Nifty analysis 15June 2023 #nifty #banknifty #nifty50 #shorts #viral

Latest full length videos related to Forex Day Trading, Simple System, and Trading Stochastic Divergence, Nifty analysis 15June 2023 #nifty #banknifty #nifty50 #shorts #viral.

Telegram group = https://t.me/+HKMnqxEZu_5hMzNl

Instagram =https://instagram.com/candle_traders?igshid=MzNlNGNkZWQ4Mg==

Top trading strategies for beginners.

How to analyze stock charts for trading success.

Best technical indicators for day trading.

Mastering options trading: A comprehensive guide.

Live trading session: Profits and losses.

Understanding candlestick patterns for profitable trading.

Trading psychology: Controlling emotions for consistent gains.

Swing trading strategies for volatile markets.

Candle trading.

Introduction to Nifty and Bank Nifty trading strategies.

Understanding technical analysis for Nifty and Bank Nifty.

How to trade Nifty and Bank Nifty options.

Strategies for day trading Nifty and Bank Nifty.

Nifty and Bank Nifty futures trading explained.

How to read Nifty and Bank Nifty charts for trading.

100 % accuracy

Trading Nifty and Bank Nifty using moving averages.

Candlestick patterns for Nifty and Bank Nifty trading.

Fibonacci retracement in Nifty and Bank Nifty trading.

Bollinger Bands strategy for Nifty and Bank Nifty.

MACD indicator for Nifty and Bank Nifty trading.

RSI indicator strategy for Nifty and Bank Nifty.

Volume analysis in Nifty and Bank Nifty trading.

Support and resistance levels in Nifty and Bank Nifty.

Breakout trading strategies for Nifty and Bank Nifty.

Intraday trading techniques for Nifty and Bank Nifty.

Swing trading strategies for Nifty and Bank Nifty.

Options strategies for Nifty and Bank Nifty.

Hedging techniques in Nifty and Bank Nifty trading.

Risk management in Nifty and Bank Nifty trading.

Position sizing for Nifty and Bank Nifty trades.

Stop-loss and target placement in Nifty and Bank Nifty trading.

Gap trading in Nifty and Bank Nifty.

Seasonal patterns in Nifty and Bank Nifty.

Option chain analysis for Nifty and Bank Nifty.

Trading psychology for Nifty and Bank Nifty.

Algorithmic trading in Nifty and Bank Nifty.

Backtesting strategies for Nifty and Bank Nifty.

Trading Nifty and Bank Nifty with moving average crossovers.

Breakout trading strategies for Bank Nifty.

Intraday scalping strategies for Nifty and Bank Nifty.

Options selling strategies for Nifty and Bank Nifty.

Hedging with options in Nifty and Bank Nifty.

High-frequency trading in Nifty and Bank Nifty.

Nifty and Bank Nifty trading with price action.

Trading ranges in Nifty and Bank Nifty.

Trading with market profile in Nifty and Bank Nifty.

Market breadth analysis for Nifty and Bank Nifty.

Swing trading strategies for Bank Nifty.

Intraday momentum trading in Nifty and Bank Nifty.

Option buying strategies for Nifty and Bank Nifty.

Trend reversal patterns in Nifty and Bank Nifty.

Trading divergence in Nifty and Bank Nifty.

Option Greeks and their impact on Nifty and Bank Nifty trades.

Price and volume analysis in Nifty and Bank Nifty.

Swing trading with Fibonacci retracement in Nifty and Bank Nifty.

Breakout pullback trading strategy for Bank Nifty.

Intraday trading with VWAP in Nifty and Bank Nifty.

Options straddle and strangle strategies for Nifty and Bank Nifty.

Delta hedging in Nifty and Bank Nifty options.

Market-making strategies in Nifty and Bank Nifty.

Nifty and Bank Nifty trading with Ichimoku Cloud.

Intraday volume profile analysis for Nifty and Bank Nifty.

Order flow analysis in Nifty and Bank Nifty trading.

Option writing strategies for Nifty and Bank Nifty.

Swing trading with RSI divergence in Nifty and Bank Nifty.

Day trading using VWAP deviation in Nifty and Bank Nifty.

Nifty and Bank Nifty trading with Heikin Ashi charts.

Intraday breakout trading strategy for Bank Nifty.

Options hedging strategies for Nifty and Bank Nifty.

Range breakout trading in Nifty and Bank Nifty.

Volume-weighted average price (VWAP) trading in Nifty and Bank Nifty.

Delta-neutral strategies for Nifty and Bank Nifty options.

Arbitrage opportunities in Nifty and Bank Nifty.

Nifty and Bank Nifty trading using the ATR indicator.

Intraday pullback trading in Nifty and Bank Nifty.

Scalping with pivot points in Nifty and Bank Nifty.

Trading with the Parabolic SAR indicator in Nifty and Bank Nifty.

Moving average convergence divergence (MACD) trading in Nifty and Bank Nifty.

Intraday range trading in Nifty and Bank Nifty.

Options iron condor strategy for Nifty and Bank Nifty.

Volume-based trading strategies for Nifty and Bank Nifty.

Swing trading with the Average True Range (ATR) in Nifty and Bank Nifty.

Intraday mean reversion trading in Nifty and Bank Nifty.

Breakout pullback continuation trading strategy in Nifty and Bank Nifty.

Trading with the Relative Strength Index (RSI) in Nifty and Bank Nifty.

Intraday gap trading strategy for Nifty and Bank Nifty.

Swing trading with the Moving Average Convergence Divergence (MACD) in Nifty and Bank Nifty.

Scalping with the Stochastic Oscillator in Nifty and Bank Nifty

Options calendar spread strategy for Nifty and Bank Nifty

Breakout pullback trend reversal trading strategy in Nifty and Bank Nifty

Intraday momentum breakout trading strategy for Nifty and Bank Nifty

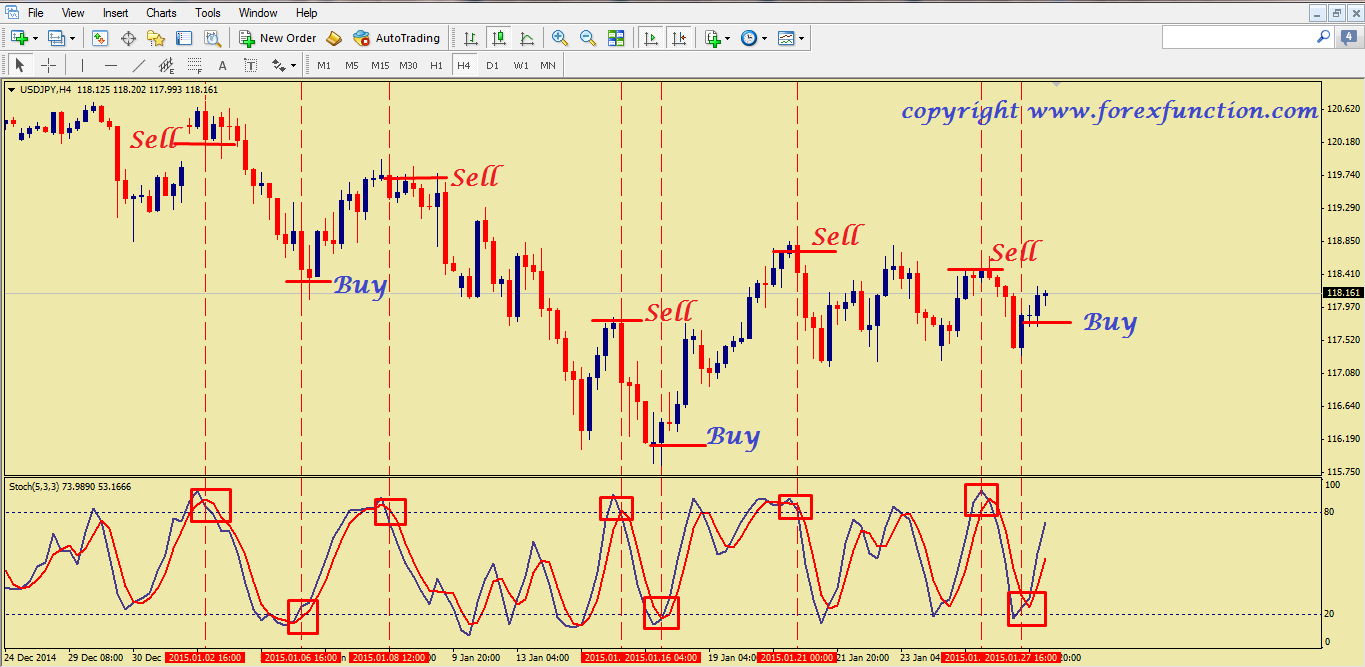

Trading Stochastic Divergence, Nifty analysis 15June 2023 #nifty #banknifty #nifty50 #shorts #viral.

Forex Online Trading – Generating Income In A Week Or Two

You may take one appearance at it and think it is rubbish. Utilizing an automatic system will help you step up your portfolio or begin developing an effective one. This daily charts technique can make you 100-500 pips per trade.

Nifty analysis 15June 2023 #nifty #banknifty #nifty50 #shorts #viral, Search most searched full videos related to Trading Stochastic Divergence.

How To Generate Income At House – The Forex Trading Solution

Doing this implies you understand what your maximum loss on any trade will be rather than losing whatever. The most effective sign is the ‘moving average’. It is likewise important that the trade is as detailed as possible.

Trading on the day-to-day charts is a much simpler technique as compared to trading intraday. This everyday charts strategy can make you 100-500 pips per trade. You don’t need to sit in front of your computer for hours when trading with this everyday charts method.

If you purchase and offer these breaks, you can participate and stay with every significant trend. Breakout Stochastic Trading is an easy, tested way to generate income – however most traders can’t do it and the factor is easy.

An excellent trader not just thinks about the heights of revenues but also considers the danger included. The trader needs to be all set to acknowledge how much they are all set to lose. The upper and lower limit ought to be clear in the trade. The trader must choose how much breathing time he wants to offer to the trade and at the exact same time not risk too much also.

Not all breakouts continue obviously so you need to filter them and for this you require some momentum indications to validate that cost momentum is speeding up. Two excellent ones to utilize are the Stochastic Trading and RSI. These indicators offer confirmation of whether momentum supports the break or not.

MACD Crossover. After you have actually looked into a stocks chart to see if the stock is trending, you should now examine out its MACD chart. MACD-stands for Moving Average Convergence-Divergence. This chart has 2 lines, the crossing of the 2 lines is a signal of a new pattern. The two lines consist of a quick line and a slow line. Where the crossover occurs informs you if there is Stochastic Trading a trend. The fast line has to cross above the sluggish line, or above the 0 line. The greater it rises above the 0 line the stronger the uptrend. The lower it comes down below the 0 line the more powerful the downtrend. A trader or investor desires to capture stocks that are trending huge time, that is how it is possible to make excellent cash!

Based on this info we correctly predicted the market was decreasing. Now a number of you would ask me why not just get in your trade and ride it down.

Currency trading is a way of generating income however it likewise depends upon the luck element. However all is not lost if the traders make rules for themselves and follow them. This will not only guarantee greater profits however also reduce the risk of greater losses in trade.

Forex trading is all about buying and selling of foreign currencies. This week we are going to take a look at the US Dollar V British Pound and Japanese Yen. Look at support and resistance levels and pivot points.

If you are looking rare and engaging comparisons about Trading Stochastic Divergence, and Forex Swing Trading Systems, Effectively Trade Forex, Daily Charts Strategy, Fast Stochastic you should subscribe in subscribers database for free.