Intraday trading using Stochastic RSI

Trending guide highly rated Trading System, Forex Trading Advice, and How To Use Stochastic For Day Trading, Intraday trading using Stochastic RSI.

Stochastic RSI :

What Is the Stochastic RSI?

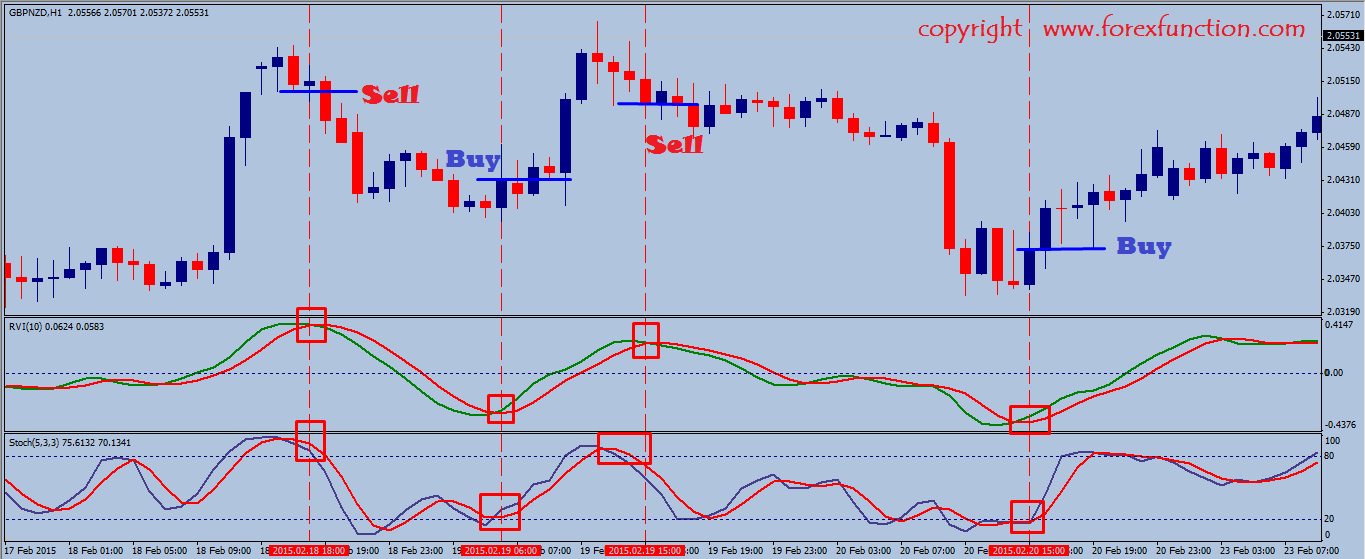

The Stochastic RSI (StochRSI) is an indicator used in technical analysis that ranges between zero and one (or zero and 100 on some charting platforms) and is created by applying the Stochastic oscillator formula to a set of relative strength index (RSI) values rather than to standard price data. Using RSI values within the Stochastic formula gives traders an idea of whether the current RSI value is overbought or oversold.

The StochRSI oscillator was developed to take advantage of both momentum indicators in order to create a more sensitive indicator that is attuned to a specific security’s historical performance rather than a generalized analysis of price change.

Crate your Wazirx account now:

https://wazirx.com/invite/uu5z4rsc

How To Use Stochastic For Day Trading, Intraday trading using Stochastic RSI.

3 Ways To Utilize Technical Analysis As Part Of Your Trading Strategy.

Though naturally applying an easy plan to a complicated market is not an easy job at all!

Path your stop up slowly and beyond typical volatility, so you do not get bumped out of the trend to quickly.

Intraday trading using Stochastic RSI, Explore interesting explained videos about How To Use Stochastic For Day Trading.

Who Wishes To Be A Forex Trading Millionaire?

Forex trading can be found out by anyone and simple forex trading systems are best. The easier your system is, the more profits it will create on a long run. Do not ever buy any forex robotic that does not have a money-back warranty.

Swing trading in Forex, is one of the best ways to earn money in currencies and the reason that is – its basic to understand, fun and interesting to do and can make substantial gains. Let’s take a look at the logic behind Forex swing trading and how to make regular profits.

Cost spikes always happen and they constantly fall back and the aim of the swing trader is – to offer the spike and make a quick revenue. Now we will look at a simple currency swing Stochastic Trading strategy you can use today and if you utilize it correctly, it can make you triple digit gains.

You then require to see if the chances are on your side with the breakout so you inspect cost momentum. There are great deals of momentum signs to help you time your move and get the speed of rate on your side. The ones you select refer individual preference however I like the ADX, RSI and stochastic. If my momentum estimation builds up I choose the break.

Stochastic Trading The swing trader buys into worry and sells into greed, so lets look at how the successful swing trader does this and look at a bullish trend as an example.

Do you have a stop loss or target to exit a trade? One of the greatest errors that forex traders made is trading without a stop loss. I have stressed lot of times that every position must have a stop loss however till now, there are much of my members still Stochastic Trading without setting a stop. Are you one of them?

The easier your system is, the more revenues it will create on a long term. When their trading system is easy to comprehend and follow, it is proven that traders run in an optimum state.

It takes persistence and discipline to wait on the best breakouts and then much more discipline to follow them – you need confidence and iron discipline – but you can have these if you wish to and quickly be piling up triple digit earnings.

You can use the strategy to generate your own signal to trade FX from day to day. As a market moves upward toward a resistance, stochastic lines ought to usually punctuate. By awaiting a much better rate they miss the relocation.

If you are looking best ever exciting comparisons related to How To Use Stochastic For Day Trading, and Forex Trading Strategies, Forex Trading Advice, Forex Day Trading Signals please subscribe our subscribers database totally free.