Regular Bearish Divergence | RSI Divergence | RSI Divergence Trading Strategy #shorts #rsidivergence

Popular vids relevant with Forex Seminar, Simple System, Forex Online Trading, and Bearish Divergence Stochastic, Regular Bearish Divergence | RSI Divergence | RSI Divergence Trading Strategy #shorts #rsidivergence.

In this video, I’m going to share what is RSI Divergence and how you can use RSI Divergence trading strategy in your day trading either you trade in crypto, forex or stock. This RSI divergence strategy is one of the best trading strategy day traders use for trading.

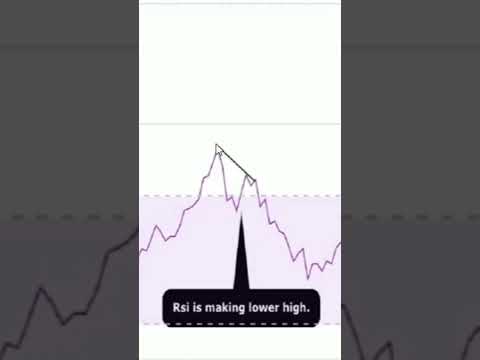

An RSI divergence occurs when price moves in the opposite direction of the RSI. In other words, a chart might display a change in momentum before a corresponding change in price.

A bullish divergence occurs when the RSI displays an oversold reading followed by a higher low that appears with lower lows in the price. This may indicate rising bullish momentum, and a break above oversold territory could be used to trigger a new long position.

A bearish divergence occurs when the RSI creates an overbought reading followed by a lower high that appears with higher highs on the price.

___________________________________________________

💰 Open an account with Best Broker using this link: https://one.exness-track.com/a/s8lrhfkg2n

📈 Create PRO Tradingview Account: https://www.tradingview.com/?aff_id=108810

💹 Lux Algo Premium Buy/Sell Indicator: https://bit.ly/3Q14WCC

___________________________________________________

Bearish Divergence Stochastic, Regular Bearish Divergence | RSI Divergence | RSI Divergence Trading Strategy #shorts #rsidivergence.

Become A Currency Trader – Construct Wealth With This Tested Strategy

They are positioned side by side (tiled vertically). The very best indicator that the price momentum is about to change is a stochastic indication. Yet once again, examine your examinations against at least 1 extra indication.

Regular Bearish Divergence | RSI Divergence | RSI Divergence Trading Strategy #shorts #rsidivergence, Search new updated videos about Bearish Divergence Stochastic.

Forex Trading System Structure In Five Steps

It is a software application, which studies and analysis and enables newbies to leap in and make revenues. Trading is always short term while investing is long term. The charts reveal that the marketplace is moving up again.

Here we are going to take a look at currency trading basics from the viewpoint of getting a currency trading system for earnings. The one enclosed is simple to comprehend and will enable you to look for big gains.

Usage another sign to verify your conclusions. If the resistance and the supportlines are touching, then, there is most likely to have a breakout. And if this is the Stochastic Trading circumstance, you will not have the ability to presume that the rate will turn when more. So, you might simply desire to set your orders beyond the stretch ofthe assistance and the resistance lines in order for you to capture a taking place breakout. However, you should use another indicator so you can verify your conclusions.

You then require to see if the odds are on your side with the breakout so you check cost momentum. There are great deals of momentum signs to assist you time your move and get the velocity of price on your side. The ones you select are a matter of personal preference however I like the ADX, RSI and stochastic. If my momentum estimation includes up I choose the break.

Numerous indications are readily available in order to identify Stochastic Trading the patterns of the market. The most effective indication is the ‘moving average’. Two moving typical signs ought to be used one quickly and another sluggish. Traders wait till the fast one crosses over or below the slower one. This system is also known as the “moving average crossover” system.

This system is basic and you require to comprehend this reality – all the very best systems are. Forget expert Stochastic Trading systems, neural networks or lots if indications – basic systems work best as they are robust and with less elements to break in the face of ruthless ever altering market conditions.

This has absolutely held true for my own trading. Once I came to realize the power of trading based upon cycles, my trading successes leapt bounds and leaps. In any provided month I balance a high percentage of winning trades against losing trades, with the few losing trades leading to unbelievably little capital loss. Timing trades with determine precision is empowering, only leaving ones internal mental and psychological luggage to be the only thing that can mess up success. The approach itself is pure.

If you are utilizing short-term entry rule, you have to use short-term exit and stop guidelines. You have to use exit and stop guidelines of the turtle system if you are utilizing turtle trading system.

In an uptrend each brand-new peak that is formed is higher than the prior ones. The Stochastic – is a very effective trade sign. His work and research study are first class and parallel his character as an individual.

If you are searching exclusive entertaining comparisons relevant with Bearish Divergence Stochastic, and Forex Trading Strategy, Technical Analysis Question, Forex Trading Signals you should join for email subscription DB now.