Lecture Computational Finance / Numerical Methods 12: Time-Discretisation of Stochastic Processes

Latest full videos top searched Forex Tips, Successful Trading, and Most Accurate Stochastic Settings, Lecture Computational Finance / Numerical Methods 12: Time-Discretisation of Stochastic Processes.

Lecture on Computational Finance / Numerical Methods for Mathematical Finance. Session 12: Time-Discretisation of Stochastic Processes

The first session on the time-discretisation of stochastic processes.

– Comment on Monte-Carlo Simulation of Stochastic Processes

– Review of Numerical Schemes

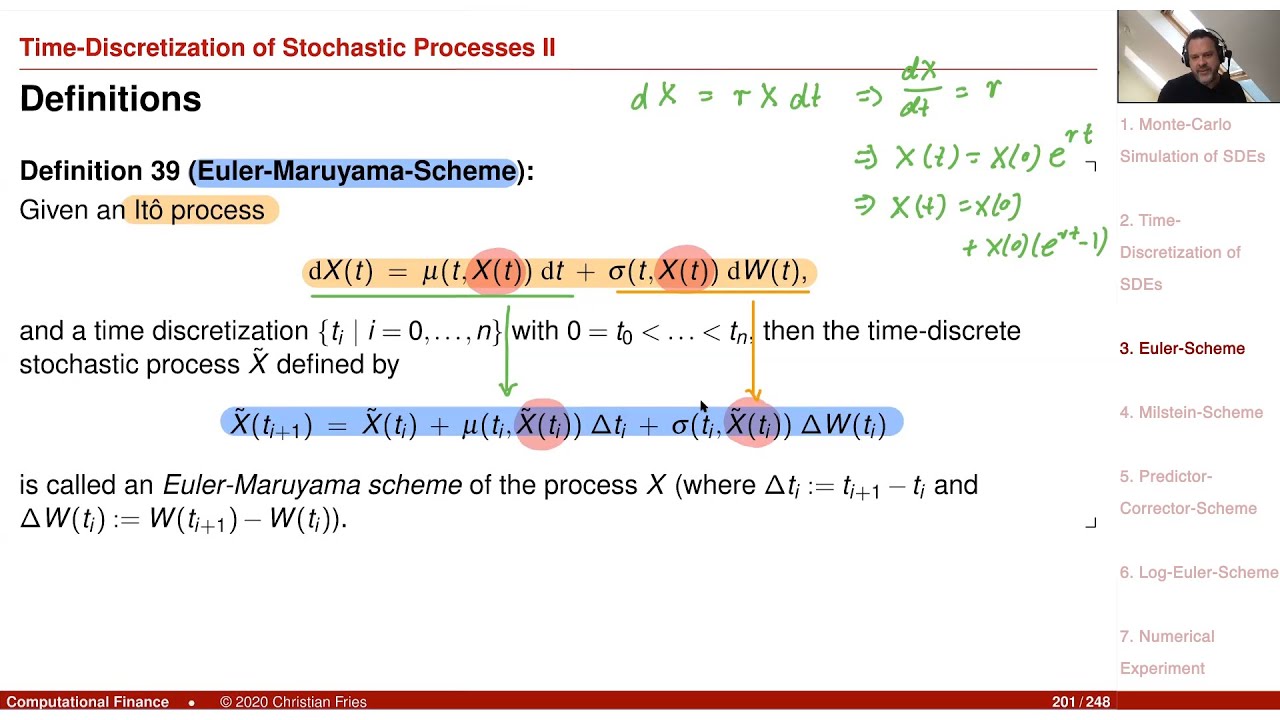

– Euler-Scheme

– Milstein-Scheme

– Predictor-Corrector-Scheme

– Log-Euler-Scheme

– Numerical Experiment: Schemes for dX = sigma X dW

Most Accurate Stochastic Settings, Lecture Computational Finance / Numerical Methods 12: Time-Discretisation of Stochastic Processes.

Stock Market Trading Systems – Part 2

You might take one look at it and believe it is rubbish. Using an automatic system will help you step up your portfolio or start developing an effective one. This daily charts method can make you 100-500 pips per trade.

Lecture Computational Finance / Numerical Methods 12: Time-Discretisation of Stochastic Processes, Explore interesting updated videos relevant with Most Accurate Stochastic Settings.

Currency Trading Essentials – A Simple System Anybody Can Use For Big Profits

As a market moves upward towards a resistance, stochastic lines must typically punctuate. She or he has a long term time horizon like a couple of months to even a few years. No one can anticipate where the marketplace will go.

There is a difference in between trading and investing. Trading is always short-term while investing is long term. The time horizon in trading can be as brief as a few minutes to a few days to a few weeks. Whereas in investing, the time horizon can be months to years. Many individuals day trade or swing trade stocks, currencies, futures, options, ETFs, products or other markets. In day trading, a trader opens a position and closes it in the same day making a quick earnings. In swing trading, a trader tries to ride a trend in the market as long as it lasts. On the other hand, a financier is least pushed about the short-term swings in the market. He or she has a long term time horizon like a few months to even a few years. This long period of time horizon matches their investment and monetary goals!

Good ones to look at are Relative Strength Index (RSI) Stochastic Trading, Typical Directional Motion (ADX) – There are others – however these are a great place to begin.

Tonight we are trading around 1.7330, our very first area of resistance remains in the 1,7380 range, and a 2nd area around 1.7420. Strong assistance exits From 1.7310 to 1.7280 levels.

OK now, not all breakouts are developed equal and you want the ones where the odds are highest. You’re trying to find Stochastic Trading support and resistance which traders discover crucial and you can often see these levels in the news.

This system is easy and you need to understand this reality – all the very best systems are. Forget expert Stochastic Trading systems, neural networks or lots if indicators – simple systems work best as they are robust and with fewer aspects to break in the face of brutal ever altering market conditions.

Examine some momentum indications, to see how overbought momentum is and an excellent one is the stochastic. We do not have time to discuss it in complete information here so look it up, its a visual indication and will just take 30 minutes or two to find out. Try to find it to end up being overbought and then. simply look for the stochastic lines to cross and turn down and get brief.

In typical with virtually all aspects of life practice is the key to getting all 4 components collaborating. This is now easier to attain as lots of Forex websites have demonstration accounts so you can practice without risking any actual money. They are the nearby you can get to trading in genuine time with all the pressure of possible losses. But remember – practice makes ideal.

Doing this means you know what your optimum loss on any trade will be rather than losing whatever. Trading is constantly short-term while investing is long term. The 2 charts being the 5 minute and 60 minute EUR/USD.

If you are looking best ever entertaining reviews relevant with Most Accurate Stochastic Settings, and Forex Tip, Technical Analysis Trading Strategies, Currency Trading Forex Education you should signup in subscribers database now.

![How to use other MT4 Indicators – Oscillator Analysis – [Elite Day Trading Academy] How to use other MT4 Indicators – Oscillator Analysis – [Elite Day Trading Academy]](https://Stochastictrader.com/wp-content/uploads/1668643011_How-to-use-other-MT4-Indicators-Oscillator-Analysis-200x137.jpg)