Scalping TDI Trading Strategy – TREND SCALPING TDI STRATEGY

Interesting guide highly rated Forex Robots, Forex Tips for Beginners – How to Make Money When There Is No Trend, and Stochastic Settings For Day Trading, Scalping TDI Trading Strategy – TREND SCALPING TDI STRATEGY.

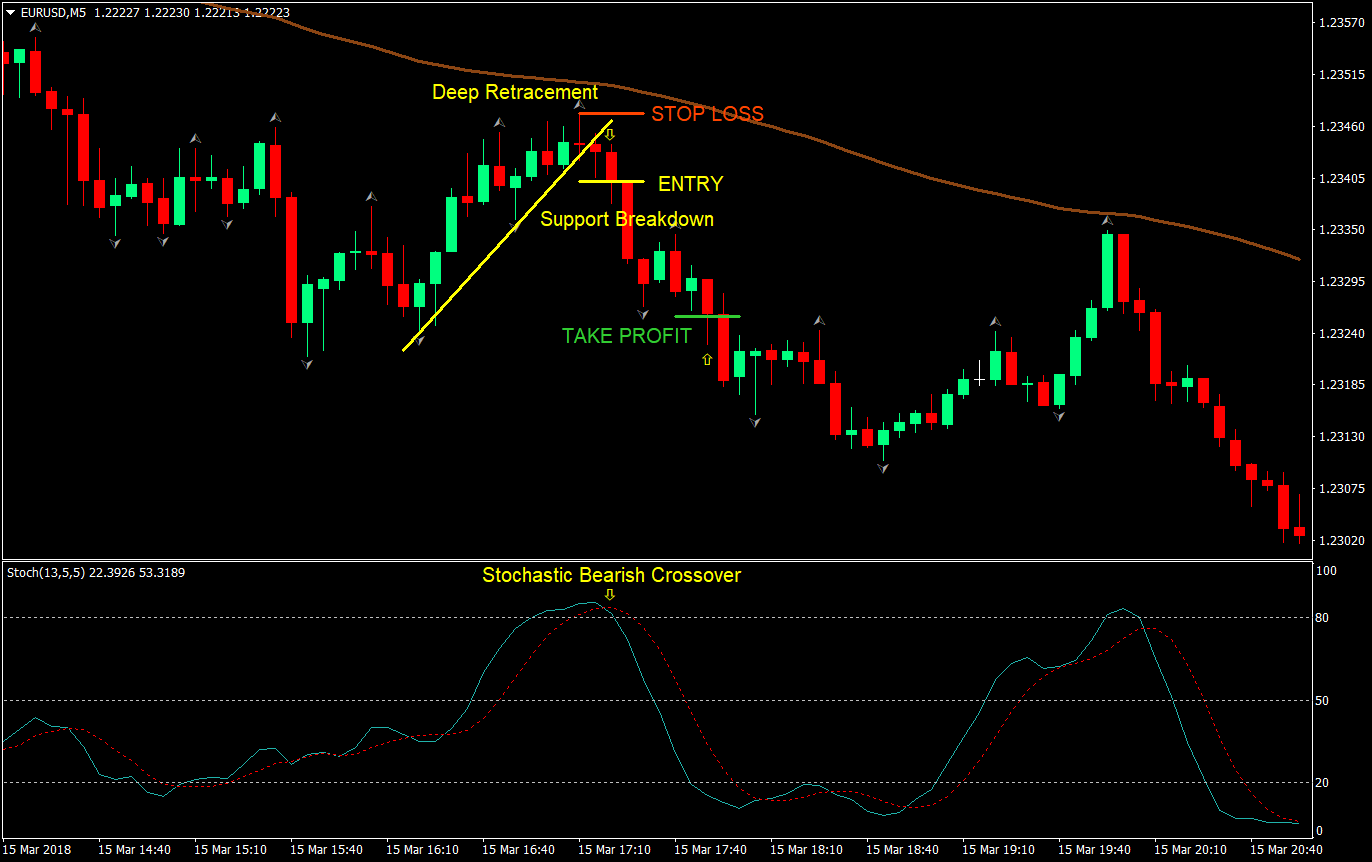

This is SCALPING TRADING STRATEGY. We will be using the TDI indicator to find entries.

Check out our free signals telegram channel

http://t.me/bigfreesignals

ADVANCED COURSE enquiry – https://t.me/Bunnex_investment_group

Get an FTMO funded account

https://bit.ly/3cnpXoJ

Best Forex Broker HOTFOREX

https://www.hotforex.com/?refid=304773

Connect with us on Social Media

instagram: https://rb.gy/lwz9fq

Twitter: https://rb.gy/bgkbr7

Stochastic Settings For Day Trading, Scalping TDI Trading Strategy – TREND SCALPING TDI STRATEGY.

The Very Best Forex Trading System For Newbies Keeps You Busy – Not Bored

They are put side by side (tiled vertically). Get too made complex with a lot of rules, and you’ll merely be slowed down. Look over the sellers website and inspect the variation number of the software application being sold.

Scalping TDI Trading Strategy – TREND SCALPING TDI STRATEGY, Watch top explained videos related to Stochastic Settings For Day Trading.

A Plan To Success – A Rewarding Trading Plan

This depends upon how often one refers the trade charts. When the guidelines are fulfilled, whatever it is, the trader can exit the trading or go into. But all is not lost if the traders make guidelines for themselves and follow them.

When actually all they need is to do a bit of research on the internet and construct their own, today numerous traders purchase commodity trading systems and spent money on costly software.

You can get in on and stay with every significant trend if you buy and sell these breaks. Breakout Stochastic Trading is a basic, proven way to generate income – however most traders can’t do it and the reason is easy.

You then require to see if the odds are on your side with the breakout so you check cost momentum. There are lots of momentum indicators to help you time your relocation and get the velocity of price on your side. The ones you select refer individual choice however I like the ADX, RSI and stochastic. , if my momentum computation adds up I go with the break..

These are the long term financial investments that you do not rush into. This is where you take your time examining Stochastic Trading a great area with resistance and support to make a big slide in earnings.

If the support Stochastic Trading and resistance lines are converging, a breakout is likely. In this case you can not assume that the cost will constantly turn. When it occurs, you might prefer to set orders outside the variety of the converging lines to capture a breakout. But again, inspect your conclusions versus a minimum of another sign.

To see how overbought the currency is you can utilize some momentum signs which will provide you this information. We do not have time to discuss them here but there all easy to learn and use. We like the MACD, the stochastic and the RSI however there are much more, just pick a couple you like and use them.

Keep in mind you will always offer bit back at the end of a pattern however the big patterns can last numerous weeks or months and if you get just 70% of these patterns, you will make a lot of money.

Note that the previous indicators can be used in combination and not just one. You need to see thoroughly as the price relocations towards the support or resistance. This is to confirm that the price trend is true.

If you are looking exclusive exciting reviews related to Stochastic Settings For Day Trading, and Trending Market, Technical Analysis Tool you should signup our a valuable complementary news alert service now.