Scalping Vs Intraday Vs Swing Vs Positional | Which is best trading strategy?#rishimoney

Popular complete video top searched Trade Without Indicators, Forex Tip Trading, and What’s Swing Trading, Scalping Vs Intraday Vs Swing Vs Positional | Which is best trading strategy?#rishimoney.

Whatsapp 8448307971- for COURSES

Whatsapp 9910765548- TRADING SETUP

What is the difference between Intraday Trading and Scalping and Swing Trading,

What timeframe is best?

There are four types of trading style:

1. Scalping

2. Day trading which is popularly known as Intraday trading

3. Swing trading

4. Positional trading.

Scalping and Intraday trading styles are both day trading style because here positions a squared off within the day.

Swing trading is a kind of positional trade. In swing trading, traders try to catch the swing highs and swing lows to initiate a trade.

Positional trading is longest form of trading from weeks to month.

All the type trading styles have their own merits as well as demerits. A traders should know them well and choose accordingly. Watch the full video to know the pros and cons of each trading style

⚡️🔴 WhatsApp 9958375549 – ADVISORY SERVICES

⚡️🔴WhatsApp 8448307971 – COURSES

⚡️🔴WhatsApp 9910765548 – TRADING SETUP

MOBILE APP – For Intraday and Scalping Courses

Android- https://play.google.com/store/apps/details?id=co.bran.nnbim

IOS- https://apps.apple.com/in/app/myinstitute/id1472483563 (org code: nnbim)

Open free D-Mat Account

https://zerodha.com/open-account?c=ZZ5487

Upstox: https://upstox.com/open-account/?f=33BFZ7

SOCIAL MEDIA

𝐈𝐧𝐬𝐭𝐚𝐠𝐫𝐚𝐦: https://instagram.com/rai_rishimoney

𝐋𝐢𝐧𝐤𝐞𝐝𝐢𝐧: https://www.linkedin.com/in/-ca-rishi-rai/

Telegram: https://t.me/rishimoneytg

Facebook Page: https://www.facebook.com/rairishimoneyfb/

Twitter: https://twitter.com/rai_rishimoney

Disclaimer: This video is only for educational purpose.

Trainer Mr. Rishi Rai is a Chartered Accountant by profession, Investor, Equity Research Analyst & Investment Adviser, one of the aspiring finances and business coach. We are SEBI Registered INH000010423.

What’s Swing Trading, Scalping Vs Intraday Vs Swing Vs Positional | Which is best trading strategy?#rishimoney.

Practical Pointers On How To Stand Out At Stock Trading

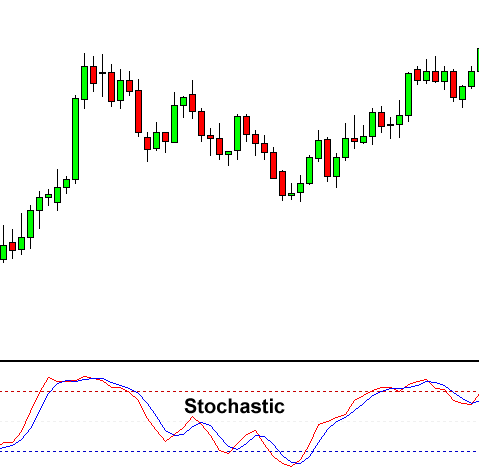

The Stochastic Oscillator is an overbought/oversold indicator established by Dr.

The above technique is extremely basic and can be learned by anybody and is a timeless method to make big Forex gains.

Scalping Vs Intraday Vs Swing Vs Positional | Which is best trading strategy?#rishimoney, Search more explained videos about What’s Swing Trading.

Variety Trading Secrets

Trade the chances and this means rate momentum should support your view and confirm the trade prior to you get in. Nevertheless, if for some factor, the software application does not work for you it’s great comfort to have.

, if you desire to win at forex trading and take pleasure in currency trading success possibly one of the easiest ways to accomplish it is to trade high chances breakouts.. Here we will take a look at how you can do this and make big earnings.

If one should understand anything about the stock exchange, it is this. It is ruled by feelings. Emotions are like springs, they stretch and agreement, both for just so long. BB’s procedure this like no other sign. A stock, especially widely traded large caps, with all the essential research study in the world currently done, will only lie dormant for so long, and after that they will move. The relocation after such dormant periods will generally remain in the instructions of the general pattern. If a stock is above it’s 200 day moving average Stochastic Trading then it is in an uptrend, and the next move will likely be up also.

Your Approach: this suggest the rules you use to recognize the trend and the how the cash is handled in the forex account. As mentioned above, it should be basic to relieve the usage of it.

OK now, not all breakouts are developed equivalent and you want the ones where the odds are greatest. You’re looking for Stochastic Trading support and resistance which traders discover important and you can typically see these levels in the news.

Stochastic Trading If the break occurs you go with it, you need to have the frame of mind that. Sure, you have actually missed out on the very first little revenue but history reveals there is typically plenty more to follow.

Based upon this info we properly predicted the market was decreasing. Now much of you would ask me why not simply get in your trade and ride it down.

Position the trade at a stop loss of approximately 35 pips and you must apply any of these two techniques for the purpose of making earnings. The first is use a good risk to a rewarding ratio of 1:2 while the next is to make use of support and resistance.

In fact that’s why monthly you can see new plans being offered online to brand-new traders. Attempt this now: Purchase Stock Assault 2.0 stock exchange software.

If you are finding rare and entertaining comparisons relevant with What’s Swing Trading, and Forex Traders, Stock Market System, Trend Following System, a Great Stock Trading Indicator: Try This Now dont forget to subscribe in email subscription DB for free.