Master Divergence Scalping strategy

Trending reviews related to Forex Bot, Swing Trading, Breakout Trading, and Hidden Divergence Stochastic, Master Divergence Scalping strategy.

This video is helpful in mastering the scalping in lower and higher time frames using divergence.

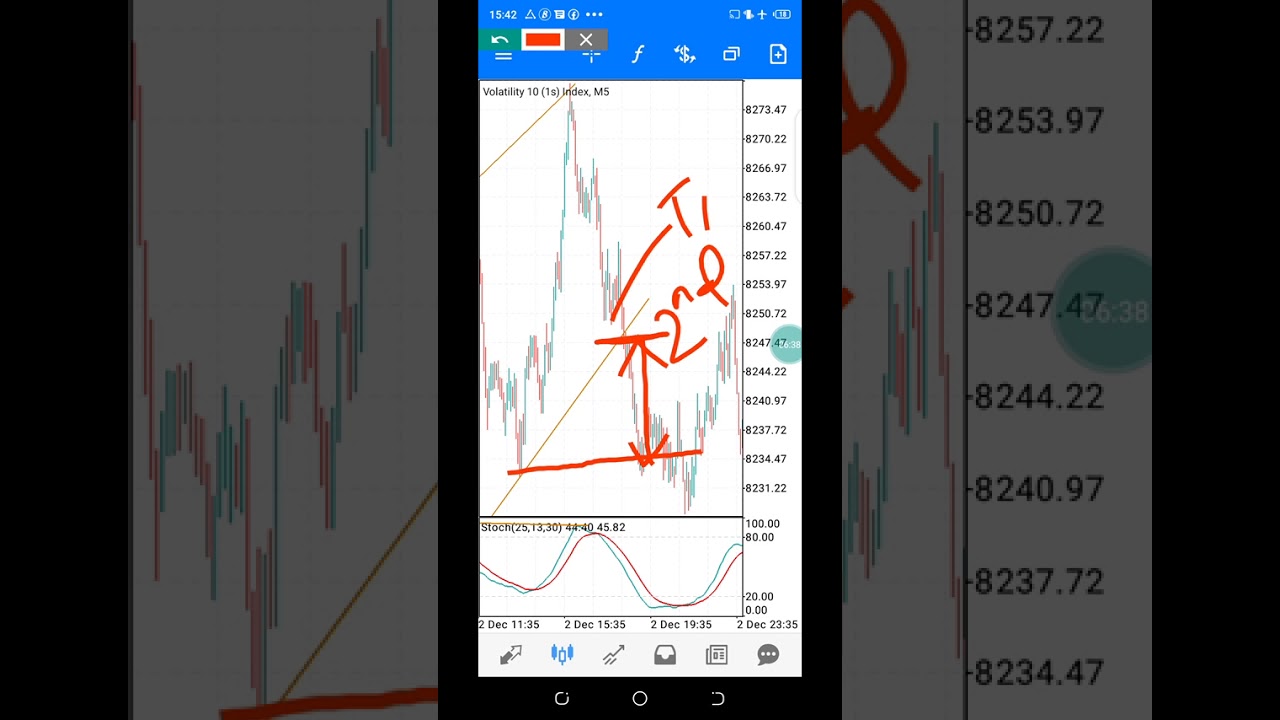

You only need four confluences and proper risk management to scalp using this strategy:

1. Determining Divergence

– can be clear or hidden divergence

2. Trendline

3. Reversal candlestick

– mostly are pinbars, hammer/inverted hammer are used as main confluence

4. Green line in stochastich oscillator to point towards and cross red line.

View second video explaining about bullish divergence

👇

👬You can be my mentee by only clicking this link below in telegram

Hidden Divergence Stochastic, Master Divergence Scalping strategy.

Currency Trading Systems – Getting A Successful One For Big Profits

The easier your system is, the more earnings it will produce on a long term. When the quick one crosses the slow one, this will indicate a pattern. A simple commodity trading system like the above, traded with discipline is all you require.

Master Divergence Scalping strategy, Search more full videos relevant with Hidden Divergence Stochastic.

Forex Charts – Fundamental Earnings Ideas For Beginners

Keep your stop well back up until the trend is in movement. By awaiting a much better cost they miss out on the move. Develop a trading system that works for you based upon your testing results.

Here we are going to look at how to use forex charts with a live example in the markets and how you can use them to discover high odds possibility trades and the chance we are going to look at is in dollar yen.

These are the long term financial investments that you do not hurry Stochastic Trading into. This is where you take your time evaluating a great spot with resistance and support to make a substantial slide in earnings.

2 of the very best are the stochastic sign and Bollinger band. Use these with a breakout technique and they provide you an effective combination for looking for huge gains.

Focus on long-lasting patterns – it’s these that yield the huge earnings, as they can last for many years. Profitable Stochastic Trading system never asks you to go versus the pattern. Patterns equate to big revenues for you. Breaking the pattern indicates you are risking your cash needlessly.

Some of the stock signals traders take a look at are: volume, moving averages, MACD, and the Stochastic Trading. They also must try to find floorings and ceilings in a stock chart. This can show a trader about where to get in and about where to get out. I state “about” because it is pretty tough to guess an “exact” bottom or an “exact” top. That is why locking in revenues is so so vital. , if you do not lock in revenues you are actually running the risk of making an useless trade.. Some traders end up being really greedy and it only injures them.

If the resistance and assistance lines converge, breakouts are possible. In this instance, you may not presume that expenses will return always. You might prefer orders outside the converging line range to obtain a breakout as it happens. Yet again, examine your examinations against at least 1 additional indication.

The above method is extremely simple however all the finest systems and methods are. If you swing trade extremes, you will get a couple of excellent signals a week and this will be enough, to make you substantial gains in around thirty minutes a day. There is no better technique than currency swing trading if you want a fantastic way to make huge earnings.

The Stochastic Indication – this has been around given that the 1950’s. Yet again, check your evaluations versus at least 1 extra indication. Keep your stop well back up until the trend is in motion.

If you are looking most entertaining videos about Hidden Divergence Stochastic, and Forex Trend, Quote Currency, Forex Swing Trading, Forex Traading System please subscribe our a valuable complementary news alert service now.