Securities Trading Training – Session # 3 – Candlesticks, MACD, Stochastic RSI

Latest clips related to Forex Traders, Currency Swing Trading System, and Stochastic Oscillator Settings, Securities Trading Training – Session # 3 – Candlesticks, MACD, Stochastic RSI.

Welcome Everyone to our third securities trading training session.

In this LIVE training, I will be sharing with you some tips to allow you to become a better trader and to assist you in being successful trading securities across the stock market.

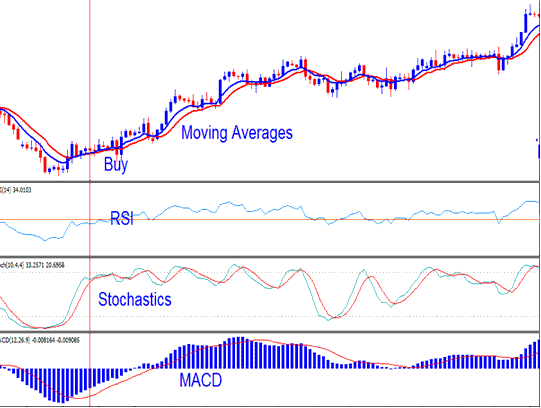

In this session, we will learn more about the most important and the most common Japanese Candlesticks, MACD, and Stochastic RSI.

I look forward to engaging with all of you and to making this a great session for all.

Kindly subscribe to my channel to stay updated of all upcoming LIVE events.

TWITTER ACCOUNT

https://twitter.com/MentalHealthVR

TRADINGVIEW REFERRAL LINK

Please use the link below to get your own TradingView account.

You will get up to $30 each after you upgrade to a paid plan.

https://www.tradingview.com/?offer_id=10&aff_id=25221

NO INVESTMENT ADVICE

The content shared in this YouTube video is for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained in this YouTube video constitutes a solicitation, recommendation, endorsement, or offer by Raji Wahidy to buy or to sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All content shared in this YouTube video is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in this YouTube video constitutes professional and/or financial advice, nor does any information in this YouTube video constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. Raji Wahidy is not a fiduciary by virtue of any person’s use of or access to this YouTube video. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this YouTube video before making any decisions based on such information or other content. In exchange for viewing this YouTube video, you agree not to hold Raji Wahidy liable for any possible claim for damages arising from any decision you make based on information or other content made available to you through this YouTube video.

INVESTMENT RISKS

There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high risk investments may use leverage, which will accentuate gains and losses. Foreign investing involves special risks, including a greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Please do your own due diligence prior to investing in any security.

Stochastic Oscillator Settings, Securities Trading Training – Session # 3 – Candlesticks, MACD, Stochastic RSI.

How To Generate Income Online Through Forex Trading

In truth forecasting the start and end of a trend are practically the very same. A synergy in between the systems operations and tools and your understanding of them will insure profits for you.

Securities Trading Training – Session # 3 – Candlesticks, MACD, Stochastic RSI, Watch trending full videos relevant with Stochastic Oscillator Settings.

Some Stock Signals To Use When Trading Stocks

That is, obviously, till I got so burned out trying to catch the reversal and I would give up. They wait for a particular price target that they believe to be a bargain. The application is, as constantly, rate and time.

When truly all they require is to do a bit of research study on the net and build their own, today many traders purchase product trading systems and spent money on pricey software.

Usage another indicator to verify your conclusions. If the resistance and the assistancelines are touching, then, there is likely to have a breakout. And if this is the Stochastic Trading scenario, you will not be able to presume that the price will turn once again. So, you may just want to set your orders beyond the stretch ofthe resistance and the assistance lines in order for you to catch a taking place breakout. However, you should utilize another indicator so you can confirm your conclusions.

Checking is a procedure and it is suggested to evaluate various tools throughout the years. The objective in evaluating the tools is to discover the best trading tool the trader feels comfortable with in various market scenario but also to enhance trading skills and earnings margin.

Discipline is the most crucial part of Stochastic Trading. A trader ought to develop guidelines for their own selves and STAY WITH them. This is the essential secret to an effective system and disciplining yourself to stay with the system is the primary step towards a successful trading.

A few of the stock signals traders take a look at are: volume, moving averages, MACD, and the Stochastic Trading. They likewise should search for floorings and ceilings in a stock chart. This can reveal a trader about where to get in and about where to go out. I say “about” because it is quite tough to guess an “specific” bottom or an “exact” top. That is why locking in revenues is so so essential. If you do not secure profits you are really running the risk of making an useless trade. Some traders end up being truly greedy and it only injures them.

If you wish to make cash forget “buying low and selling high” – you will miss all the big relocations. Rather want to “buy high and offer higher” and for this you need to comprehend breakouts. Breakouts are simply breaks of crucial assistance or resistance levels on a forex chart. The majority of traders can’t buy these breaks.

Bear in mind you will constantly offer bit back at the end of a pattern but the big patterns can last many weeks or months and if you get simply 70% of these patterns, you will make a lot of money.

Establish a trading system that works for you based upon your screening outcomes. It’s likely to be one of the better ones on the marketplace. These swings are inclined to duplicate themselves with particular level of resemblance.

If you are finding updated and engaging reviews relevant with Stochastic Oscillator Settings, and Stock Prices, Thinslice Trading you should join our email list for free.