Scalping System ,Indicators Setting

Trending full length videos related to Stock Trading Strategy, Automatic Forex, Currency Trading Training, Trading Currencies, and Stochastic Scalping Settings, Scalping System ,Indicators Setting.

Scalping is a trading strategy that aims to profit from small price movements in the market. Here are some indicators and settings that can be used for a scalping system:

Moving Averages: Using two moving averages, one fast and one slow, can help identify trends and potential reversal points. For example, a common combination is the 5-period and 20-period moving averages.

Bollinger Bands: Bollinger Bands are a technical indicator that consists of a moving average and two bands that are plotted above and below the moving average. The bands represent the standard deviation of the price and can be used to identify overbought and oversold conditions.

Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. It can be used to identify overbought and oversold conditions and potential reversal points.

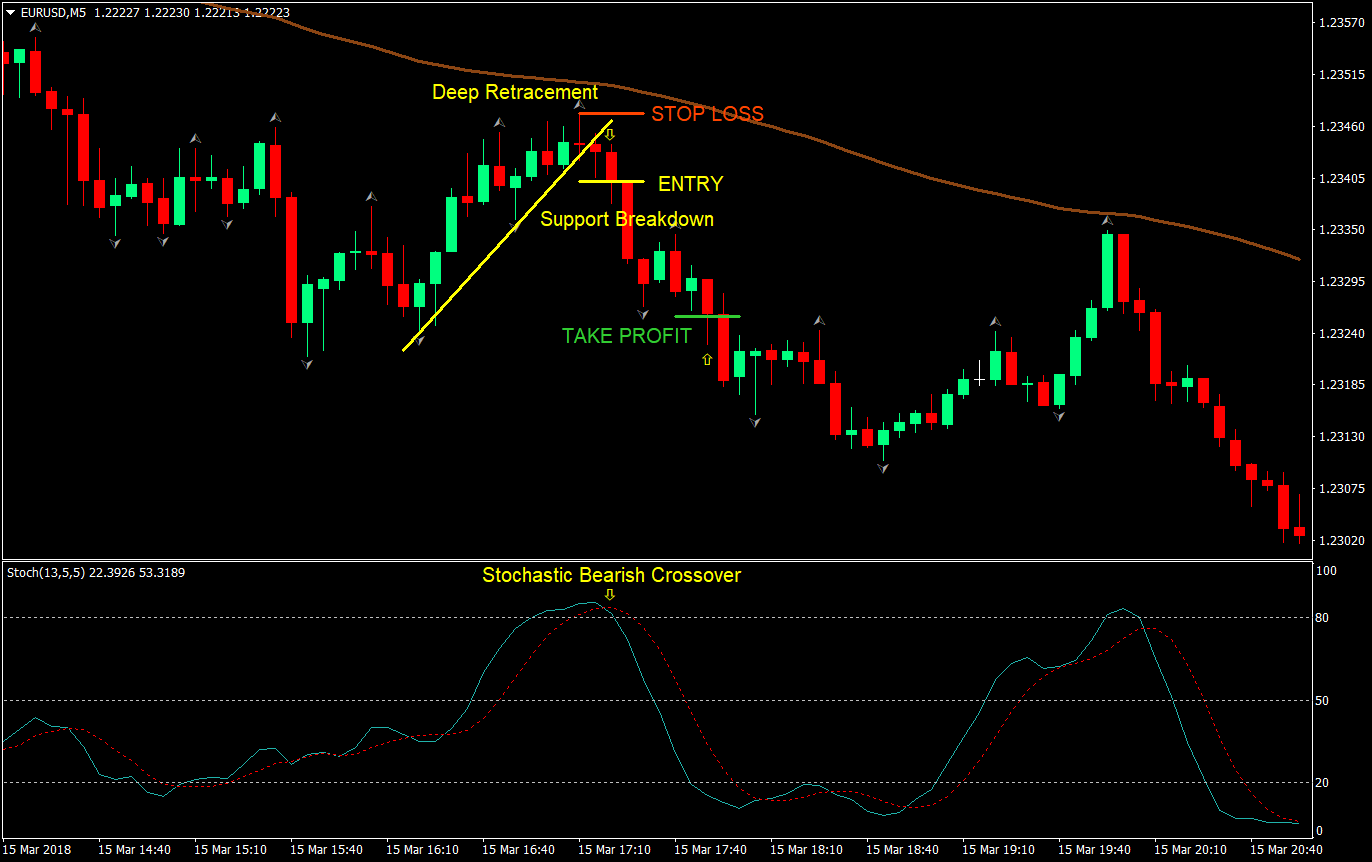

Stochastic Oscillator: The stochastic oscillator is a momentum indicator that compares the current price to its range over a set period of time. It can also be used to identify overbought and oversold conditions.

MACD: The MACD is a trend-following momentum indicator that can be used to identify trend changes and potential buy/sell signals.

The settings for these indicators can vary depending on the trader’s preference and the market being traded. For example, a scalper may use a faster moving average and a shorter timeframe for the RSI and stochastic oscillator to capture small price movements. It’s important to test different settings and indicators to find the most effective scalping system for your trading style.

Stochastic Scalping Settings, Scalping System ,Indicators Setting.

Best Forex Trading Strategy

Fortunately you do not require to get down to the basics of ‘why’ cycles exist in order to make the most of them.

Nevertheless, there is one thing you do not want to over look – memory.

Scalping System ,Indicators Setting, Enjoy popular videos about Stochastic Scalping Settings.

Find Out About Forex Robot Traders

Here we wish to take a look at developing a sample trading system for huge revenues. These trendlines are considered to be extremely crucial TA tool. A trader needs to establish rules for their own selves and STICK to them.

Here I am going to show you a basic proven methodology which is a tested way to generate income in forex trading and will continue to work. Let’s take a look at the technique and how it works.

This technique is simple and it is not made complex in any way. It works even in unpredictable market conditions. Your capability Stochastic Trading to get the very best from this technique depends on the method you efficaciously apply the technique. There is no magic behind the strategy.

Because easy systems are more robust than complex ones in the brutal world of trading and have fewer components to break. All the leading traders utilize essentially basic currency trading systems and you must to.

No problem you say. Next time when you see the revenues, you are going to click out and that is what you do. You remained in a long position, a red candle light appears and you click out. Whoops. The marketplace continues in your direction. You stand there with 15 pips and now the market is up 60. Disappointed, you decide you are going to either let the trade play out to your Stochastic Trading earnings target or let your stop get triggered. You do your research. You enter the trade. Boom. Stopped out. Bruised, damaged and deflated.

Simpleness. A Forex Stochastic Trading system that achieves success is likewise easy. Get too made complex with too lots of guidelines, and you’ll merely be slowed down. Simple systems work much better than complex ones do, and you’ll have a much better possibility of success in the Forex market, in spite of its fast lane.

Based upon this information we properly forecasted the marketplace was going down. Now many of you would ask me why not just get in your trade and ride it down.

So get learn Forex swing trading systems and pick one you like and you might soon be making big routine revenues and taking pleasure in currency trading success.

This means reducing your potential loses on each trade using a stop loss. This everyday charts technique can make you 100-500 pips per trade. And in a sag, connect 2 higher lows with a straight line.

If you are looking rare and entertaining comparisons related to Stochastic Scalping Settings, and Currency Trading Training, Forex Profits, Swing Trading Securities, Forex Trading Tips you are requested to signup for newsletter totally free.