Stochastic and Moving average trading Strategy | stochastic moving average strategy

Best guide relevant with Win at Forex, Forex Online Trading, Detect Trend in Forex Trading, and Stochastic Scalping System, Stochastic and Moving average trading Strategy | stochastic moving average strategy.

Stochastic and Moving average trading Strategy | stochastic moving average strategy WELCOME TO OUR NEW VIDEO❤️ …

Stochastic Scalping System, Stochastic and Moving average trading Strategy | stochastic moving average strategy.

Currency Trading System – A Timeless Basic Way To Make Big Gains

What is does is connect a series of points together forming a line. They are placed side by side (tiled vertically). Utilizing the SMA line in the middle of the Bollinger Bands gives us an even better photo.

Stochastic and Moving average trading Strategy | stochastic moving average strategy, Search interesting full length videos related to Stochastic Scalping System.

How To Comprehend Currency Trading Charts To Earn You Maximum Profits

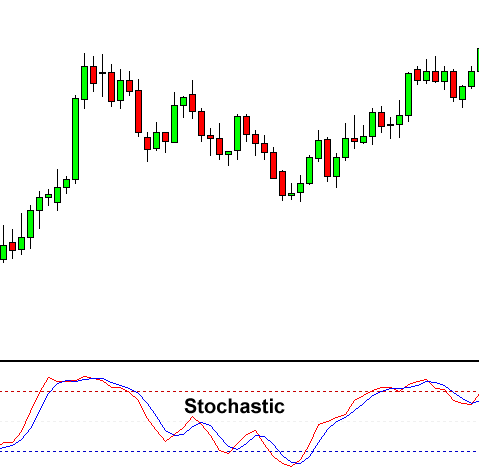

There are numerous meanings to the terms vary trading. The ones you pick are a matter of personal choice but I like the ADX, RSI and stochastic. But how to predict that the existing pattern is ending or is about to end?

Here I am going to show you an easy tested approach which is a proven way to earn money in forex trading and will continue to work. Let’s take a look at the method and how it works.

Good ones to look at are Relative Strength Index (RSI) Stochastic Trading, Typical Directional Motion (ADX) – There are others – but these are a fantastic place to start.

Search for divergences, it informs you that the cost is going to reverse. , if price makes a brand-new high and at the very same time that the stochastic makes lower high.. This is called a “bearish divergence”. The “bullish divergence” is when the price makes a brand-new low while the stochastic makes greater low.

Several traders just await the time when the price will reach near the point they are anticipating and think that at that point of time they will enter the trade and wish for Stochastic Trading much better levels of hold.Because it will lead to a fast wipe out and the market will take off your equity and will not provide you any benefits, never ever forecast anything or think anything.

Lots of traders make the error of believing they can use the swing trade method daily, however this is not a good idea and you can lose equity rapidly. Rather reserve forex swing trading for days when the marketplace is simply right for swing trading. So, how do you understand when the marketplace is right? When the chart is low or high, enjoy for resistance or support that has been held numerous times like. Watch the momentum and look for when prices swing highly toward either the resistance or the assistance, while this is happening look for verification that the momentum will turn. This verification is important and if the momentum of the cost is starting to wane and a turn is likely, then the chances are in terrific favor of a swing Stochastic Trading environment.

Keep your stop well back until the trend remains in movement. Trail your block slowly and outside of normal volatility, so you don’t get bumped out of the trend to quickly.

Keep in mind you will constantly provide bit back at the end of a trend however the big trends can last numerous weeks or months and if you get just 70% of these patterns, you will make a lot of money.

Sure enough, you can apply these ideas while utilizing a demonstration account. It is properly one of the reasons that the interest in trading Forex online has actually been increasing. What were these essential analysts missing?

If you are searching rare and engaging comparisons about Stochastic Scalping System, and Daily Charts Forex Tradin, Currency Swing Trading System, Forex Tips for Beginners – How to Make Money When There Is No Trend please list your email address for newsletter for free.