Simple 1 Minute Smart Money Trading Strategy

Best replays top searched Automatic Trading System, Free Forex Eudcation, Forex Trading System. Forex Trading, and Bearish Divergence Stochastic, Simple 1 Minute Smart Money Trading Strategy.

In this episode, we will explain to you one of our advanced scalping strategies in a 1-minute time frame based on the smart money …

Bearish Divergence Stochastic, Simple 1 Minute Smart Money Trading Strategy.

Forex Trading – Swing Trading In 3 Simple Actions For Huge Profits

The very best method to time your entry is to look for the break on the cost level. The only thumb-down in this business is that it is extremely dangerous. The majority of traders like to wait on the pullback but they never ever get in.

Simple 1 Minute Smart Money Trading Strategy, Search top replays related to Bearish Divergence Stochastic.

Win Forex Trading – If You Wish To Win Trade The Big Breakouts

Doing this implies you know what your optimum loss on any trade will be instead of losing everything. The most effective sign is the ‘moving average’. It is also essential that the trade is as detailed as possible.

Today lots of traders purchase commodity trading systems and invested cash on costly software when really all they require is to do a little research on the net and develop their own.

Use another sign to verify your conclusions. If the support and the resistancelines are touching, then, there is likely to have a breakout. And if this is the Stochastic Trading circumstance, you will not be able to presume that the rate will turn when more. So, you might just want to set your orders beyond the stretch ofthe resistance and the support lines in order for you to capture a happening breakout. However, you must use another indication so you can verify your conclusions.

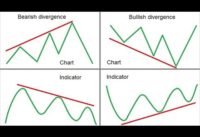

Try to find divergences, it tells you that the rate is going to reverse. , if cost makes a brand-new high and at the very same time that the stochastic makes lower high.. This is called a “bearish divergence”. The “bullish divergence” is when the cost makes a new low while the stochastic makes greater low.

It should increase the profits and cut the losses: when you see a trend and use the system you constructed Stochastic Trading , it needs to continue opening the deal if the revenues going high and seal the deal if the losses going on.

Stochastic Trading If the break occurs you go with it, you need to have the frame of mind that. Sure, you have missed out on the very first bit of revenue however history reveals there is typically plenty more to follow.

Breakouts are probable if the resistance and support lines converge. In this circumstances, you might not presume that costs will return constantly. You may have a choice for orders outside the converging line range to acquire a breakout as it takes place. Yet again, inspect your evaluations against at least 1 additional sign.

Rule number one: Cash management is of utmost value if you remain in for a long period of TF. Adjust to the emerging trading patterns. A synergy in between the systems functions and tools and your understanding of them will insure earnings for you. Using an automatic system will assist you step up your portfolio or start creating an effective one. Carefully choose the automated trading system that covers your work step by step and not get swindled by a system shown to make the owner money from offering an inferior item.

Permit market correction to occur prior to positioning any trade. It would make our life as traders a lot simpler and a lot more successful. Ensure price momentum is entering the direction of your trading signal.

If you are looking instant entertaining videos relevant with Bearish Divergence Stochastic, and Trading 4x Online, Forex Market, Unpredictable Market you are requested to signup in a valuable complementary news alert service for free.

![stochastic indicator sinhala [technical analysis sinhala]best indicator sinhala /sl passive income stochastic indicator sinhala [technical analysis sinhala]best indicator sinhala /sl passive income](https://Stochastictrader.com/wp-content/uploads/1645602384_stochastic-indicator-sinhala-technical-analysis-sinhalabest-indicator-sinhala-sl-passive-200x137.jpg)