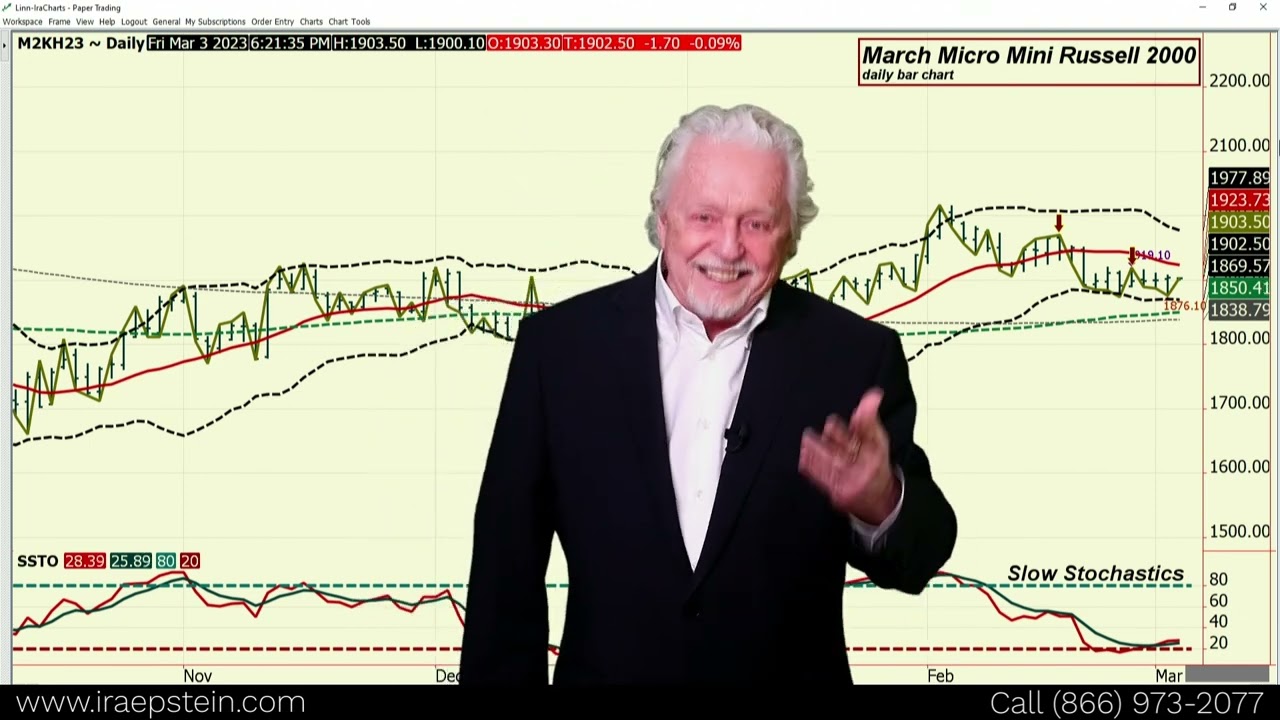

Keep an Eye on Stock Indices, Was This Just a Short Covering Rally? – Ira's Financial Video 3 2 2023

Latest un-edited videos top searched Stock Prices, Market Trading Systems, Turtle Trading, Trading Rules, and How To Trade Stochastic, Keep an Eye on Stock Indices, Was This Just a Short Covering Rally? – Ira's Financial Video 3 2 2023.

Ira Epstein prepares you for today’s trading and informs you of market conditions. For more information and access to Ira’s free offers for commodity traders, visit https://www.iraepstein.com.

Link to Our Website: https://www.iraepstein.com

Link for Ira’s Free Offers: https://www.iraepstein.com/free-offers/

Learn about Ira’s Charting Course: https://www.iraepstein.com/our-products/ira-epsteins-charting-course/

Commodities, Ira Epstein, Linn & Associates, Futures Trading, Online Trading, Technical Analysis, Stock Indices, S&P 500 Index, NASDAQ, Russell 2000, Treasuries, Finance, Fox Business News, CNBC, Sky Business, Business News Network, Bloomberg, Tic-Toc, Dow Jones Newswires,Charting, Financial Report, gold, silver, platinum, palladium, bitcoin, gdx, gld, tlt, dollar index, eurocurrency, cryptocurrency, crude oil, Sales: 866-973-2077

How To Trade Stochastic, Keep an Eye on Stock Indices, Was This Just a Short Covering Rally? – Ira's Financial Video 3 2 2023.

Forex-Ology Simplified – 5 Unorthodox Actions Of A Winning Forex Strategy

Guideline number one: Finance is of utmost significance if you are in for a long period of time of TF. Nevertheless, when the price touches the upper band or the lower band, it in itself is not a trading signal.

Keep an Eye on Stock Indices, Was This Just a Short Covering Rally? – Ira's Financial Video 3 2 2023, Search more replays about How To Trade Stochastic.

Stochastic System – A Swing Trading Stochastics System For Huge Gains

Finance: this subject is among the most important things to think about when building the system. You can earn money in a ranging market, and here is how. By waiting on a better rate they miss out on the relocation.

Among the things a brand-new trader discovers within a couple of weeks or two of starting his new experience into the world of day trading is the distinction in between 3 symbol stocks and 4 symbol stocks.

The trader can monitor at which pivot level the cost has actually reached. if it addresses greater level, this can be presumed as severe point for the price, the trader then should examine the Stochastic Trading value. This will be indication that the currency is overbought and the trader can go short if it is greater than 80 percent for long time. the currency will go short to much at this case.

Try to find divergences, it tells you that the rate is going to reverse. If rate makes a new high and at the same time that the stochastic makes lower high. This is called a “bearish divergence”. The “bullish divergence” is when the rate makes a new low while the stochastic makes higher low.

OK now, not all breakouts are produced equivalent and you desire the ones where the odds are greatest. You’re searching for Stochastic Trading support and resistance which traders find crucial and you can frequently see these levels in the news.

MACD Crossover. After you have actually researched a stocks chart to see if the stock is trending, you need to now take a look at its MACD graph. MACD-stands for Moving Average Convergence-Divergence. This graph has 2 lines, the crossing of the 2 lines is a signal of a brand-new trend. The two lines include a sluggish line and a quick line. If there is a trend Stochastic Trading , where the crossover occurs informs you. The quick line has to cross above the slow line, or above the 0 line. The higher it ascends above the 0 line the stronger the uptrend. The lower it comes down below the 0 line the more powerful the downtrend. A trader or investor desires to capture stocks that are trending huge time, that is how it is possible to make great cash!

How do you draw trendlines? In an up pattern, link 2 lower highs with a line. That’s it! And in a sag, link two greater lows with a straight line. Now, the slope of a trendline can inform you a lot about the strength of a trend. For example, a steep trendline shows extreme bullish attitude of the buyers.

In common with virtually all elements of life practice is the crucial to getting all 4 components collaborating. This is now much easier to attain as numerous Forex websites have demonstration accounts so you can practice without risking any actual money. They are the nearest you can get to trading in genuine time with all the pressure of potential losses. But keep in mind – practice makes perfect.

This means you don’t need to be creative and have a college education. Doing this indicates you understand what your optimum loss on any trade will be rather than losing everything. In an up trend, connect 2 lower highs with a line.

If you are finding unique and entertaining comparisons related to How To Trade Stochastic, and Forex Strategies, Forex Day you are requested to join in email subscription DB for free.