MACD scalping strategy for boom and crash || insane strategy for boom and crash

Latest clips highly rated Forex Basics, Commodity Trading Systems, Learn Forex, Stochastic Indicator, and Stochastic Scalping Settings, MACD scalping strategy for boom and crash || insane strategy for boom and crash.

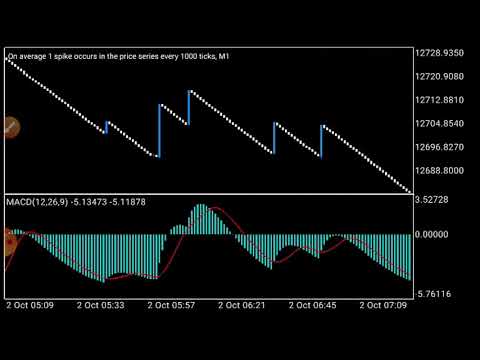

This video is about MACD scalping strategy for boom and crash.

This strategy is not like others because it is based on the best indicator called MACD which doesn’t lag behind the price.

It is all suitable for small and big account, enjoy scalping the small candles.

Forsage Recruit Team: https://t.me/forsage_j_trading

J Trading Free School: https://t.me/forexgeek1

VIP Mentorship: https://t.me/madresbonita

*******************************

subscribe———like———–share

*******************************

#Forex #Trading #BoomAndCrash #Indices #Volatility #Deriv #BinaryTrading #Trend #Breakout #ChartPatterns #BoomAndCrashStrategy

#Bitcoin #Ethereum #TDI #TradingStrategy #MoneyManagement #MakeProfit #Boom500 #Boom1000 #Crash500 #Crash1000

Stochastic Scalping Settings, MACD scalping strategy for boom and crash || insane strategy for boom and crash.

My Favorite Trading Strategy

Trading is always short term while investing is long term. Also trade on the period where significant markets are open. The concept is “Do not predict the marketplace”.

The charts reveal that the marketplace is moving up once again.

MACD scalping strategy for boom and crash || insane strategy for boom and crash, Play more videos about Stochastic Scalping Settings.

3 Things You Require To Know About Range Trading

Forex swing trading is among the very best ways for novices to seek big gains. Sadly, that’s what a lot of traders think technical analysis is. Keep your stop well back up until the trend is in motion.

Pattern trading is certainly my preferred type of trading. When the market patterns, you can make a load of money in just a really brief time. However, many of the time the marketplace isn’t trending. In some cases it just ranges back and forth. Does this mean you have to just leave? Barely! You can earn money in a varying market, and here is how.

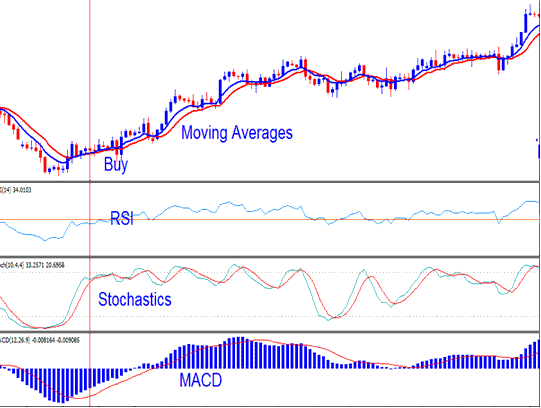

Take a look at support and resistance levels and pivot points. When it approaches them, in a perfect choppy market the assistance and resistance lines will be parallel and you can expect the market to turn. Check against another sign such as the Stochastic Trading oscillator. You have another signal for the trade if it shows that the rate is in the overbought or oversold variety.

Your Approach: this imply the guidelines you utilize to recognize the trend and the how the money is handled in the forex account. As stated above, it must be easy to relieve the use of it.

Concentrate on long-lasting trends – it’s these that yield the huge profits, as they can last for many years. Rewarding Stochastic Trading system never ever asks you to go versus the pattern. Trends translate to big earnings for you. Going versus the trend implies you are risking your cash needlessly.

You can spend around thirty minutes a day, trading in this manner with your forex Stochastic Trading method and after that go and do something else. Once or twice a day and that’s it, you just require to examine the rates.

To see how overbought the currency is you can utilize some momentum signs which will provide you this information. We do not have time to explain them here however there all easy to find out and use. We like the MACD, the stochastic and the RSI however there are much more, just pick a couple you like and utilize them.

Await the signs to signal the bears are taking control, through the stochastic and RSI and remember the bulls just take charge above January’s highs.

It is best to keep updates to the most recent trends to maintain the profits. That takes a very long time to develop, and it’s something I’ll cover in my site in a lot more information.

If you are searching best ever exciting reviews related to Stochastic Scalping Settings, and Forex Trading Tips, Determining Market Cycles please subscribe for email subscription DB for free.