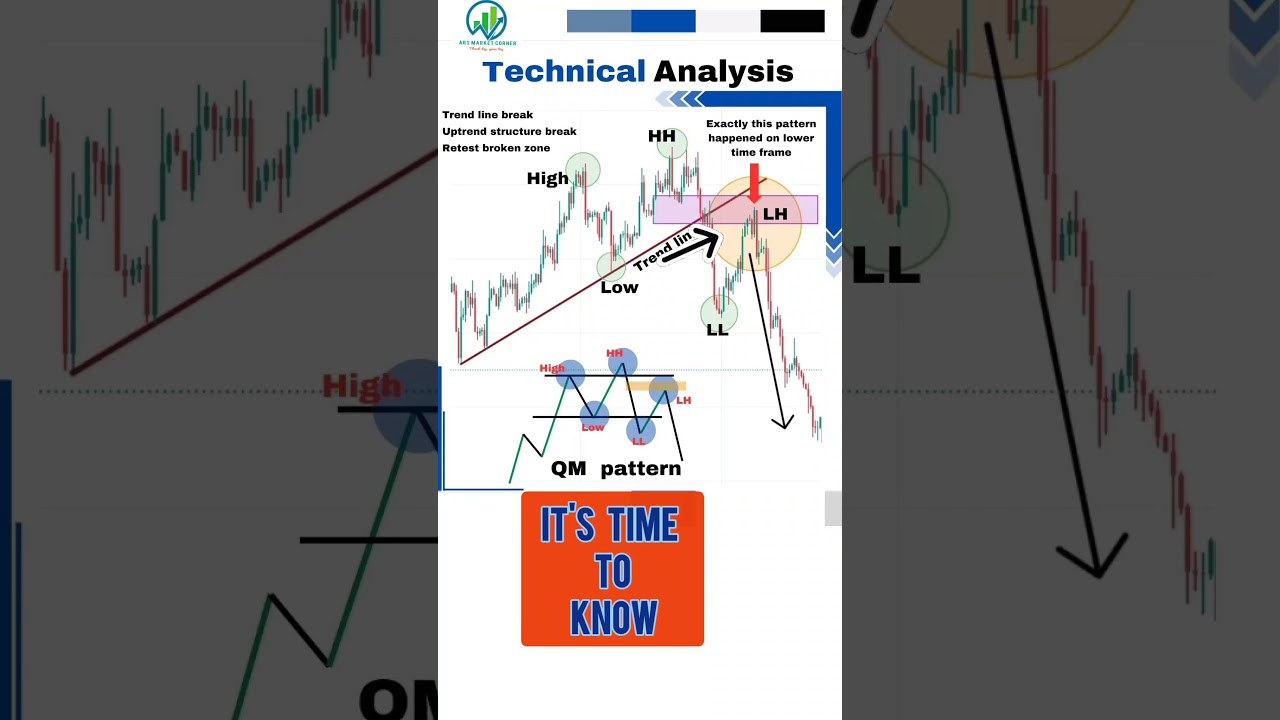

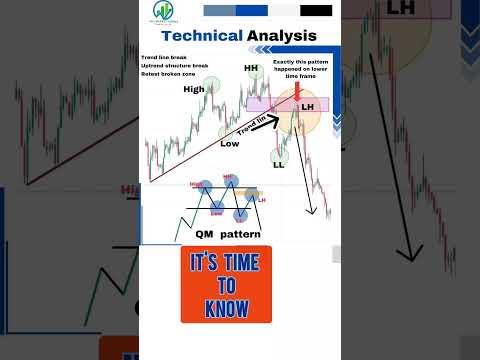

technical analysis swing trading chart pattern #arsmarketcorner,#shorts

New vids relevant with Forex Robots, Forex Tips for Beginners – How to Make Money When There Is No Trend, and What’s Swing Trading, technical analysis swing trading chart pattern #arsmarketcorner,#shorts.

technical analysis chart pattern #arsmarketcorner,#shorts Technical analysis chart patterns book Higher high lower low trading …

What’s Swing Trading, technical analysis swing trading chart pattern #arsmarketcorner,#shorts.

5 Things You Should Have For An Effective Forex System

This is to anticipate the future pattern of the cost. The broader the bands are apart the higher the volatility of the currency studied. When they do concentrate on the long term and do not snatch early.

technical analysis swing trading chart pattern #arsmarketcorner,#shorts, Search popular full videos relevant with What’s Swing Trading.

Win At Forex – An Easy 3 Step Forex Trading Method For Big Gains

The buzzword today in trading is “indications, indicators, indications”. In an uptrend each new peak that is formed is higher than the prior ones. Drawing trendlines on these charts will show you where the market is heading.

Numerous traders look to buy a currency trading system and do not understand how easy it is to construct their own. Here we want to take a look at developing a sample trading system for substantial profits.

These are the long term investments that you do not hurry Stochastic Trading into. This is where you take your time analyzing a good area with resistance and assistance to make a big slide in earnings.

Do not predict – you must just act upon verification of cost modifications and this constantly implies trading with cost momentum in your corner – when applying your forex trading technique.

Now I’m not going to get into the information regarding why cycles exist and how they relate to cost action. There is much composed on this to fill all your quiet nights in reading for decades. If you invest just a little bit of time seeing a MACD or Stochastic Trading indicator on a price chart, you need to already be convinced that cycles are at work behind the scenes. Just enjoy as they swing up and down in between extremes (overbought and oversold zones) to get a ‘feel’ for the cycle ups and downs of rate action.

If you saw our previous report you will see we banked a great short revenue in the Pound and now were Stochastic Trading taking a look at it from the long side in line with the longer term trend, with the very same approach.

Keep your stop well back until the pattern remains in movement. Path your stop up gradually and beyond regular volatility, so you don’t get bumped out of the pattern to quickly.

It takes patience and discipline to wait on the ideal breakouts and after that a lot more discipline to follow them – you require self-confidence and iron discipline – however you can have these if you wish to and quickly be accumulating triple digit earnings.

As we went over in Part 1 of this series, by now you must have an identified trends for the stocks you are seeing. Flatter the assistance and resistance, stronger will be your conviction that the variety is authentic.

If you are looking most entertaining comparisons relevant with What’s Swing Trading, and Win at Forex, Online Currency Trading, Forex Swing Trading, Forex Software you should join for subscribers database for free.