Moving Average Crossover **IT DOES NOT WORK**

New YouTube videos about Trade Forex, Currency Trading Tutorial, Stock Investing, Trade Stochastics, and Bearish Divergence Stochastic, Moving Average Crossover **IT DOES NOT WORK**.

The moving average crossover is one of the most common strategies used by day traders. However the moving average crossover is one of the worst ways to find your entry for your trade. In this video I’m going to show you how to actually use a moving average crossover, as well as show you how to find an entry well before any moving averages actually cross over actually happens. Getting you more profit for each trade.

#movingaverage #movingaveragecrossover #daytrading

The trading floor is a new project that I just launched.

World class day trading education and tools

https://www.trdfloor.com/welcome

FunderPro

Start your funded account challenge HERE (20% discount with link)

https://funderpro.com/get-funded-with-tma-and-funderpro

my twitter https://twitter.com/artybryja

For charts Use Trading View

https://www.tradingview.com/?aff_id=113274

New Official Telegram Group

TMA OFFICIAL®

https://t.me/TMAbyArty

Looking for a forex broker?

I use Osprey

https://ospreyfx.com/tradewithtma

regulated broker i recommend is Blueberry markets

https://bit.ly/blueberrytma

Try a $100,000 funded account from OspreyFX

https://ospreyfx.com/tradewithtma

Use coupon code

movingaverage50

To get $50 off

or try FTMO

https://ftmo.com/en/?affiliates=2677

Get a free audio book from audible

https://tmafocus.com/2WyXSqa

Links to the indicators

TMA Overlay

https://www.tradingview.com/script/zX3fvduH-TMA-Overlay/

TMA Divergence indicator

https://tmafocus.com/3nfcEfd

TMA shop

https://shop.spreadshirt.com/themovingaverage/

Get some free stocks from WEBULL

https://tmafocus.com/3p0vatP

also

Get some free stocks from Public

https://tmafocus.com/3GUUojh

Trading Platform

META TRADER 4

The moving average (MA) is a simple technical analysis tool that smooths out price data by creating a constantly updated average price. The average is taken over a specific period of time, like 10 days, 20 minutes, 30 weeks or any time period the trader chooses. There are advantages to using a moving average in your trading, as well as options on what type of moving average to use. Moving average strategies are also popular and can be tailored to any time frame, suiting both long-term investors and short-term traders.

KEY TAKEAWAYS

A moving average (MA) is a widely used technical indicator that smooths out price trends by filtering out the “noise” from random short-term price fluctuations.

Moving averages can be constructed in several different ways, and employ different numbers of days for the averaging interval.

The most common applications of moving averages are to identify trend direction and to determine support and resistance levels.

While moving averages are useful enough on their own, they also form the basis for other technical indicators such as the moving average convergence divergence (MACD).

Why Use a Moving Average

A moving average helps cut down the amount of “noise” on a price chart. Look at the direction of the moving average to get a basic idea of which way the price is moving.

As a general guideline, if the price is above a moving average, the trend is up. If the price is below a moving average, the trend is down.

NOT FINANCIAL ADVICE DISCLAIMER

The information contained here and the resources available for download through this website is not intended as, and shall not be understood or construed as, financial advice. I am not an attorney, accountant or financial advisor, nor am I holding myself out to be, and the information contained on this Website is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation.

We have done our best to ensure that the information provided here and the resources available for download are accurate and provide valuable information. Regardless of anything to the contrary, nothing available on or through this Website should be understood as a recommendation that you should not consult with a financial professional to address your particular information. The Company expressly recommends that you seek advice from a professional.

*None of this is meant to be construed as investment advice, it’s for entertainment purposes only. Links above include affiliate commission or referrals. I’m part of an affiliate network and I receive compensation from partnering websites. The video is accurate as of the posting date but may not be accurate in the future.

Bearish Divergence Stochastic, Moving Average Crossover **IT DOES NOT WORK**.

Forex Pattern Analysis – How To Identify When The Very Best Time Is To Sell

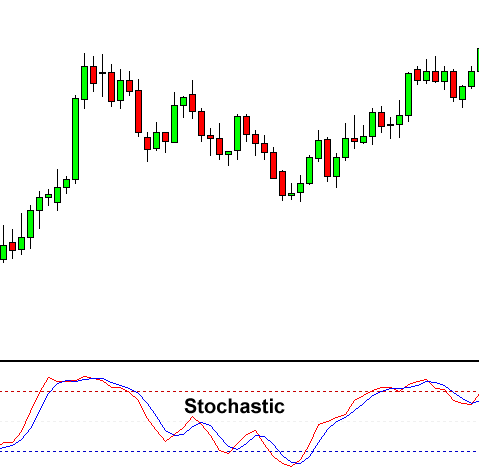

This graph has 2 lines, the crossing of the two lines is a signal of a new pattern. You then need to see if the odds are on your side with the breakout so you check price momentum. So how do we respect the pattern when day trading?

Moving Average Crossover **IT DOES NOT WORK**, Get top videos related to Bearish Divergence Stochastic.

The Less Is More Approach To Learning To Trade Forex Successfully

On the other hand, an investor is least pressed about the short-term swings in the market. Guideline primary: Money management is of utmost significance if you remain in for a long period of time of TF.

Here we are going to take a look at 2 trading chances recently we banked a fantastic profit in the British Pound. Today we are going to look at the United States Dollar V British Pound and Japanese Yen.

Usage another indication to verify your conclusions. If the support and the resistancelines are touching, then, there is likely to have a breakout. And if this is the Stochastic Trading situation, you will not be able to presume that the price will turn once again. So, you may simply want to set your orders beyond the stretch ofthe support and the resistance lines in order for you to catch a taking place breakout. Nevertheless, you must use another indication so you can verify your conclusions.

The first point to make is if you like action and wish to trade all the time do not keep reading – this is everything about trading really high odds trades for huge earnings not trading for enjoyable or messing about for a few pips.

Keep in mind, you will never ever sell at the precise top since no one understands the marketplace for particular. You should keep your winning trades longer. Nevertheless, if your technical indications break you, and the patterns start to stop working, that’s when you need to offer your stock and take Stochastic Trading profit.

To get the odds much more Stochastic Trading on your side, when the breakout starts, price momentum must be on the rise and here you need to learn more about momentum oscillators.

Two of the best are the stochastic indicator and Bollinger band. Utilize these with a breakout approach and they give you an effective combination for seeking huge gains.

Wait on the indications to signify the bears are taking control, through the stochastic and RSI and keep in mind the bulls just take charge above January’s highs.

Do not expect t be a millionaire over night, since that’s just not sensible. Nobody can forecast where the marketplace will go. You can use the mid band to buy or offer back to in strong patterns as it represents worth.

If you are looking instant exciting videos about Bearish Divergence Stochastic, and Range Trading Strategy, Trading Forex Successfully please list your email address for email alerts service now.