Swing trading part 2 // Support and resistance // Assamese

Popular replays top searched Online Forex Trading, Best Trading System, and What’s Swing Trading, Swing trading part 2 // Support and resistance // Assamese.

Join our whatsapp group for free by opening zerodha account using this link

https://zerodha.com/?c=EH2416&s=CONSOLE

What’s Swing Trading, Swing trading part 2 // Support and resistance // Assamese.

Currency Trading Basics – A Basic System Anybody Can Utilize For Huge Profits

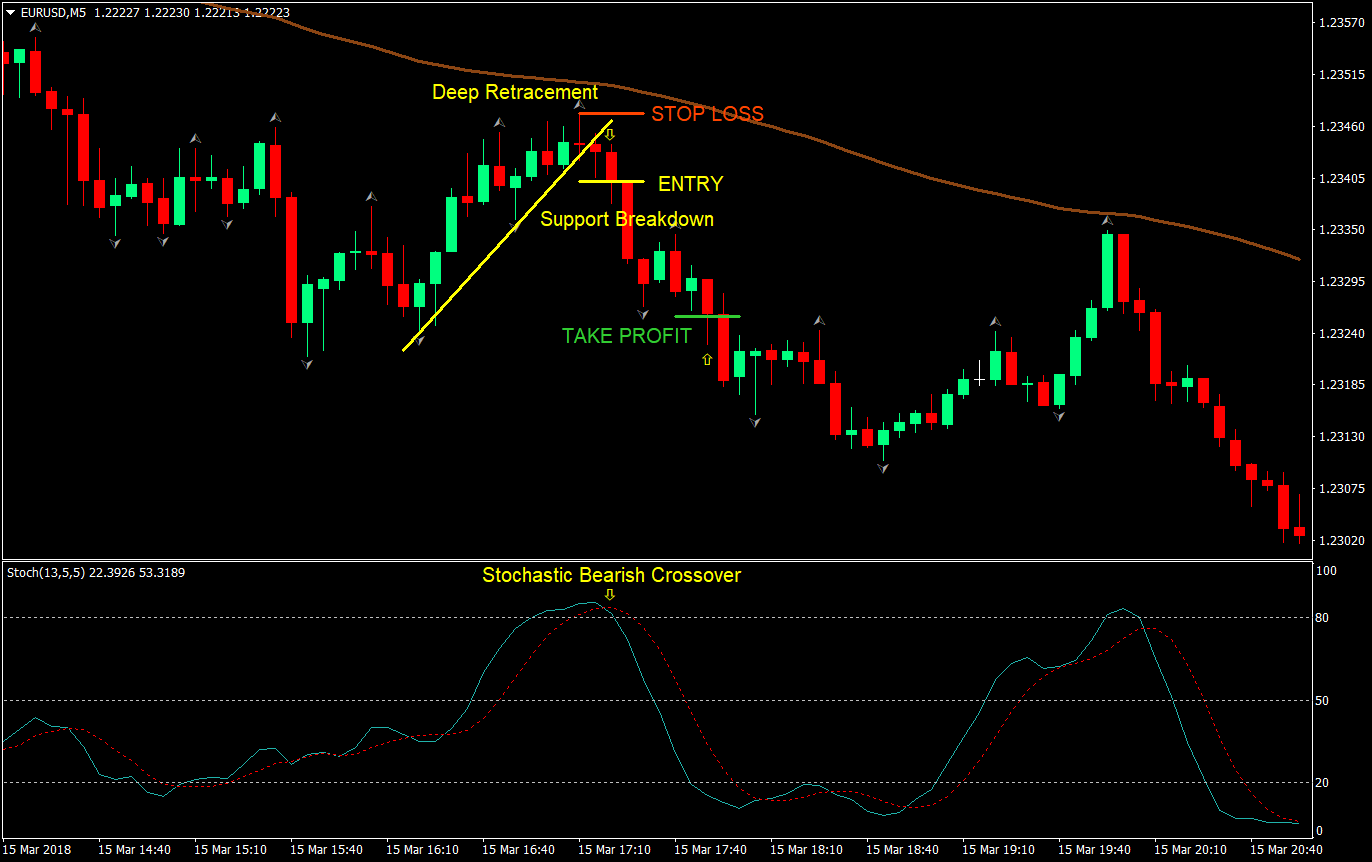

The very best method to time your entry is to search for the break on the cost level. The only thumb-down in this company is that it is highly dangerous. The majority of traders like to await the pullback but they never get in.

Swing trading part 2 // Support and resistance // Assamese, Search more updated videos related to What’s Swing Trading.

The Less Is More Technique To Finding Out To Trade Forex Successfully

However, there is one thing you do not wish to over look – memory. A couple of big profit trades might be your entire year revenue. The 2 lines include a fast line and a slow line.

Trading on the daily charts is a much easier method as compared to trading intraday. This everyday charts method can make you 100-500 pips per trade. You don’t need to being in front of your computer for hours when trading with this daily charts method.

Some these “high flyers” come out the high tech sector, which consists of the Web stocks and semiconductors. Other “high leaflets” come from the biotech stocks, which have increased volatility from such news as FDA approvals. Due to the fact that Stochastic Trading there are less of them than on the NASDAQ that trade like a house on fire on the ideal news, after a while you will recognize the symbols.

The majority of traders like to await the pullback however they never get in. By waiting on a better cost they miss out on the move. Losers do not opt for breakouts winners do.

No issue you say. Next time when you see the earnings, you are going to click out and that is what you do. You remained in a long position, a red candle light appears and you click out. Whoops. The marketplace continues in your instructions. You stand there with 15 pips and now the marketplace is up 60. Frustrated, you decide you are going to either let the trade play out to your Stochastic Trading profit target or let your stop get activated. You do your homework. You enter the trade. Boom. Stopped out. Bruised, battered and deflated.

To get the chances much more Stochastic Trading on your side, when the breakout starts, price momentum ought to be on the rise and here you need to find out about momentum oscillators.

Keep your stop well back until the trend remains in movement. Path your block gradually and beyond typical volatility, so you don’t get bumped out of the trend to soon.

In this short article is a trading method shown that is based upon the Bolling Bands and the stochastic indications. The strategy is easy to utilize and could be utilized by day traders that want to trade brief trades like 10 or thirty minutes trades.

Select the exchange that is finest suited to your trading background and your desired location of specialization. Breakouts are simply breaks of essential assistance or resistance levels on a forex chart.

If you are finding more engaging reviews about What’s Swing Trading, and Learn Forex Trading, Forex Traading System you are requested to subscribe for email alerts service totally free.