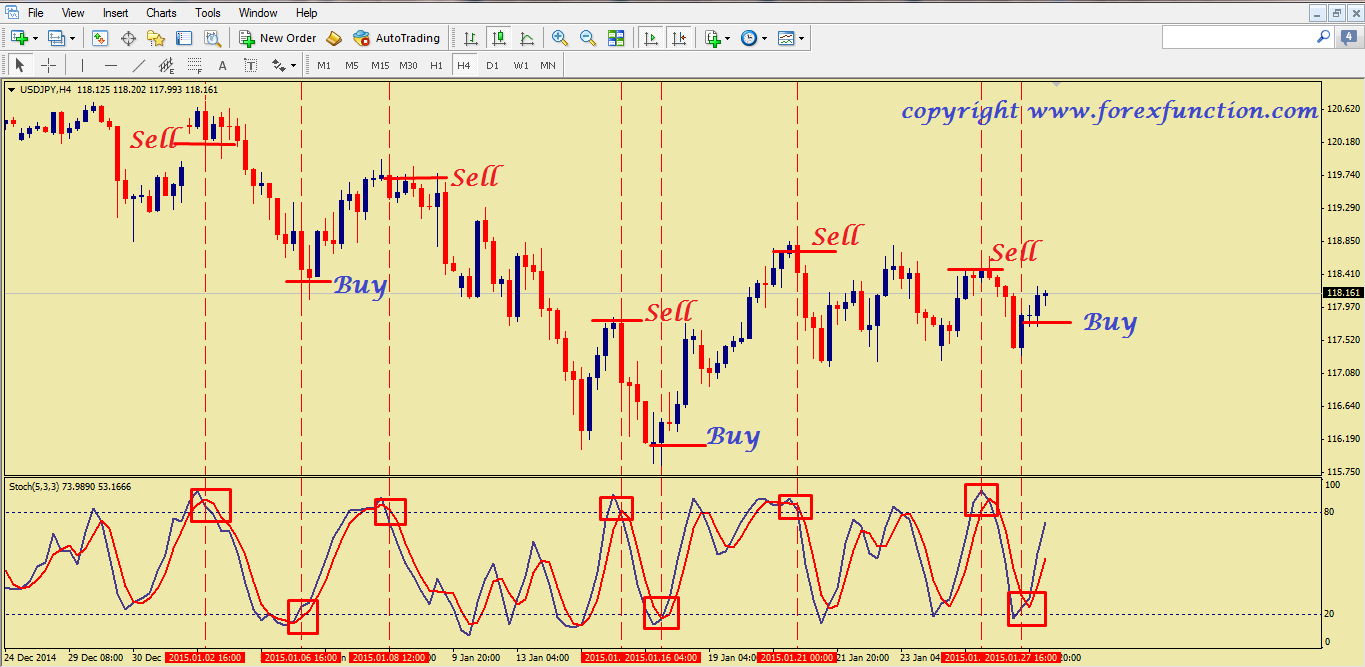

As a market moves up toward a resistance, stochastic lines need to typically point up. She or he has a long term time horizon like a couple of months to even a couple of years. No one can forecast where the marketplace will go.

The Stochastic Oscillator is an overbought/oversold indicator established by Dr. George Lane. The stochastic is a typical sign that is integrated into every charting software including MetaStock.

These are the long term financial investments that you do not rush Stochastic Trading into. This is where you take your time evaluating a great spot with resistance and support to make a big slide in revenue.

His primary methods involve the Dedication of Traders Index, which checks out like a stochastic and the second is Major & Minor Signals, which are based upon a fixed jump or decline in the previously mentioned index. His work and research are very first class and parallel his character as an individual. However, for any method to work, it needs to be something the trader is comfortable with.

Not all breakouts continue of course so you require to filter them and for this you require some momentum indicators to validate that rate momentum is accelerating. 2 good ones to utilize are the Stochastic Trading and RSI. These indicators offer verification of whether momentum supports the break or not.

If you saw our previous report you will see we banked an excellent short profit in the Pound and now were Stochastic Trading looking at it from the long side in line with the longer term trend, with the exact same method.

The Stochastic Indication – this has actually been around since the 1950’s. It is a momentum sign which measures over bought (readings above 80) and over sold (readings below 20), it compares today’s closing price of a stocks cost range over a recent time period.

You have to utilize short-term exit and stop guidelines if you are using short-term entry guideline. You have to use exit and stop guidelines of the turtle system if you are utilizing turtle trading system.

Don’t anticipate t be a millionaire overnight, because that’s just not sensible. Nobody can forecast where the market will go. You can utilize the mid band to purchase or sell back to in strong trends as it represents worth.

If you are finding best ever engaging videos related to What’s Swing Trading, and Stock Trading Strategy, Simple Forex Trading Strategy, Forextrading Strategy, Currency Trading you should join in email alerts service totally free.