Swing Trading Trick – 3 EMA Indicator

New reviews about Forex Trend Following, Swing Traders, Trend Follow Forex, Forex Basics, and What’s Swing Trading, Swing Trading Trick – 3 EMA Indicator.

Swing Trading Trick – 3 EMA Indicator

What’s Swing Trading, Swing Trading Trick – 3 EMA Indicator.

Forex Trading – How To Catch The Mega Patterns For Substantial Profits!

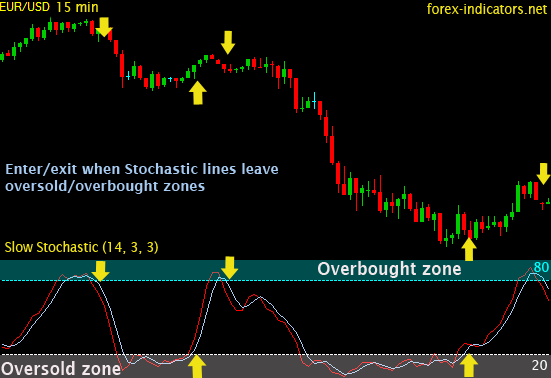

The assistance and resistance levels in the range need to form a horizontal line. Common indications used are the moving averages, MACD, stochastic, RSI, and pivot points. What is does is connect a series of points together forming a line.

Swing Trading Trick – 3 EMA Indicator, Enjoy most shared complete videos about What’s Swing Trading.

Forex Trading Methods For Success

And if this is the situation, you will not be able to presume that the rate will turn once again. Path your block slowly and beyond typical volatility, so you don’t get bumped out of the trend to quickly.

Many traders seek to buy a currency trading system and do not understand how easy it is to build their own. Here we want to take a look at constructing a sample trading system for huge profits.

Usage another indicator to verify your conclusions. If the resistance and the supportlines are touching, then, there is most likely to have a breakout. And if this is the Stochastic Trading situation, you will not be able to presume that the price will turn once again. So, you may just wish to set your orders beyond the stretch ofthe resistance and the support lines in order for you to catch an occurring breakout. Nevertheless, you need to utilize another indication so you can validate your conclusions.

Tonight we are trading around 1.7330, our first area of resistance is in the 1,7380 range, and a 2nd region around 1.7420. Strong assistance exits From 1.7310 to 1.7280 levels.

Not all breakouts continue obviously so you need to filter them and for this you need some momentum signs to validate that cost momentum is accelerating. Two excellent ones to utilize are the Stochastic Trading and RSI. These signs provide verification of whether momentum supports the break or not.

Numerous traders make the mistake of believing they can utilize the swing trade technique daily, but this is not a good idea and you can lose equity quickly. When the market is simply right for swing trading, instead reserve forex swing trading for days. So, how do you know when the market is right? When the chart is high or low, enjoy for resistance or support that has been held numerous times like. Look and see the momentum for when costs swing highly toward either the resistance or the assistance, while this is occurring expect verification that the momentum will turn. This confirmation is vital and if the momentum of the cost is starting to subside and a turn is likely, then the odds are in great favor of a swing Stochastic Trading environment.

Breakouts are likely if the resistance and support lines converge. In this instance, you may not assume that costs will return always. You might like orders outside the converging line variety to acquire a breakout as it takes place. Yet once again, inspect your assessments against at least 1 additional indication.

Yes and it will always generate income as long as markets pattern breakouts will occur and if you are selective on the ones you choose and confirm the moves, you could take pleasure in magnificent currency trading success.

Also, check the copyright at the bottom of the page to see how often the page is upgraded. I highly recommend you get at least a megabyte or more of memory. This depends on how typically one refers the trade charts.

If you are looking exclusive exciting reviews relevant with What’s Swing Trading, and Trading 4x Online, Forex Market, Unpredictable Market you are requested to list your email address our email alerts service for free.