Swing Trading Strategy – How to Become Richest with Swing trading strategy?

Popular full videos top searched Currency Trading Tutorial, Online Forex Trading, Trading Rules, and What’s Swing Trading, Swing Trading Strategy – How to Become Richest with Swing trading strategy?.

#Technicalanalysis#Intradaytrading#Swingtrading strategy

Angel Broking FREE Account Opening Link 👇🏻👇🏻👇🏻👇🏻

http://tinyurl.com/yxxzuspg

Choice Broking

Link for Account Opening

https://jiffy.choicebroking.in/open.html?ref=RGR4

1 paisa for Intraday 10 paisa for Delivery Brokerage

India Infoline Free Demat Account Link

https://www.indiainfoline.com/clip/op…

Trading successfully requires staying disciplined, learning new

strategies and putting them in place, which are some of the most

important factors. At Chart Analysis, Mr Umesh Sharma guide you

every day about the right trading tips. By providing regular stock

market analysis, he helps you develop a successful trading plan for

the future.

What we shared with you today?

In the above video, we had discussed the right tips for finding the

stocks to trade-in. Here Mr Umesh Sharma had elaborated about

some best stocks you should trade in tomorrow. This video will also

guide you about how Swing trading can help you to trade well. Watch

and review the above video carefully to know all the major aspects

of Swing trading.

Explaining Swing Trading

A swing trade is a strategy that attempts to buy and sell stocks over

a targeted period that can range from one day to several weeks to

capture short-to-medium-term gains. In order to find the right

trading opportunity, swing traders rely heavily on technical analysis.

Fundamental analysis is also used by swing traders to discern price

patterns and trends.

Swing trading achieves its purpose by occupying a chunk of a

potential price movement. In this case, you are predicting the future

movement of the price of an asset. So, here's the main information

you need to know about swing trading.

Swing trading usually involves holding long or short positions on stock

for more than one trading session. It doesn 't last more than a couple

of weeks or months. Furthermore, swing traders can also take place

during trading sessions. As a result of extremely volatile conditions,

this is actually a rare occurrence. Stay up-to-date on the stock

market with Chart Analysis. Feel free to post your views and queries

in the comment section below.

Follow us on Twitter: https://rb.gy/nqu1is

Follow us on Facebook- https://rb.gy/zqzti3

Follow us on Instagram – https://rb.gy/5yo5gu

Follow us on YouTube- https://rb.gy/lnftrp

Follow us on LinkedIn: https://rb.gy/hyjjj6

For MT4 Software

3 Month Payment Link: https://imojo.in/3y33zz0

6 Month Payment Link: https://imojo.in/41w1p44

12 Month Payment Link: https://imojo.in/14pgtpl

Join Telegram Channel.

https://telegram.me/umeshsharmacharta…

Follow me on Twitter- https://twitter.com/ChartAnalysis01

Website: http://www.chartanalysis.co.in

Channel Link https://youtu.be/PgtY5RzGpU8

For More Details Contact – 9711501546

What’s Swing Trading, Swing Trading Strategy – How to Become Richest with Swing trading strategy?.

3 Sure-Fire Methods For Long Term Forex Trading

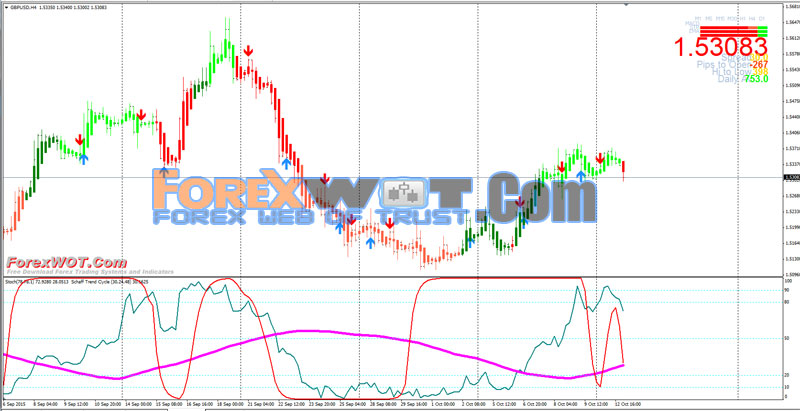

Typical signs utilized are the moving averages, MACD, stochastic, RSI, and pivot points. In some cases, either one or both the support and resistance are slanting. Those lines might have crossed 3 or 4 times prior to only to revert back.

Swing Trading Strategy – How to Become Richest with Swing trading strategy?, Get trending full length videos about What’s Swing Trading.

Forex Trading – Swing Trading In 3 Easy Actions For Huge Profits

Dow theory in nutshell states that you can use the past price action to anticipate the future rate action. Use these with a breakout technique and they give you a powerful combination for seeking huge gains.

Swing trading in Forex, is one of the best methods to earn money in currencies and the reason is – its basic to understand, fun and amazing to do and can make huge gains. Let’s look at the reasoning behind Forex swing trading and how to make regular profits.

You will comprehend it and this understanding results in confidence which leads onto discipline. Individuals Stochastic Trading who purchase ready made systems don’t comprehend what their doing their simply following and have no self-confidence.

You then need to see if the odds are on your side with the breakout so you check rate momentum. There are lots of momentum indications to help you time your move and get the speed of price on your side. The ones you select refer individual preference however I like the ADX, RSI and stochastic. If my momentum computation adds up I go with the break.

A necessary starting point is enough money to get through the preliminary phases. If you have adequate money you have the time to learn and improve your Stochastic Trading until you are earning money. How much money is required depends upon the number of agreements you desire to trade. For instance to trade 1 $100,000 dollar agreement you need in between $1000 and $1500 as margin.

To get the chances a lot more Stochastic Trading on your side, when the breakout begins, rate momentum should be on the increase and here you require to discover momentum oscillators.

Keep your stop well back up until the trend is in motion. Path your stop up slowly and outside of normal volatility, so you do not get bumped out of the trend to quickly.

Bear in mind you will constantly give bit back at the end of a trend but the big trends can last numerous weeks or months and if you get simply 70% of these trends, you will make a great deal of cash.

This is simply a minimum list of tools that you will need to be effective. The concept is “Do not forecast the marketplace”. Searching for a Forex robot to assist you trade? A Forex trading system that succeeds is likewise easy.

If you are looking most exciting videos about What’s Swing Trading, and Stock Market Trend, Trading Strategies, Forex Trading Tips, Forex Trading Ideas you are requested to join for email list totally free.