The 13 Steps of Profitable Swing Trading: Mentorship Monday on June 18th, 2018

Top guide top searched Short Swing Trading, Currency Trading Basics, Stock Market Trading System, and What’s Swing Trading, The 13 Steps of Profitable Swing Trading: Mentorship Monday on June 18th, 2018.

Hi everyone! As you likely know, every Monday – Friday from 5-6 pm Eastern, Real Life Trading hosts a post market swing trading room. This is a recording of that along with much more! Jerremy covers which time frames to focus on, look at and discusses in depth the exact procedures and steps for analyzing swing trades.

Enjoy!

What’s Swing Trading, The 13 Steps of Profitable Swing Trading: Mentorship Monday on June 18th, 2018.

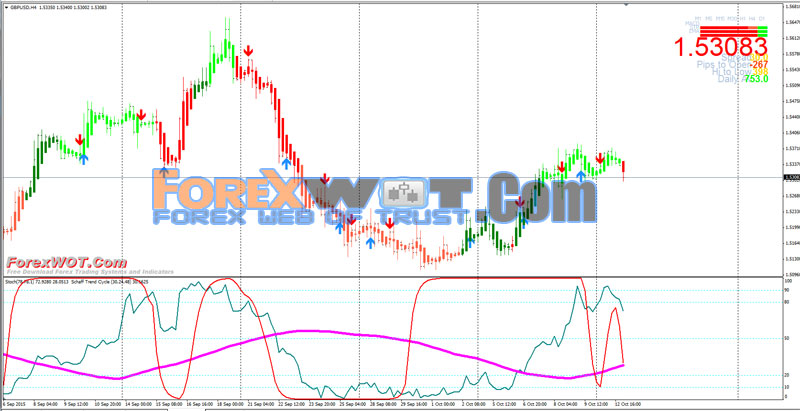

Forex Charts – Fundamental Earnings Suggestions For Beginners

And if this is the scenario, you will not have the ability to presume that the cost will turn once again. Use the technical indications you learn and evaluate them with historic data.

The 13 Steps of Profitable Swing Trading: Mentorship Monday on June 18th, 2018, Get most searched complete videos about What’s Swing Trading.

When Trading Forex, How To Identify A Trending Market.

It is a software, which researches and analysis and allows newbies to jump in and make revenues. Trading is always brief term while investing is long term. The charts show that the market is going up again.

Forex swing trading is easy to comprehend, only requires an easy system, its likewise amazing and fun to do. Here we will look at how you can become an effective swing trader from house and stack up huge revenues in around thirty minutes a day.

Use another sign to validate your conclusions. If the support and the resistancelines are touching, then, there is likely to have a breakout. And if this is the Stochastic Trading scenario, you will not be able to presume that the rate will turn again. So, you may just desire to set your orders beyond the stretch ofthe resistance and the assistance lines in order for you to capture a happening breakout. However, you must utilize another sign so you can verify your conclusions.

Them significant issue for most traders who use forex technical analysis or forex charts is they have no understanding of how to deal with volatility from a entry, or stop viewpoint.

Resistance is the area of the chart where the cost stops increasing. No brand-new highs have actually been satisfied in the last few Stochastic Trading sessions and the cost remains in a sideways instructions.

To get the chances a lot more Stochastic Trading on your side, when the breakout begins, cost momentum should be on the rise and here you need to learn more about momentum oscillators.

Technical Analysis is based upon the Dow Theory. Dow theory in nutshell states that you can use the past rate action to forecast the future price action. These costs are expected to integrate all the publicly available info about that market.

If the cost goes to a greater pivot level (which can be assistance or resistance) and the stochastic is high or low for a large time, then a turnaround will take place. Then a new trade can be entered appropriately. Thus, in this forex trading method, w wait till the market saturate to low or high and after that sell or buy depending upon the scenario.

And second of all, by using it to direct our trading preferably by means of. sound stock exchange trading system. It is among the most convenient tools used in TA. The two lines include a slow line and a fast line.

If you are finding more engaging videos related to What’s Swing Trading, and E Mini Trading, Trading Forex Online dont forget to signup for newsletter now.