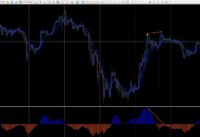

RSI Divergence | Bearish RSI Divergence | Nifty 50 | Intraday Setup | #shorts #trading #nifty50

Trending high defination online streaming related to Currency Trading Education, Momentum Trading, How to Trade Support and Resistance, and Bearish Divergence Stochastic, RSI Divergence | Bearish RSI Divergence | Nifty 50 | Intraday Setup | #shorts #trading #nifty50.

RSI Divergence Real Example in Nifty 50. RSI Divergence Backtest with Real Example.

#rsi #rsidivergence #shorts #youtube #nifty50 #trading .

Bearish Divergence Stochastic, RSI Divergence | Bearish RSI Divergence | Nifty 50 | Intraday Setup | #shorts #trading #nifty50.

Complimentary Forex Trading Strategy

And if this is the circumstance, you will not be able to presume that the price will turn again. Utilize the technical indicators you learn and check them with historic information.

RSI Divergence | Bearish RSI Divergence | Nifty 50 | Intraday Setup | #shorts #trading #nifty50, Play top full length videos relevant with Bearish Divergence Stochastic.

3 Methods To Use Technical Analysis As Part Of Your Trading Method.

Without a stop loss, do you know that you can clean out your trading account really easily? Trail your stop up gradually and outside of normal volatility, so you do not get bumped out of the trend to soon.

One of the aspects that you need to learn in Forex trading is comprehend the importance of currency trading charts. The main purpose of Forex charts is to assist making presumptions that will result in better choice. However before you can make excellent one, you first must learn to know how to utilize them.

Look at support and resistance levels and pivot points. When it approaches them, in a perfect choppy market the assistance and resistance lines will be parallel and you can anticipate the market to turn. Check against another indicator such as the Stochastic Trading oscillator. You have another signal for the trade if it shows that the price is in the overbought or oversold range.

2 of the finest are the stochastic indication and Bollinger band. Use these with a breakout method and they offer you a powerful mix for seeking big gains.

It must go up the earnings and cut the losses: when you see a pattern and utilize the system you built Stochastic Trading , it needs to continue opening the deal if the revenues going high and close the deal if the losses going on.

Stochastic Trading If the break happens you go with it, you require to have the mindset that. Sure, you have actually missed the first bit of revenue however history reveals there is typically plenty more to follow.

If you follow the above 4 actions in building your forex trading strategy, you will have the fundamentals of a system that’s simple to comprehend apply and makes big revenues.

Keep in mind, if your trading stocks, do your research and go in with a plan and stick to it. Don’t forget to secure earnings. Stock trading can make you a lot of money if carried out in a disciplined manner. So go out there and try it out.

When the rate touches the lower band, the marketplace is considered to be oversold. 2 of the best are the stochastic indicator and Bollinger band. The broader the bands are apart the higher the volatility of the currency studied.

If you are looking exclusive exciting reviews related to Bearish Divergence Stochastic, and Automatic Trading System, Forex Profits, Easy Forex Trading System please join in a valuable complementary news alert service now.

![Stochastic Indicator on BitSeven [2019] Stochastic Indicator on BitSeven [2019]](https://Stochastictrader.com/wp-content/uploads/1640063489_Stochastic-Indicator-on-BitSeven-2019-200x137.jpg)