Joynals Scalping Strategy Part One

Top YouTube videos top searched Learn Forex Trading, Daily Timeframe Strategy, Trading Strategies, and Stochastic Scalping Strategy, Joynals Scalping Strategy Part One.

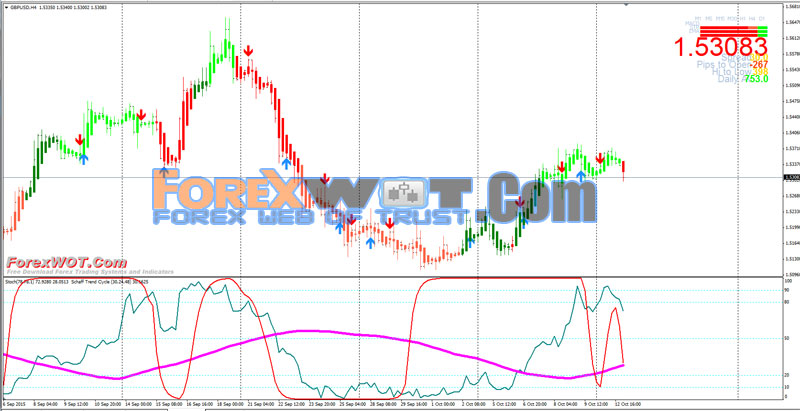

Simple Scalping Strategy using MACD, Stochastic Oscillator and Bollinger Band.

Details: http://www.pipsstreet.com/2011/08/17/joynals-scalping-strategy

Stochastic Scalping Strategy, Joynals Scalping Strategy Part One.

Daily Charts Strategy That Pulls 100-500+ Pips Per Trade

When the cost reaches the upper band, the market is thought about to be overbought. Is this indicator being used to a suitable timeframe and prices range? Two main points should be thought about for effective trading.

Joynals Scalping Strategy Part One, Get trending full length videos about Stochastic Scalping Strategy.

5 Suggestions To Trade Forex Effectively

The trade offered on a downturn in momentum after the first high at the 80.0 level. Usually, the greater the durations the more earnings the trader can get and also the more dangers. The 2nd indicator is the pivot point analysis.

Here I am going to share with you a basic tested methodology which is a proven way to make money in forex trading and will continue to work. Let’s look at the method and how it works.

You will understand it and this understanding causes self-confidence which leads onto discipline. People Stochastic Trading who purchase ready made systems do not understand what their doing their simply following and have no self-confidence.

Don’t forecast – you need to just act upon verification of cost modifications and this always means trading with cost momentum on your side – when applying your forex trading technique.

It should go up the earnings and cut the losses: when you see a pattern and utilize the system you built Stochastic Trading , it should continue opening the offer if the profits going high and seal the deal if the losses going on.

The secret to utilizing this simple system is not simply to search for overbought markets however markets are very Stochastic Trading overbought – the more a market is overbought, the larger the move down will be, so be selective in your trades.

Breakouts to brand-new market highs or lows and this is the method, we desire to use and it will always work as a lot of traders can not buy or sell breakouts. A lot of traders have the idea they want to buy low sell high, so when a break happens they want to get in at a better rate on a pullback however of course, on the big breaks the rate does NOT pullback and the trader is left believing what might have been.

This forex trading method illustrates how concentrating on a bearish market can benefit a currency that is overbought. Whether this method is wrong or ideal, it provides a good risk-reward trade off and is well established on its brief position in forex trading.

Although, it is not precisely sure-fire, you can still get a good upper hand by using it. A trader may focus on other charts but this will be the primary area of concern. The application is, as always, rate and time.

If you are looking most exciting comparisons relevant with Stochastic Scalping Strategy, and Forex Options Trading, Forex Trading Tips, Free Forex Buy and Sell Signals, Trade Plan please signup our subscribers database totally free.