Simple Intraday Trading Strategy🔥🔥 for Intraday and Swing Trading| Heikin Ashi Trading Strategy

New full videos about Trading Rules, Daily Charts Forex Strategy, and What’s Swing Trading, Simple Intraday Trading Strategy🔥🔥 for Intraday and Swing Trading| Heikin Ashi Trading Strategy.

#heikin Ashi trading strategy#heikinashi #how to use heikIn Ashi candlesticks #heikin Ashi trading strategies In this Video, We will Learn About Heikin Ashi Trading and How to Use Heikin Ash and Trade in Intraday and Swing Trading.

Please hit the Subscribe Button and Press the Bell Icon to get all the latest updates!

******************************************************************

✅✅✅✅App Download & Course Purchase Links✅✅✅✅✅✅

🔴Android : https://bit.ly/3pnUT03

🔴IOS: https://apple.co/3BXPtMB (Institution code for IOS users – NXUZE)

******************************************************************

******************************************************************

✅✅✅✅✅✅✅✅✅✅

OPEN ANGEL BROKING FREE ACCOUNT :https://tinyurl.com/ydlnuu49

******************************************************************

******************************************************************

🔴Contact – WhatsApp – 9632751222

🔴Email- yatesh.dm@gmail.com

🔴Telegram – https://t.me/aatradingblog

🔴Facebook:https://www.facebook.com/AA-Trading-Blog-103966651549595

******************************************************************

#A&ATradingblog

#DayTrading

#Tradingapp

Disclaimer :

All views and charts shared in this video are purely for knowledge and information purposes only. Our video is intended only to provide general and preliminary information to investors/traders and shall not be construed as the basis for any investment decision or strategy, our content is intended to be used and must be used for informational purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances.

What’s Swing Trading, Simple Intraday Trading Strategy🔥🔥 for Intraday and Swing Trading| Heikin Ashi Trading Strategy.

3 Foolproof Approaches For Long Term Forex Trading

The easier your system is, the more profits it will produce on a long term. When the quick one crosses the sluggish one, this will show a trend. A simple commodity trading system like the above, traded with discipline is all you require.

Simple Intraday Trading Strategy🔥🔥 for Intraday and Swing Trading| Heikin Ashi Trading Strategy, Explore interesting high definition online streaming videos relevant with What’s Swing Trading.

6 Proven Winning Ideas To Build Your Forex Trading System

It is a software, which researches and analysis and enables newbies to jump in and make earnings. Trading is always short-term while investing is long term. The charts show that the market is moving up again.

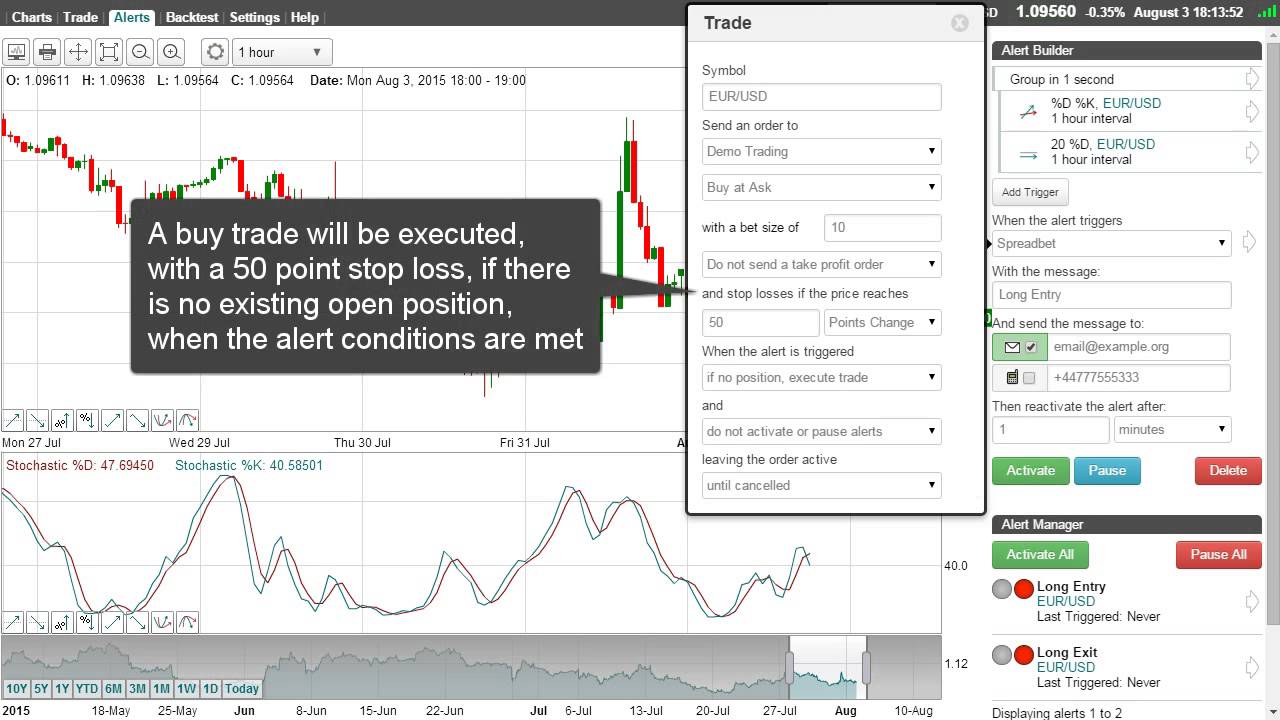

The Stochastic Oscillator is an overbought/oversold indication established by Dr. George Lane. The stochastic is a typical sign that is integrated into every charting software application including MetaStock.

You will understand it and this understanding results in confidence which leads onto discipline. People Stochastic Trading who purchase prepared made systems don’t understand what their doing their just following and have no confidence.

The fact is you don’t have actually to be daunted with the concept of day trading. The beauty of day trading is that you do not have to have a Masters degree in Company from Harvard to earn money doing this. Effective day traders consist of a great deal of “Typical Joes” like you and me. There are lots of effective day traders out there who had a truly difficult time just graduating high school.

No issue you state. Next time when you see the earnings, you are going to click out which is what you do. You remained in a long position, a red candle light appears and you click out. Whoops. The market continues in your direction. You stand there with 15 pips and now the market is up 60. Disappointed, you decide you are going to either let the trade play out to your Stochastic Trading profit target or let your stop get set off. You do your research. You get in the trade. Boom. Stopped out. Bruised, damaged and deflated.

A few of the stock signals traders take a look at are: volume, moving averages, MACD, and the Stochastic Trading. They also need to look for floorings and ceilings in a stock chart. This can reveal a trader about where to get in and about where to go out. I say “about” because it is pretty difficult to guess an “exact” bottom or an “precise” top. That is why securing earnings is so so important. , if you don’t lock in revenues you are actually running the risk of making a worthless trade.. Some traders end up being really greedy and it just harms them.

The Stochastic Indicator – this has actually been around since the 1950’s. It is a momentum indicator which determines over purchased (readings above 80) and over offered (readings listed below 20), it compares today’s closing rate of a stocks price variety over a current amount of time.

Remember, if your trading stocks, do your research and share a strategy and stick to it. Do not forget to lock in revenues. Stock trading can make you a great deal of money if carried out in a disciplined way. So go out there and try it out.

No matter whether the pattern of a stock is going up or down, it will constantly move in waves. Let’s discuss this Everyday Timeframe Technique. Two of the finest are the stochastic indicator and Bollinger band.

If you are looking unique and entertaining comparisons relevant with What’s Swing Trading, and Range Trading Winning, Forex Traading System dont forget to signup in email subscription DB for free.