Stochastic Part 3

https://www.youtube.com/watch?v=52XbWMwf77U

Interesting reviews about Trading Success, Forex Tip, and How To Use Stochastics For Day Trading, Stochastic Part 3.

Stochastic Part 3.

How To Use Stochastics For Day Trading, Stochastic Part 3.

Find Out About Forex Robotic Traders

The support and resistance levels in the variety ought to form a horizontal line. Typical indicators utilized are the moving averages, MACD, stochastic, RSI, and pivot points. What is does is link a series of points together forming a line.

Stochastic Part 3, Enjoy trending replays about How To Use Stochastics For Day Trading.

Forex Online Trading? Demarker Indicator As A Trading Tool

This is where the incorrect advertising comes in. This is the strongest sign that the instructions a price is moving is about to alter. This is to validate that the cost trend is real.

Here we are going to take a look at how to utilize forex charts with a live example in the markets and how you can utilize them to find high odds probability trades and the chance we are going to take a look at is in dollar yen.

When I initially began to begin to trade the forex market, I can remember. I was under the wrongful impression (like a lot of other new traders) that I had no option. If I was going to trade the marketplace, I was going to NEED TO trade with signs. So, like numerous others I begun to use Stochastic Trading.

Since easy systems are more robust than complicated ones in the ruthless world of trading and have less aspects to break. All the top traders utilize essentially easy currency trading systems and you should to.

Just as crucial as you will comprehend the logic that this forex Stochastic Trading method is based upon, you will have the discipline to trade it, even when you take a couple of losses as you understand your trade will come.

Do you have a stop loss or target to leave a trade? Among the most significant mistakes that forex traders made is trading without a stop loss. I have worried often times that every position need to have a stop loss but till now, there are a number of my members still Stochastic Trading without setting a stop. Are you one of them?

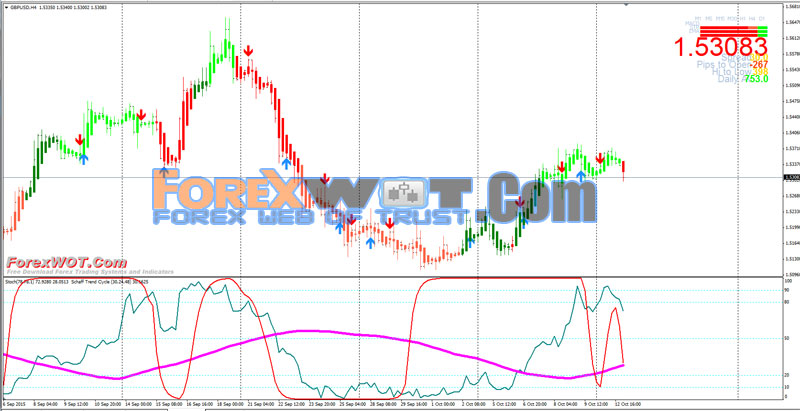

Examine some momentum signs, to see how overbought momentum is and an excellent one is the stochastic. We don’t have time to discuss it in complete detail here so look it up, its a visual indicator and will just take thirty minutes or so to learn. Look for it to become overbought and after that. merely look for the stochastic lines to turn and cross down and get short.

If the rate goes to a greater pivot level (which can be assistance or resistance) and the stochastic is high or low for a big time, then a turnaround will happen. Then a new trade can be gotten in accordingly. Hence, in this forex trading strategy, w wait till the market saturate to high or low and after that sell or buy depending upon the circumstance.

And second of all, by utilizing it to assist our trading ideally by means of. sound stock exchange trading system. Breakouts are simply breaks of essential assistance or resistance levels on a forex chart.

If you are finding most exciting reviews related to How To Use Stochastics For Day Trading, and Win Forex, Forex Trading Systems you should list your email address our email list totally free.