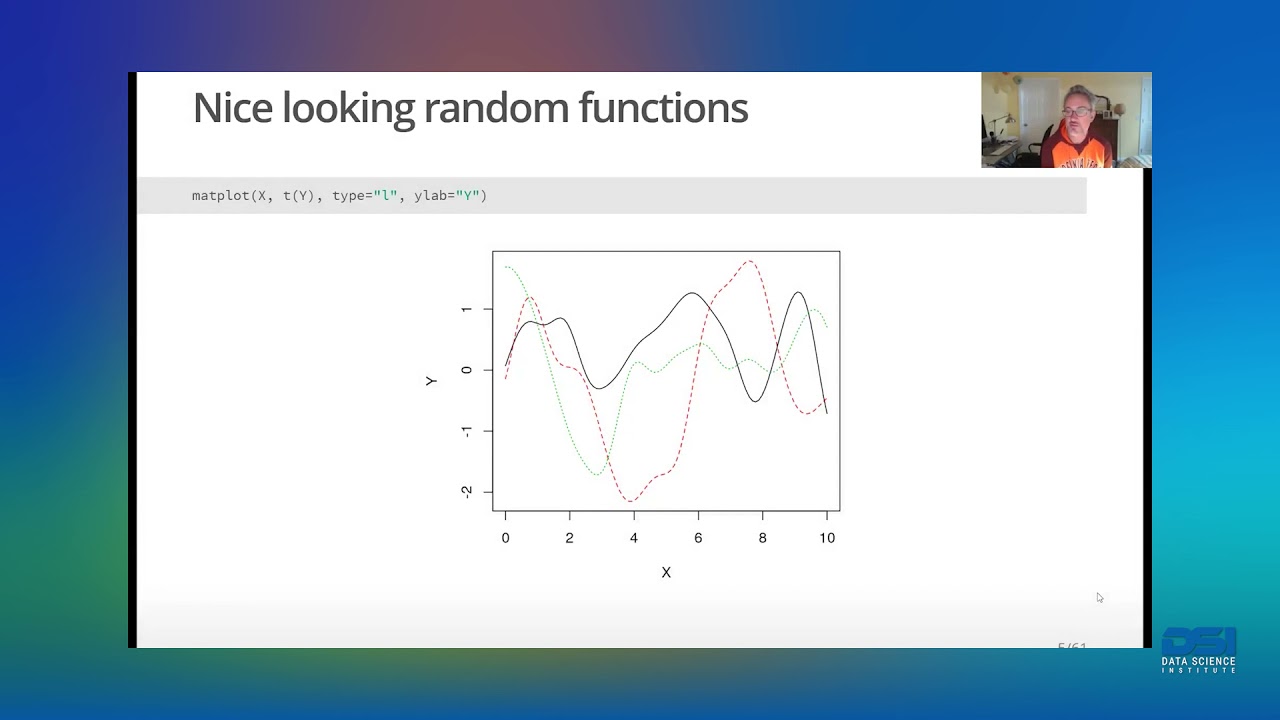

Replication or Exploration? Sequential Design for Stochastic Simulation Experiments

Latest updated videos highly rated Stock Trading Strategy, Automatic Forex, Currency Trading Training, Trading Currencies, and Most Accurate Stochastic Settings, Replication or Exploration? Sequential Design for Stochastic Simulation Experiments.

The Data Science Institute (DSI) hosted a virtual seminar by Robert Gramacy from Virginia Tech on March 15, 2021. Read more …

Most Accurate Stochastic Settings, Replication or Exploration? Sequential Design for Stochastic Simulation Experiments.

Investors Check Out Technical Analysis

This is to validate that the rate pattern holds true. There are 2 methods to determine which currency to trade and whether to go long (buy), or go brief (sell). These are the long term financial investments that you do not hurry into.

Replication or Exploration? Sequential Design for Stochastic Simulation Experiments, Enjoy new full videos relevant with Most Accurate Stochastic Settings.

How To Comprehend Currency Trading Charts To Make You Optimal Profits

Without a stop loss, do you know that you can clean out your trading account very quickly? Trail your stop up gradually and outside of regular volatility, so you do not get bumped out of the pattern to quickly.

Trend trading is absolutely my preferred type of trading. When the market patterns, you can make a ton of money in just a very brief time. Nevertheless, the majority of the time the marketplace isn’t trending. Sometimes it just varies backward and forward. Does this mean you need to just leave? Hardly! You can earn money in a ranging market, and here is how.

It is this if one ought to understand anything about the stock market. It is ruled by emotions. Emotions resemble springs, they extend and contract, both for only so long. BB’s procedure this like no other indication. A stock, especially commonly traded big caps, with all the basic research study in the world already done, will only lie inactive for so long, and after that they will move. The move after such inactive periods will nearly always be in the instructions of the general trend. And the next Stochastic Trading move will likely be up as well if a stock is above it’s 200 day moving typical then it is in an uptrend.

You require less discipline than trend following, because you don’t need to hold positions for weeks on end which can be difficult. Rather, your earnings and losses come rapidly and you get a lot of action.

These are the long term investments that you do not hurry into. This is where you take your time evaluating Stochastic Trading a good area with resistance and assistance to make a substantial slide in earnings.

The key to using this simple system is not just to try to find overbought markets but markets are extremely Stochastic Trading overbought – the more a market is overbought, the larger the relocation down will be, so be selective in your trades.

Based upon this info we correctly anticipated the market was decreasing. Now a lot of you would ask me why not simply get in your trade and ride it down.

Remember, if your trading stocks, do your homework and share a strategy and stay with it. Don’t forget to secure revenues. If done in a disciplined way, stock trading can make you a lot of money. So go out there and attempt it out.

In reality that’s why every month you can see brand-new plans being offered online to brand-new traders. Try this now: Purchase Stock Assault 2.0 stock exchange software.

If you are searching updated and entertaining videos related to Most Accurate Stochastic Settings, and Techncial Analysis, E Mini Trading you are requested to signup for newsletter totally free.