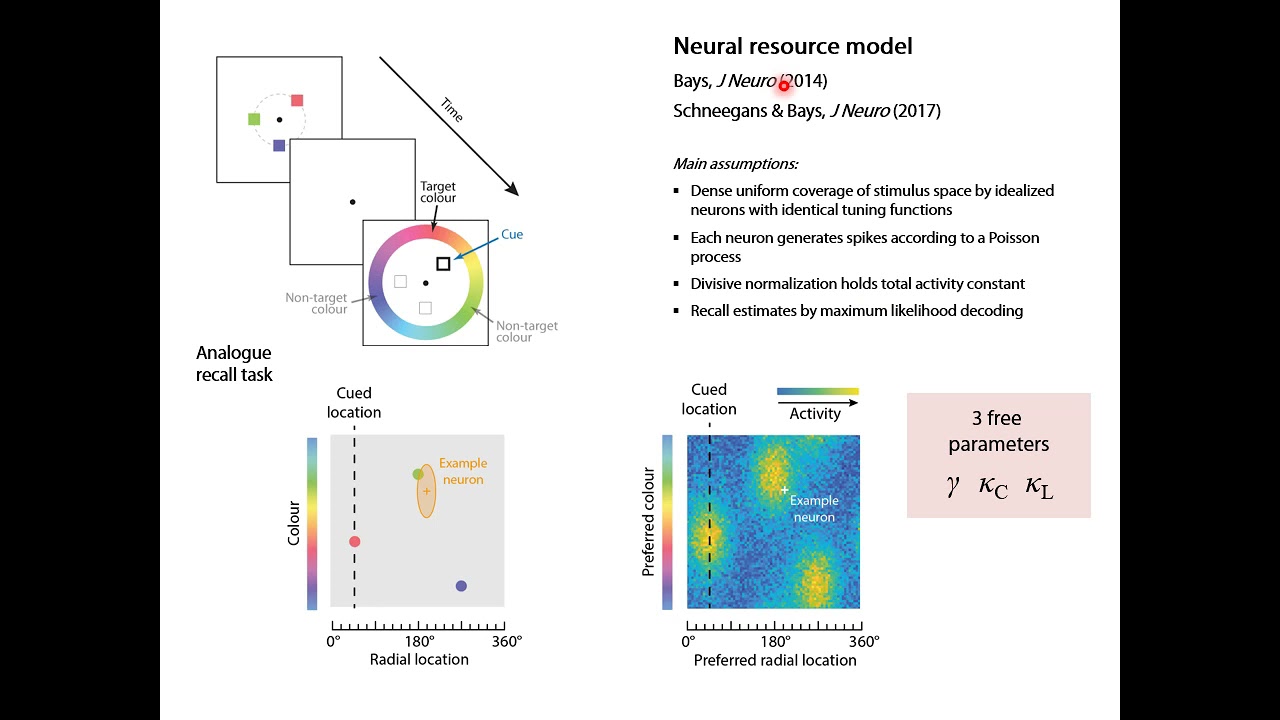

Stochastic sampling – talk by Paul Bays for MathPsych 2021

Interesting un-edited videos about Automatic Trading System, Trade Without Indicators, Stock Market Trend, and Stochastic Crossover Signal, Stochastic sampling – talk by Paul Bays for MathPsych 2021.

This presentation is part of MathPsych/ICCM 2021.

See more via http://mathpsych.org/conferences/2021.

Stochastic Crossover Signal, Stochastic sampling – talk by Paul Bays for MathPsych 2021.

Cycles Can Leapfrog Your Trading Success

You might take one take a look at it and think it is rubbish. Using an automatic system will assist you step up your portfolio or start producing an effective one. This daily charts technique can make you 100-500 pips per trade.

Stochastic sampling – talk by Paul Bays for MathPsych 2021, Search new explained videos related to Stochastic Crossover Signal.

3 Methods To Utilize Technical Analysis As Part Of Your Trading Method.

An important beginning point is adequate money to make it through the initial stages. The most risky time durations are the durations at which economy new are occurred. Then a brand-new trade can be gotten in accordingly.

There is a difference between trading and investing. Trading is always brief term while investing is long term. The time horizon in trading can be as short as a few minutes to a couple of days to a few weeks. Whereas in investing, the time horizon can be months to years. Lots of people day trade or swing trade stocks, currencies, futures, alternatives, ETFs, products or other markets. In day trading, a trader opens a position and closes it in the exact same day making a fast profit. In swing trading, a trader tries to ride a trend in the market as long as it lasts. On the other hand, an investor is least pressed about the short-term swings in the market. He or she has a long term time horizon like a few months to even a few years. This long time horizon matches their financial investment and financial objectives!

Some these “high flyers” come out the high tech sector, which includes the Web stocks and semiconductors. Other “high flyers” come from the biotech stocks, which have increased volatility from such news as FDA approvals. Since Stochastic Trading there are less of them than on the NASDAQ that trade like a house on fire on the best news, after a while you will acknowledge the symbols.

Don’t anticipate – you should only act on verification of cost changes and this constantly suggests trading with price momentum in your corner – when using your forex trading technique.

OK now, not all breakouts are developed equivalent and you desire the ones where the chances are highest. You’re trying to find Stochastic Trading support and resistance which traders discover important and you can frequently see these levels in the news.

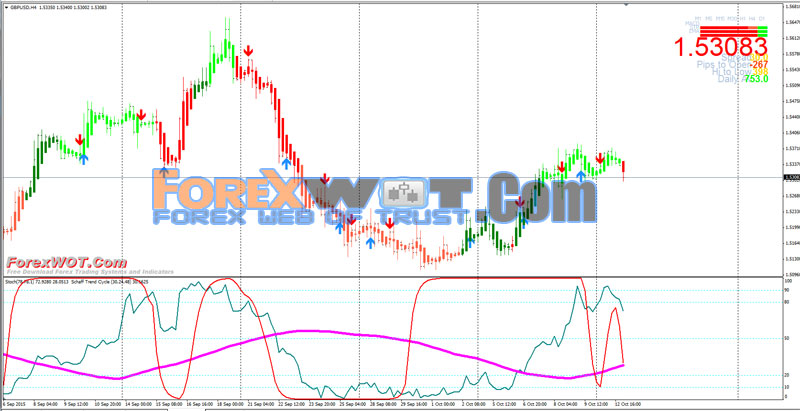

Some of the stock signals traders take a look at are: volume, moving averages, MACD, and the Stochastic Trading. They likewise must try to find floors and ceilings in a stock chart. This can reveal a trader about where to get in and about where to go out. I say “about” since it is quite hard to guess an “exact” bottom or an “specific” top. That is why securing earnings is so so important. If you don’t secure revenues you are actually running the threat of making a worthless trade. Some traders become really greedy and it only hurts them.

Technical Analysis is based on the Dow Theory. Dow theory in nutshell states that you can utilize the past price action to forecast the future rate action. These rates are expected to include all the openly available details about that market.

The above technique is incredibly simple but all the very best systems and methods are. If you swing trade extremes, you will get a couple of great signals a week and this will be enough, to make you huge gains in around 30 minutes a day. There is no much better technique than currency swing trading if you desire a great method to make big profits.

This implies minimising your prospective loses on each trade using a stop loss. This daily charts method can make you 100-500 pips per trade. And in a sag, connect two greater lows with a straight line.

If you are finding instant engaging reviews about Stochastic Crossover Signal, and Forex Swing Trading Systems, Technical Analysis Tool please signup for email alerts service totally free.