“Swing Trading: Stop Placement Strategies for Profitable Trades” #tradingstrategy #stock

Interesting complete video highly rated Trading System, Forex Trading Advice, and What’s Swing Trading, “Swing Trading: Stop Placement Strategies for Profitable Trades” #tradingstrategy #stock.

“Swing Trading: Stop Placement Strategies for Profitable Trades” #tradingstrategy #stock Welcome to Swing Trading Secrets, …

What’s Swing Trading, “Swing Trading: Stop Placement Strategies for Profitable Trades” #tradingstrategy #stock.

Forex Swing Trading – The Ideal Approach For Amateurs To Seek Big Gains

It is this if one must know anything about the stock market. It is ruled by emotions.

Trade the chances and this indicates rate momentum need to support your view and validate the trade before you enter.

“Swing Trading: Stop Placement Strategies for Profitable Trades” #tradingstrategy #stock, Get new videos related to What’s Swing Trading.

Currency Trading Basics – An Easy, Classic Method For Big Gains

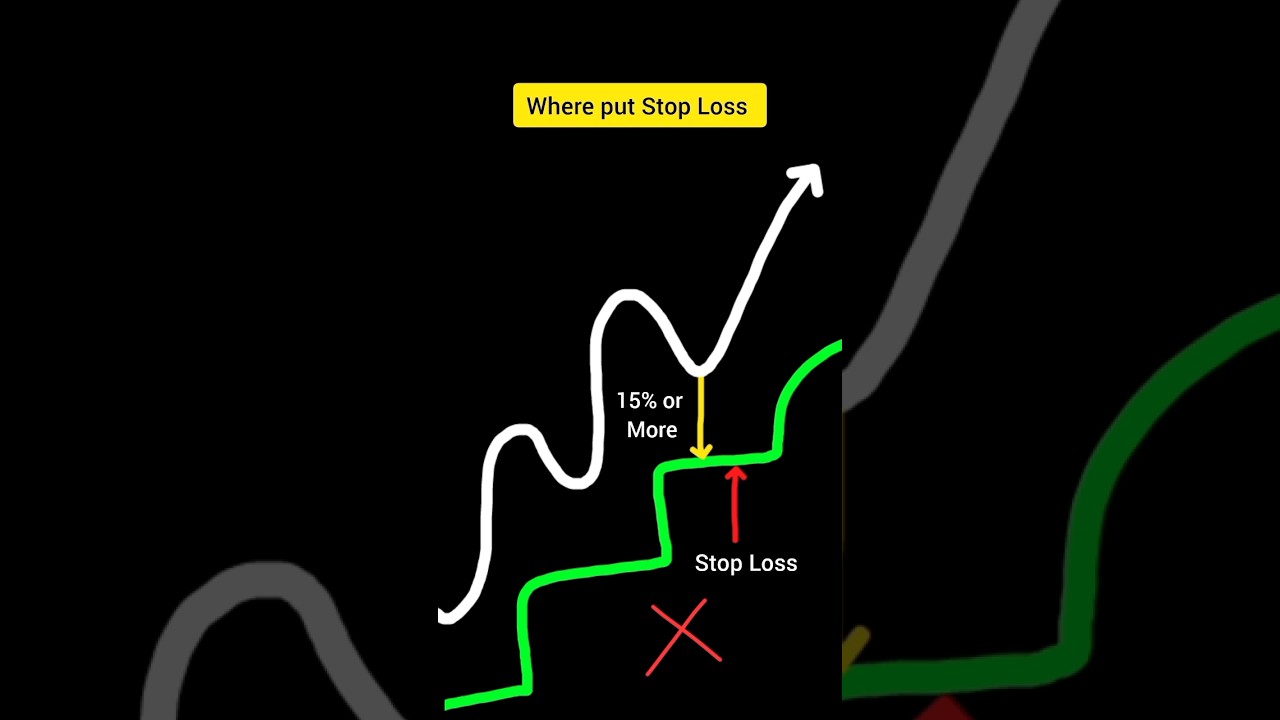

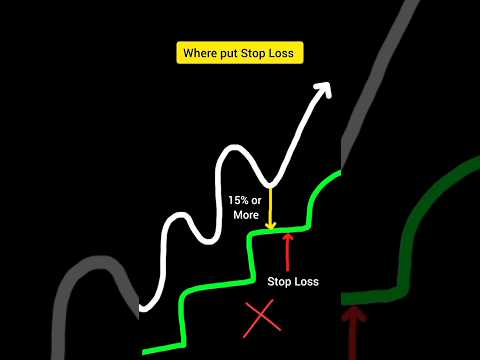

Without a stop loss, do you understand that you can erase your trading account very easily? Trail your block slowly and beyond normal volatility, so you do not get bumped out of the trend to quickly.

Trading on the everyday charts is a much easier strategy as compared to trading intraday. This day-to-day charts strategy can make you 100-500 pips per trade. When trading with this everyday charts strategy, you don’t need to sit in front of your computer system for hours.

These are the long term investments that you do not rush Stochastic Trading into. This is where you take your time evaluating a good spot with resistance and support to make a substantial slide in earnings.

Testing is a procedure and it is advisable to check various tools throughout the years. The goal in testing the tools is to discover the best trading tool the trader feels comfortable with in different market circumstance but likewise to improve trading abilities and profit margin.

Stochastic Trading The swing trader purchases into fear and offers into greed, so lets take a look at how the effective swing trader does this and take a look at a bullish trend as an example.

Numerous traders make the error of believing they can utilize the swing trade strategy daily, however this is not a good idea and you can lose equity quickly. Rather reserve forex swing trading for days when the market is ideal for swing trading. So, how do you understand when the marketplace is right? When the chart is low or high, enjoy for resistance or assistance that has been held several times like. See the momentum and look for when costs swing highly toward either the resistance or the support, while this is happening watch for verification that the momentum will turn. This verification is critical and if the momentum of the price is beginning to subside and a turn is likely, then the odds are in great favor of a swing Stochastic Trading environment.

The Stochastic Indicator – this has actually been around considering that the 1950’s. It is a momentum indicator which measures over bought (readings above 80) and over offered (readings below 20), it compares today’s closing rate of a stocks rate range over a current time period.

Bear in mind you will constantly give bit back at the end of a trend but the big patterns can last lots of weeks or months and if you get just 70% of these trends, you will make a great deal of money.

Although, it is not exactly sure-fire, you can still get an excellent upper hand by utilizing it. A trader may take note on other charts but this will be the main location of concern. The application is, as always, cost and time.

If you are finding updated and entertaining videos about What’s Swing Trading, and Forex Traading System, Trading Strategy dont forget to list your email address in email subscription DB totally free.