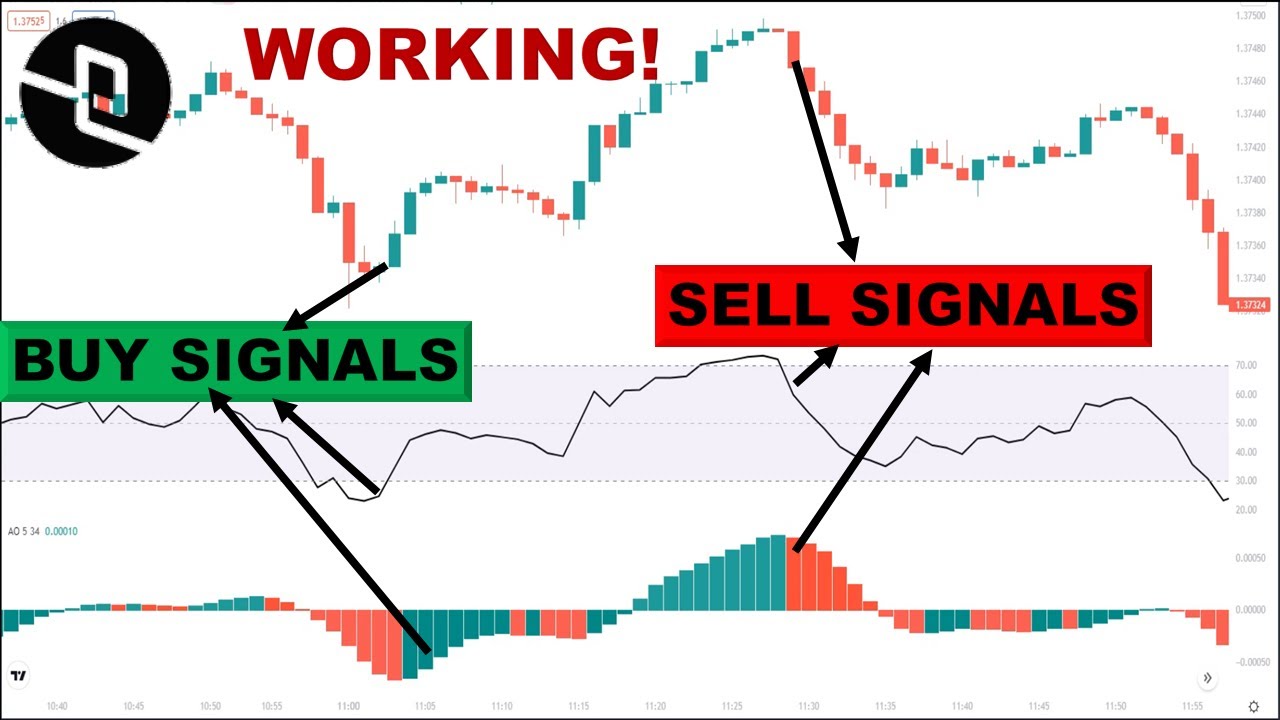

Momentum Awesome Oscillator + Relative Strength Index RSI Trading Strategy

Top YouTube videos related to Mechanical Forex Trading. Mechanical Forex Trading System, Trend Analysis, Forex Swing Trading Systems, and Macd And Stochastic A Double-cross Strategy, Momentum Awesome Oscillator + Relative Strength Index RSI Trading Strategy.

trading #strategy ✓Thanks For Watching! ✓Subscribe to Channel …

Macd And Stochastic A Double-cross Strategy, Momentum Awesome Oscillator + Relative Strength Index RSI Trading Strategy.

Forex Swing Trading Strategy – An Easy One For Huge Gains Anyone Can Use

These are: financial analysis and technical analysis. This day-to-day charts method can make you 100-500 pips per trade. The very first point is the technique to be followed while the second pint is the trading time.

Momentum Awesome Oscillator + Relative Strength Index RSI Trading Strategy, Find latest high definition online streaming videos about Macd And Stochastic A Double-cross Strategy.

Who Wishes To Be A Forex Trading Millionaire?

The one confined is easy to understand and will allow you to look for big gains. Use the technical indicators you learn and evaluate them with historical data. Bollinger bands are based upon standard deviation.

, if you want to win at forex trading and enjoy currency trading success maybe one of the most convenient methods to achieve it is to trade high odds breakouts.. Here we will look at how you can do this and make huge earnings.

If the break occurs you go with it, you need to have the Stochastic Trading frame of mind that. Sure, you have actually missed the first little bit of revenue but history reveals there is normally plenty more to follow.

The 2nd significant point is the trading time. Typically, there are specific time periods that are best to get in a trade and period that are tough to be very risky or rewarding. The dangerous period are the times at which the cost is varying and difficult to predict. The most risky period are the durations at which economy brand-new are developed. Due to the fact that the cost can not be predicted, the trader can go into a trade at this time. Also at the end day, the trader should not go into a trade. In the Forex market, the end day is on Friday.

Now I’m not going to get into the details regarding why cycles exist and how they are related to cost action. There is much written on this to fill all your quiet nights in checking out for decades. If you invest simply a little bit of time viewing a MACD or Stochastic Trading sign on a rate chart, you need to already be persuaded that cycles are at work behind the scenes. Simply watch as they swing up and down in between extremes (overbought and oversold zones) to get a ‘feel’ for the cycle ups and downs of price action.

The difficult part about forex Stochastic Trading is not a lot getting a technique – however having confidence in it and trading it with discipline. , if you do not trade with discipline you will lose and you must have self-confidence to get discipline..

To see how overbought the currency is you can utilize some momentum indicators which will give you this information. We don’t have time to describe them here however there all easy to learn and apply. We like the MACD, the stochastic and the RSI however there are numerous more, just pick a couple you like and utilize them.

This forex trading strategy illustrates how concentrating on a bearish market can benefit a currency that is overbought. Whether this strategy is incorrect or ideal, it presents an excellent risk-reward trade off and is well based on its short position in forex trading.

The Stochastic Sign – this has been around considering that the 1950’s. Yet again, inspect your assessments versus a minimum of 1 additional indicator. Keep your stop well back until the trend is in movement.

If you are looking more engaging comparisons about Macd And Stochastic A Double-cross Strategy, and Market Timing, Best Forex Tradsing Strategies please signup in a valuable complementary news alert service for free.