Swing Trading explained in 1 min @InvestAajForKal #LLAShorts 271

Interesting overview top searched Turtle Trading System, Forex Trading Strategies, Stock Market Trading System, and What’s Swing Trading, Swing Trading explained in 1 min @InvestAajForKal #LLAShorts 271.

Open Zerodha A/c, start investing: https://link.labourlawadvisor.in/zerodha

……………………………………………..

Checkout LLA Courses, Videos & Apps: https://link.labourlawadvisor.in/shorts

……………………………………………..

COURSES: https://labourlawadvisor.in/link/LPTI

……………………………………………..

QuickPayroll: https://quickpayroll.in/

……………………………………………..

Explained in 1 Minute

Let’s Swing | Andy bana Malinga | What is Swing Trading? | IPL

……………………………………………..

Editing: Rohan Agarwal

Shot by: Money Minded Mandeep

Presenter: Anadi Andy, Anant Ladha (@InvestAajForKal)

……………………………………………..

Newsletter: https://labourlawadvisor.in/newsletter/

Instagram: https://instagram.com/labourlawadvisor

Twitter: https://twitter.com/AdvisorLaborLaw

Telegram: @JoinLLA

#Shorts #LLA #Trading #StockMarket #sharemarket #SwingTrading #IPL

What’s Swing Trading, Swing Trading explained in 1 min @InvestAajForKal #LLAShorts 271.

Online Forex Trading – This Basic Fact Could Make You Big Profits

This will not just make sure higher earnings however likewise reduce the risk of greater losses in trade. Do you have a stop loss or target to leave a trade? This is simply a minimum list of tools that you will require to be successful.

Swing Trading explained in 1 min @InvestAajForKal #LLAShorts 271, Search most shared high definition online streaming videos about What’s Swing Trading.

Forex Trading Technique – A Simple System For Triple Digit Gains

It is exceptionally crucial that the forex trading robot you choose to purchase has these three things. In the chief portions you must be capable to receive some fuddled spreads and that also of some pips just.

If you want to win at forex trading and delight in currency trading success possibly one of the most convenient methods to attain it is to trade high chances breakouts. Here we will take a look at how you can do this and make big revenues.

Some these “high leaflets” come out the high tech sector, which consists of the Internet stocks and semiconductors. Other “high flyers” come from the biotech stocks, which have increased volatility from such news as FDA approvals. After a while you will recognize the symbols Stochastic Trading due to the fact that there are fewer of them than on the NASDAQ that trade like a house on fire on the best news.

The second significant point is the trading time. Generally, there are certain period that are perfect to go into a trade and time durations that are difficult to be very dangerous or lucrative. The dangerous time durations are the times at which the price is varying and difficult to anticipate. The most dangerous time durations are the periods at which economy new are arisen. Due to the fact that the cost can not be forecasted, the trader can enter a trade at this time. Likewise at the end day, the trader should not go into a trade. In the Forex market, the end day is on Friday.

While the guidelines offer you reasons to get in trades, it does not suggest that the price will enter your preferred instructions. The idea is “Do not forecast the market”. Instead, you need to let the price motion lead your method, understanding at anytime rate might go and change in a different instructions. Stochastic Trading You have to provide up and stop out if the cost does not move in your favor.

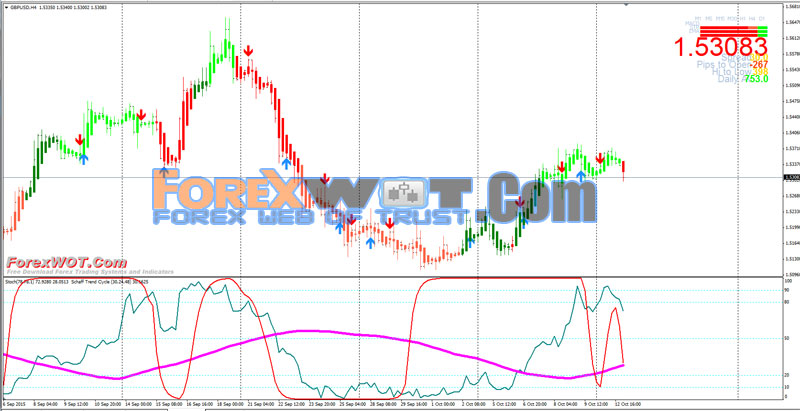

Swing Stochastic Trading systems come with different signs but the objective is always the same, to take advantage of brief term rate spikes, offer or purchase them and try to find a return to a moving average.

When the break occurs, put your stop behind the breakout point and wait till the relocation is well in progress, prior to tracking your stop. Do not put your stop to close, or within regular volatility – you will get bumped out the trade.

Currency trading is a method of making cash but it likewise depends upon the luck factor. However all is not lost if the traders make guidelines for themselves and follow them. This will not just ensure higher profits but also decrease the risk of higher losses in trade.

The Stochastic Indicator – this has actually been around given that the 1950’s. Yet again, examine your evaluations versus at least 1 extra indication. Keep your stop well back till the trend is in movement.

If you are finding rare and entertaining videos about What’s Swing Trading, and Stock Prices, Thinslice Trading you should subscribe in a valuable complementary news alert service now.