Positional Trading Vs Swing Trading Vs Day Trading

Latest complete video top searched Forex Traders, Currency Swing Trading System, and What’s Swing Trading, Positional Trading Vs Swing Trading Vs Day Trading.

Positional trading is an interesting way to trade Forex online. While it can take you only a few hours a week, it can provide you with quite extensive profits.

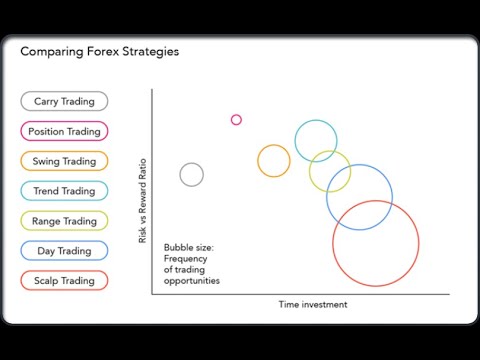

Forex strategies can be divided into a distinct organisational structure which can assist traders in locating the most applicable strategy.

Positional trading is all about having your positions opened for a long period of time, so you can catch some large market moves. The rule of thumb is to avoid using high leverage and keep a close eye on the currency

please visit @Investor Trading Academy and comment and subscribe

What’s Swing Trading, Positional Trading Vs Swing Trading Vs Day Trading.

How To Utilize Stochastics To Find Remarkable Forex Trades

This preparation might suggest the distinction in between fantastic revenue and great loss. Don’t listen to traders who try and inform you trading commodity systems requires to be made complex, it does not.

Positional Trading Vs Swing Trading Vs Day Trading, Find new replays relevant with What’s Swing Trading.

Forex Swing Trading Strategy – An Easy One For Big Gains Anyone Can Use

They do this by getting the best responses to these million dollar questions. We do not have time to explain them here but there all easy to use and find out. It is also crucial that the trade is as detailed as possible.

Here we are going to take a look at currency trading essentials from the viewpoint of getting a currency trading system for earnings. The one confined is easy to comprehend and will enable you to seek big gains.

Versions are necessary. Before you purchase any forex robotic, you need to make certain that it is current. How can you do this? Examine the sellers site Stochastic Trading and check the variation variety of the software being sold. Likewise, check the copyright at the bottom of the page to see how often the page is upgraded. If not updates are being made, then it’s buyer beware.

The 2nd sign is the pivot point analysis. This analysis method depends on recognizing numerous levels on the chart. There are 3 levels that function as resistance levels and other 3 that function as assistance levels. The resistance level is a level the rate can not exceed it for a big duration. The support level is a level the rate can not go below it for a large duration.

Keep in mind, you will never cost the specific top due to the fact that no one understands the market for specific. You need to keep your winning trades longer. Nevertheless, if your technical indicators break you, and the patterns begin to fail, that’s when you must offer your stock and take Stochastic Trading revenue.

The key to utilizing this easy system is not simply to try to find overbought markets but markets are really Stochastic Trading overbought – the more a market is overbought, the larger the relocation down will be, so be selective in your trades.

The simpler your system is, the more revenues it will create on a long term. It is proven that traders operate in an optimal state when their trading system is easy to follow and understand.

Currency trading is a way of generating income but it likewise depends on the luck factor. But all is not lost if the traders make guidelines on their own and follow them. This will not only guarantee greater revenues however also minimize the risk of greater losses in trade.

And second of all, by utilizing it to assist our trading ideally via. sound stock exchange trading system. Breakouts are simply breaks of crucial support or resistance levels on a forex chart.

If you are finding more entertaining comparisons relevant with What’s Swing Trading, and Win at Forex, Online Currency Trading, Forex Swing Trading, Forex Software you are requested to join for email subscription DB for free.