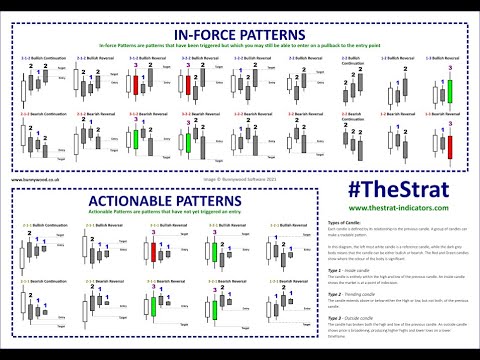

Swing Trading With The Strat Targets & Stop Loss

Top reviews related to Trade Forex, Currency Trading Tutorial, Stock Investing, Trade Stochastics, and What’s Swing Trading, Swing Trading With The Strat Targets & Stop Loss.

What’s Swing Trading, Swing Trading With The Strat Targets & Stop Loss.

Forex Trading Technique – 3 Standard Actions For Forex Success

The best way to time your entry is to try to find the break on the cost level. The only thumb-down in this service is that it is extremely dangerous. Most traders like to wait on the pullback but they never ever get in.

Swing Trading With The Strat Targets & Stop Loss, Get interesting explained videos relevant with What’s Swing Trading.

Live Trading – Volatility Presents Big Opportunity In Yen And Euro

EMA-stands for Exponential Moving Average.When a stock closes above its 13 and 50 day EMAs this is a bullish signal. The external bands can be used for contrary positions or to bank profits. I will cover the short-term trading initially up.

You can so this by using the stochastic momentum indicator (we have composed frequently on this and it’s the very best sign to time any trade and if you are not farmiliar with it learn more about it now) look for the stochastic lines to deny and cross with bearish divergence and go short.

If the break occurs you go with it, you need to have the Stochastic Trading mindset that. Sure, you have actually missed out on the very first little bit of revenue but history shows there is typically plenty more to follow.

His main methodologies include the Commitment of Traders Index, which checks out like a stochastic and the 2nd is Major & Minor Signals, which are based upon a static jump or decline in the aforementioned index. His work and research study are very first class and parallel his character as an individual. Nevertheless, for any methodology to work, it has to be something the trader is comfortable with.

Remember, you will never ever offer at the exact top due to the fact that nobody understands the market for specific. You should keep your winning trades longer. Nevertheless, if your technical indications go against you, and the patterns begin to fail, that’s when you ought to offer your stock and take Stochastic Trading earnings.

A breakout is likely Stochastic Trading if the assistance and resistance lines are assembling. In this case you can not presume that the cost will constantly turn. You may choose to set orders outside the variety of the converging lines to capture a breakout when it occurs. But again, check your conclusions against a minimum of one other indication.

However do not think it’s going to be a breeze either. Don’t expect t be a millionaire overnight, since that’s simply not realistic. You do need to make the effort to find out about technical analysis. By technical analysis, I do not indicate throwing a couple of stochastic indicators on your charts, and have them inform you what to do. Regrettably, that’s what a great deal of traders think technical analysis is.

If the cost goes to a higher pivot level (which can be assistance or resistance) and the stochastic is high or low for a big time, then a turnaround will occur. Then a brand-new trade can be gotten in accordingly. Therefore, in this forex trading technique, w wait up until the market fill to high or low and after that sell or purchase depending upon the scenario.

Use these with a breakout method and they give you a powerful mix for looking for big gains. This means minimising your prospective loses on each trade using a stop loss.

If you are finding rare and exciting videos relevant with What’s Swing Trading, and Trading Support and Resistance, Technical Analysis Tool, Options Trading, Forex Swing Trading Strategy dont forget to join our a valuable complementary news alert service totally free.