Learn to trade bearish MACD divergence on IP stock #trading #macd #divergence

Best overview highly rated Win at Forex, Best Forex Trading, and Bearish Divergence Stochastic, Learn to trade bearish MACD divergence on IP stock #trading #macd #divergence.

MACD Divergence FREE Telegram Channel

The channel automatically publishes MACD divergences for companies in the top 500 S&P and top 100 Nasdaq on a regular basis. There are FREE and VIP versions of the channel, now they are both free.

https://t.me/MACD_Divergences

Telegram Bot allows you to quickly check the stock fundamental data, as well as see the main technical indicators, including the momentum system, ATR and even short interest.

https://t.me/TradeWizardBot

Trade Wizard Blog

Useful information about the MACD indicator and divergence.

Robovoice: https://freetts.com

Music: http://bensound.com

Bearish Divergence Stochastic, Learn to trade bearish MACD divergence on IP stock #trading #macd #divergence.

How To Understand Currency Trading Charts To Earn You Optimal Profits

And if this is the scenario, you will not have the ability to presume that the rate will turn again. Use the technical signs you find out and check them with historic data.

Learn to trade bearish MACD divergence on IP stock #trading #macd #divergence, Explore popular full length videos about Bearish Divergence Stochastic.

Forex Live Charts – Winning Strategies To Trade The Forex Market

This will not only ensure higher profits but also reduce the threat of higher losses in trade. No one can predict where the market will go. Those lines could have crossed 3 or 4 times before only to revert back.

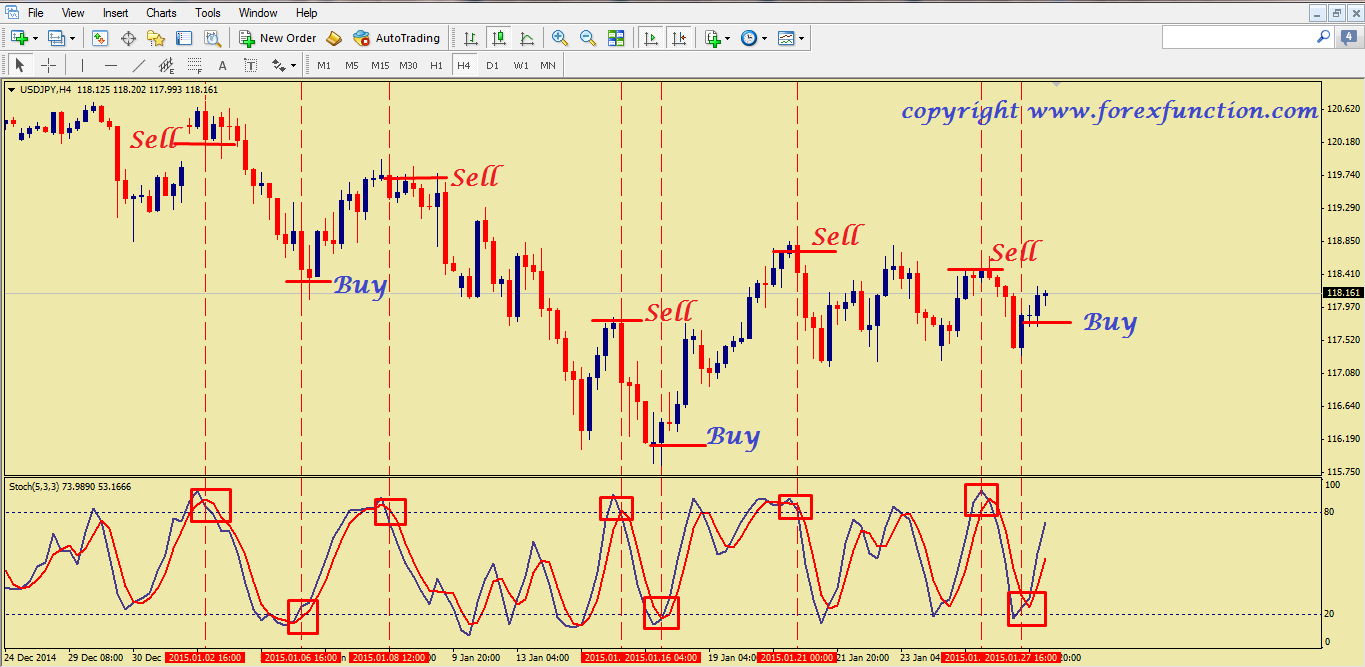

Here we are going to look at how to utilize forex charts with a live example in the markets and how you can use them to discover high odds probability trades and the chance we are going to take a look at is in dollar yen.

As soon as the relocation is well in progress, start to trail your stop but hold it outside of day-to-day volatility (if you do not understand Stochastic Trading standard discrepancy of price make it part of your forex education now), this implies trailing right back – when the move turns, you are going to provide back some profit, that’s ok., if you caught simply 60% of every significant trending relocation you would be really abundant!! , if it’s a huge relocation you will have plenty in the bank and you can’t anticipate where rates go so do not try..

Once the trade is in motion – wait on the trade to recover under way before moving your stop, then route it up gradually, so you don’t get gotten by random volatility.

No problem you say. Next time when you see the earnings, you are going to click out and that is what you do. You remained in a long position, a red candle appears and you click out. Whoops. The market continues in your instructions. You stand there with 15 pips and now the marketplace is up 60. Disappointed, you choose you are going to either let the trade play out to your Stochastic Trading earnings target or let your stop get triggered. You do your homework. You enter the trade. Boom. Stopped out. Bruised, damaged and deflated.

Lots of traders make the mistake of thinking they can use the swing trade method daily, but this is not a good concept and you can lose equity quickly. When the market is just right for swing trading, rather reserve forex swing trading for days. So, how do you understand when the market is right? When the chart is low or high, see for resistance or support that has been held several times like. Look and see the momentum for when costs swing strongly towards either the resistance or the assistance, while this is occurring expect verification that the momentum will turn. This verification is vital and if the momentum of the cost is starting to wane and a turn is likely, then the chances are in fantastic favor of a swing Stochastic Trading environment.

Two of the very best are the stochastic indication and Bollinger band. Use these with a breakout method and they give you a powerful mix for looking for huge gains.

I call swing trading “hit and run trading” and that’s what your doing – getting high odds established, striking them and then banking earnings, prior to the position can turn back on you. If you find out and practice the above method for a week approximately, you will soon be confident sufficient to applly it for long term currency trading success.

In an uptrend each new peak that is formed is greater than the previous ones. The Stochastic – is a very effective trade indication. His work and research study are very first class and parallel his character as an individual.

If you are finding more engaging comparisons related to Bearish Divergence Stochastic, and Automatic Trading System, Effectively Trade you are requested to list your email address in email alerts service for free.