Learn to trade bullish MACD divergence on VIAC stock #macd #divergence #trading

Popular YouTube videos related to Robot Trader, Currency Trading System, Stock Trading Strategy, and How To Trade Divergence, Learn to trade bullish MACD divergence on VIAC stock #macd #divergence #trading.

MACD Divergence FREE Telegram Channel

The channel automatically publishes MACD divergences for companies in the top 500 S&P and top 100 Nasdaq on a regular basis. There are FREE and VIP versions of the channel, now they are both free.

https://t.me/MACD_Divergences

Telegram Bot allows you to quickly check the stock fundamental data, as well as see the main technical indicators, including the momentum system, ATR and even short interest.

https://t.me/TradeWizardBot

Trade Wizard Blog

Useful information about the MACD indicator and divergence.

https://tradewizard.pro/

Robovoice: https://freetts.com

Music: http://bensound.com

How To Trade Divergence, Learn to trade bullish MACD divergence on VIAC stock #macd #divergence #trading.

Forex Trend Analysis – How To Identify When The Best Time Is To Sell

Some of the stock signals traders look at are: volume, moving averages, MACD, and the stochastic. It is among the easiest tools utilized in TA. Likewise trade on the duration where significant markets are open.

Learn to trade bullish MACD divergence on VIAC stock #macd #divergence #trading, Explore trending explained videos about How To Trade Divergence.

Forex Trading – Hitting And Holding The Huge Patterns For Enormous Gains

Trade the chances and this implies rate momentum should support your view and confirm the trade prior to you enter. Nevertheless, if for some reason, the software application doesn’t work for you it’s good peace of mind to have.

Although forex trading isn’t a complex process procedurally, there are things you require to find out about the marketplace to avoid making economically unpleasant mistakes. Never go into the forex trading market till you are equipped with knowledge of the market, how it acts and why the pros trade the way they do. This preparation might indicate the difference between great revenue and fantastic loss.

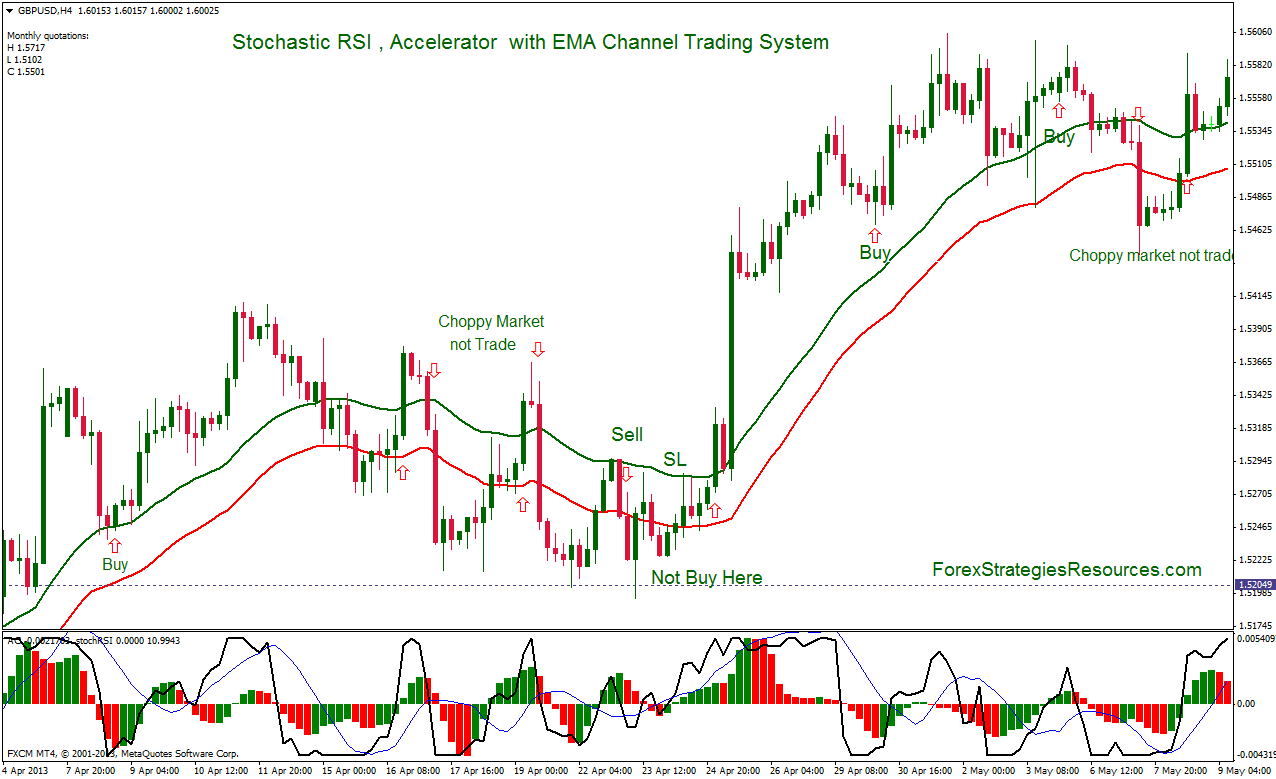

Usage another indicator to verify your conclusions. If the resistance and the assistancelines are touching, then, there is most likely to have a breakout. And if this is the Stochastic Trading situation, you will not be able to presume that the rate will turn as soon as more. So, you might simply want to set your orders beyond the stretch ofthe support and the resistance lines in order for you to catch a happening breakout. Nevertheless, you need to use another sign so you can validate your conclusions.

A good trader not only thinks about the heights of profits but likewise ponders the danger involved. The trader needs to be all set to acknowledge just how much they are ready to lose. The upper and lower limitation should be clear in the trade. The trader should decide just how much breathing time he is prepared to provide to the trade and at the very same time not run the risk of too much likewise.

These are the long term financial investments that you do not rush into. This is where you take your time examining Stochastic Trading an excellent area with resistance and assistance to make a substantial slide in earnings.

The key to using this basic system is not simply to try to find overbought markets however markets are extremely Stochastic Trading overbought – the more a market is overbought, the bigger the relocation down will be, so be selective in your trades.

This has certainly held true for my own trading. Once I pertained to understand the power of trading based on cycles, my trading successes leapt bounds and leaps. In any offered month I average a high percentage of winning trades against losing trades, with the few losing trades resulting in ridiculously little capital loss. Timing trades with identify precision is empowering, just leaving ones internal mental and emotional luggage to be the only thing that can mess up success. The method itself is pure.

This forex trading technique highlights how focusing on a bearish market can benefit a currency that is overbought. Whether this method is wrong or best, it provides an excellent risk-reward trade off and is well based on its short position in forex trading.

In fact that’s why monthly you can see brand-new strategies being used online to new traders. Attempt this now: Invest in Stock Attack 2.0 stock market software application.

If you are looking updated and exciting comparisons related to How To Trade Divergence, and Forex Strategies, Forex Day you should join for email subscription DB now.

![Trade With Jon [Lesson 7] – Stochastic Trade With Jon [Lesson 7] – Stochastic](https://Stochastictrader.com/wp-content/uploads/1645948370_Trade-With-Jon-Lesson-7-Stochastic-200x137.jpg)