Study 8% moves if you want to improve your swing trading results

Best vids about Trading Forex Online, Forex Strategy, and What’s Swing Trading, Study 8% moves if you want to improve your swing trading results.

Daily study past winners and losers on various time frames and note down your observations.

If you can develop this habit you will see steady improvement in your understanding of market moves and it will be based on your own efforts.

What should you study for short term swing trading

Study stocks up 8% plus in last 5 days

Study stocks down 8% plus in last 5 days

Those are the kind of stock moves that swing traders are interested in. By studying them daily you will understand what works and what to look for in momentum burst swing moves. Where to put stop. Where to exit. What to look for on day one of move.

If you do this for weeks and months or years you will be expert in 8% plus moves. When you study these moves over and over again you start finding small nuances to look for in successful breakouts.

——————————————————————————————————-

Software used in these videos is Telechart https://goo.gl/DRdA4K

Blog: http://stockbee.blogspot.com/

Facebook: https://www.facebook.com/stockbee/

Amazon: http://astore.amazon.com/stockbee-20

Affilates: Amazon , Worden

-~-~~-~~~-~~-~-

Please watch: “How to select the best 4% breakout setups ”

-~-~~-~~~-~~-~-

What’s Swing Trading, Study 8% moves if you want to improve your swing trading results.

How To Generate Income At House – The Forex Trading Solution

This preparation could indicate the distinction in between fantastic earnings and fantastic loss. If not updates are being made, then it’s buyer beware. The outer bands can be used for contrary positions or to bank profits.

Study 8% moves if you want to improve your swing trading results, Get latest high definition online streaming videos relevant with What’s Swing Trading.

Forex Trend Following – Capturing The Huge Trends

And if this is the scenario, you will not be able to presume that the price will turn once again. Path your stop up slowly and beyond typical volatility, so you do not get bumped out of the trend to soon.

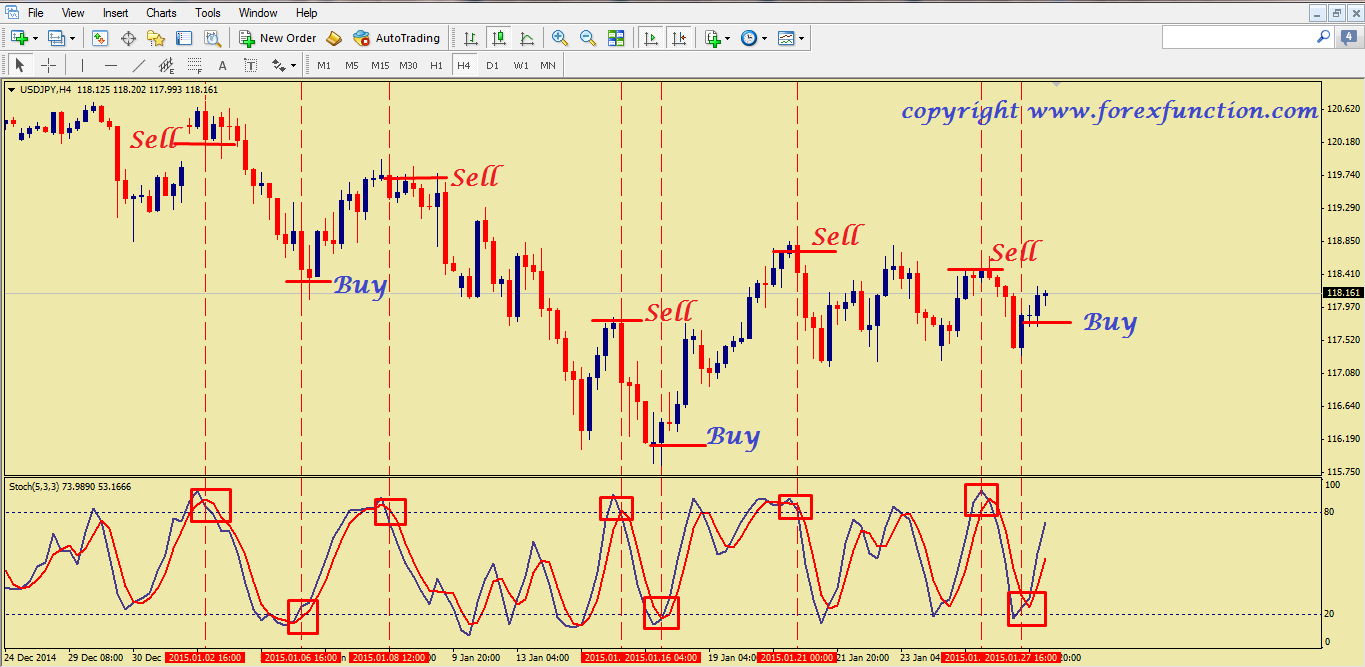

You can so this by utilizing the stochastic momentum indicator (we have actually written frequently on this and it’s the best indicator to time any trade and if you are not farmiliar with it find out about it now) watch for the stochastic lines to deny and cross with bearish divergence and go short.

I can remember when I first began to begin to trade the forex market. I was under the wrongful impression (like a great deal of other new traders) that I had no option. If I was going to trade the marketplace, I was going to NEED TO trade with indicators. So, like numerous others I begun to utilize Stochastic Trading.

Search for divergences, it informs you that the price is going to reverse. , if cost makes a new high and at the very same time that the stochastic makes lower high.. This is called a “bearish divergence”. The “bullish divergence” is when the price makes a new low while the stochastic makes greater low.

Not all breakouts continue of course so you need to filter them and for this you require some momentum signs to verify that cost momentum is speeding up. 2 good ones to utilize are the Stochastic Trading and RSI. These indicators provide confirmation of whether momentum supports the break or not.

If you caught simply 50% of every significant trend, you would be really abundant; accept short-term dips versus Stochastic Trading you and keep your eyes on the bigger long term prize.

While these breaks can sometimes be difficult to take, if the support or resistance stands, the odds favour a huge relocation – however not all breakouts are developed equal.

In common with virtually all aspects of life practice is the essential to getting all 4 elements collaborating. This is now easier to accomplish as lots of Forex websites have demonstration accounts so you can practice without running the risk of any real money. They are the nearest you can get to trading in real time with all the pressure of prospective losses. But keep in mind – practice makes perfect.

You will understand it and this understanding causes confidence which leads onto discipline. Based on this details we correctly predicted the market was going down. This is to verify that the rate trend is true.

If you are finding unique and engaging videos about What’s Swing Trading, and Win at Forex, Online Currency Trading, Forex Swing Trading, Forex Software dont forget to join for a valuable complementary news alert service now.