Learn swing trading in real time market | Hashtag Hammer – Episode 14

Top complete video about Forex Online Trading, Learn Currency Trading Online, Large Cap Stocks, Best Forex Trading, and What’s Swing Trading, Learn swing trading in real time market | Hashtag Hammer – Episode 14.

Follow me on TELEGRAM for real-time updates and assistance in terms of knowledge and healthy discussions: …

What’s Swing Trading, Learn swing trading in real time market | Hashtag Hammer – Episode 14.

An Appearance Back At Forex Trading – 4/3/06

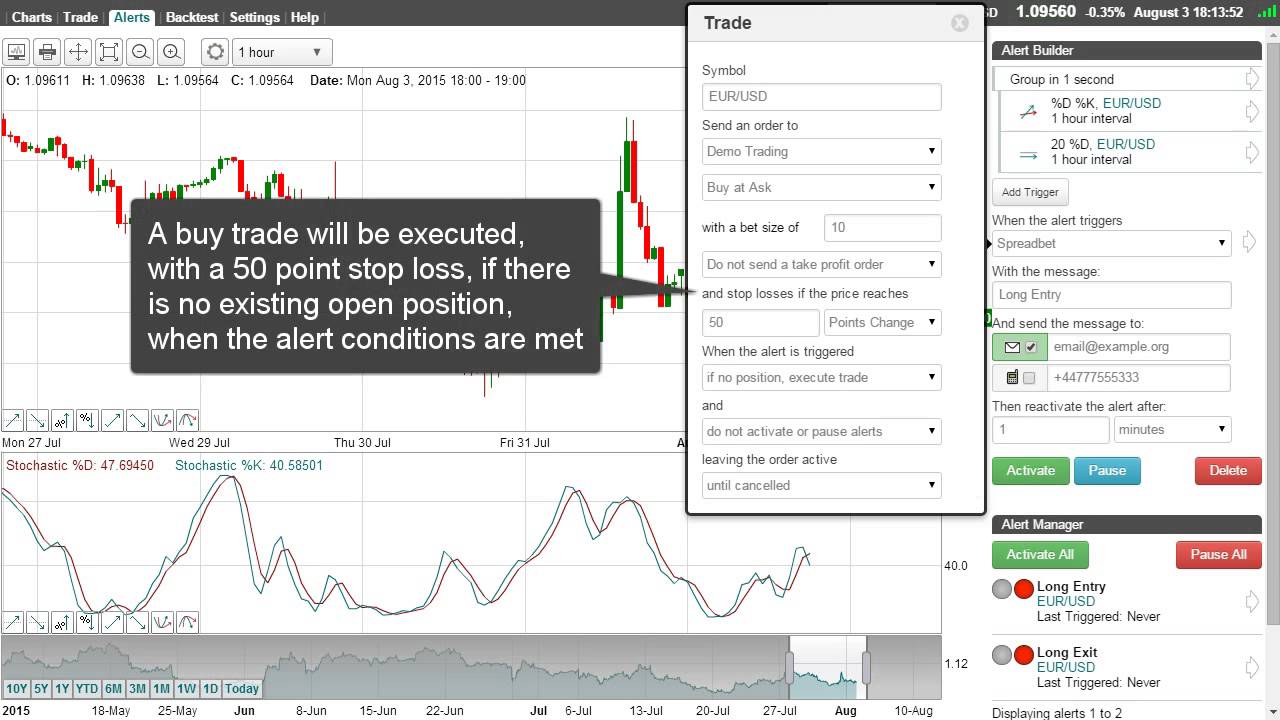

Some of the stock signals traders take a look at are: volume, moving averages, MACD, and the stochastic. It is one of the easiest tools used in TA. Also trade on the duration where major markets are open.

Learn swing trading in real time market | Hashtag Hammer – Episode 14, Watch more replays relevant with What’s Swing Trading.

Commodity Trading Systems – This Ones Totally Free And Makes Huge Gains!

The concept here is to draw a fast moving average and a slow one. These 2 indicators can be discovered in a couple of hours and offer you a visual view of momentum. Trend trading is certainly my favorite kind of trading.

Today lots of traders buy commodity trading systems and spent money on pricey software when really all they require is to do a bit of research study on the net and build their own.

Some these “high leaflets” come out the high tech sector, which includes the Internet stocks and semiconductors. Other “high leaflets” come from the biotech stocks, which have increased volatility from such news as FDA approvals. Due to the fact that Stochastic Trading there are less of them than on the NASDAQ that trade like a home on fire on the ideal news, after a while you will acknowledge the symbols.

The very first indicate make is if you like action and want to trade all the time do not continue reading – this is all about trading really high odds trades for big profits not trading for fun or messing about for a couple of pips.

Now I’m not going to get into the information regarding why cycles exist and how they belong to price action. There is much written on this to fill all your quiet nights in reading for years. If you spend simply a little bit of time seeing a MACD or Stochastic Trading sign on a cost chart, you should already be encouraged that cycles are at work behind the scenes. Just enjoy as they swing up and down in between extremes (overbought and oversold zones) to get a ‘feel’ for the cycle ups and downs of rate action.

You require to have the Stochastic Trading frame of mind that if the break occurs you choose it. Sure, you have missed out on the first bit of revenue however history shows there is usually plenty more to follow.

If you follow the above 4 actions in constructing your forex trading technique, you will have the fundamentals of a system that’s simple to understand use and makes big profits.

It takes perseverance and discipline to wait for the best breakouts and then a lot more discipline to follow them – you require confidence and iron discipline – however you can have these if you desire to and soon be stacking up triple digit earnings.

Trading without a stop loss does not motivate a calm and detached trading method. There are a number of definitions to the terms range trading. What were these essential experts missing?

If you are finding instant engaging videos relevant with What’s Swing Trading, and Techncial Analysis, E Mini Trading you are requested to subscribe in email alerts service now.