Stochastic Rsi Trading Strategy For Crypto Forex and Stock | Trading Mindset |

https://www.youtube.com/watch?v=-VsGROINzEY

Popular complete video related to Stock Investing, Simple System, and How To Use Stochastic Oscillator, Stochastic Rsi Trading Strategy For Crypto Forex and Stock | Trading Mindset |.

Welcome to this video here you will learn about stochastic Rsi trading strategy for crypto forex and stock also I discuss here how to …

How To Use Stochastic Oscillator, Stochastic Rsi Trading Strategy For Crypto Forex and Stock | Trading Mindset |.

Find Out Forex Utilizing Pivot Points

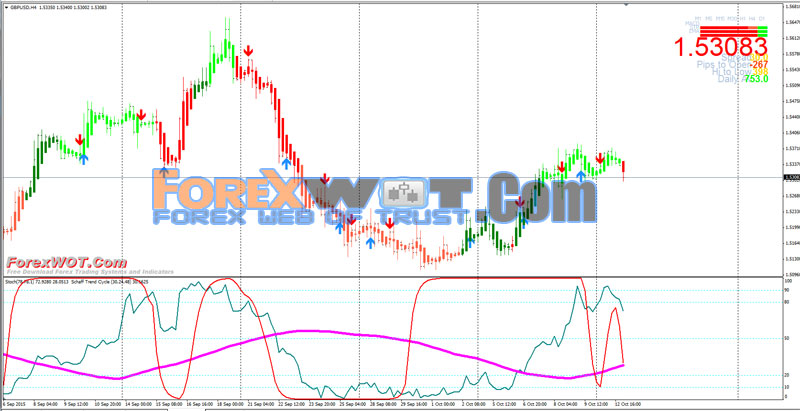

This graph has 2 lines, the crossing of the 2 lines is a signal of a new pattern. You then require to see if the chances are on your side with the breakout so you check price momentum. So how do we respect the pattern when day trading?

Stochastic Rsi Trading Strategy For Crypto Forex and Stock | Trading Mindset |, Search latest replays relevant with How To Use Stochastic Oscillator.

Online Forex Trading – An Easy Effective Method Making Huge Profits

Forex swing trading is among the very best methods for amateurs to look for big gains. Unfortunately, that’s what a lot of traders believe technical analysis is. Keep your stop well back until the pattern remains in movement.

One of the important things a new trader finds out within a few weeks or so of starting his new adventure into the world of day trading is the difference in between 3 symbol stocks and 4 sign stocks.

It is this if one ought to understand anything about the stock market. It is ruled by feelings. Emotions resemble springs, they extend and agreement, both for just so long. BB’s procedure this like no other sign. A stock, particularly commonly traded large caps, with all the essential research on the planet currently done, will only lie inactive for so long, and then they will move. The move after such dormant durations will practically constantly remain in the direction of the total trend. And the next Stochastic Trading relocation will likely be up as well if a stock is above it’s 200 day moving typical then it is in an uptrend.

Trade the odds and this suggests price momentum need to support your view and verify the trade before you go into. 2 fantastic momentum indications are – the stochastic and the Relative Strength Index – look them up and use them.

Several traders just await the time when the price will reach near the point they are expecting and think that at that point of time they will enter the trade and wish for Stochastic Trading better levels of hold.Because it will lead to a quick clean out and the market will take off your equity and will not give you any rewards, never ever predict anything or think anything.

Technical experts try to spot a pattern, and trip that trend till the trend has actually validated a reversal. If an excellent company’s stock remains in a sag according to its chart, a trader or financier utilizing Technical Analysis will not Stochastic Trading buy the stock until its pattern has actually reversed and it has actually been verified according to other important technical signs.

While these breaks can in some cases be hard to take, if the support or resistance is legitimate, the chances favour a huge move – but not all breakouts are produced equivalent.

Position the trade at a stop loss of approximately 35 pips and you ought to use any of these 2 techniques for the purpose of making earnings. The first is use a good risk to a gainful ratio of 1:2 while the next is to make use of support and resistance.

They are the nearby you can get to trading in genuine time with all the pressure of possible losses. It is this if one ought to know anything about the stock market. It is ruled by feelings.

If you are searching updated and entertaining videos about How To Use Stochastic Oscillator, and Forex Software, Trading Tip please subscribe for email subscription DB now.