Improving Market Timing and Accuracy

Interesting full length videos highly rated Turtle Trading System, Forex Trading Strategies, Stock Market Trading System, and Stochastic Indicator Pdf, Improving Market Timing and Accuracy.

Join Stuart today as he demonstrates how two simple and popular indicators can be combined to help with accuracy and market timing. With professional demonstrations and invaluable information, this unmissable session with interactive Q&A includes:

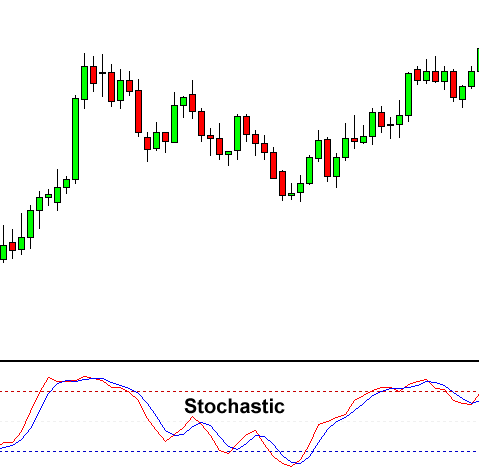

• Bollinger Bands and Stochastics

• Timing & Accuracy

• A complete countertrend, Mean Reverting system

Stochastic Indicator Pdf, Improving Market Timing and Accuracy.

Four Pointers To Effectively Trade Forex In An Unforeseeable Market

This strategy is simple and it is not made complex in any manner. The above technique is very simple but all the finest methods and systems are. They also need to try to find floorings and ceilings in a stock chart.

Improving Market Timing and Accuracy, Play more replays relevant with Stochastic Indicator Pdf.

Using Bollinger Bands For Trading Big Cap Stocks

Doing this suggests you understand what your optimum loss on any trade will be as opposed to losing everything. Bollinger bands are based upon standard discrepancy. Standard variance is the step of the spread of a set of number.

Here we are going to look at how to utilize forex charts with a live example in the markets and how you can use them to discover high chances possibility trades and the opportunity we are going to take a look at is in dollar yen.

Great ones to take a look at are Relative Strength Index (RSI) Stochastic Trading, Average Directional Motion (ADX) – There are others – however these are an excellent place to start.

Your Method: this mean the rules you use to identify the trend and the how the cash is handled in the forex account. As stated above, it needs to be basic to ease the use of it.

Stochastic Trading The swing trader buys into worry and sells into greed, so lets appearance at how the successful swing trader does this and take a look at a bullish trend as an example.

MACD Crossover. After you have looked into a stocks chart to see if the stock is trending, you need to now have a look at its MACD chart. MACD-stands for Moving Average Convergence-Divergence. This graph has 2 lines, the crossing of the 2 lines is a signal of a new trend. The 2 lines include a sluggish line and a fast line. If there is a pattern Stochastic Trading , where the crossover takes place informs you. The quick line needs to cross above the slow line, or above the 0 line. The higher it ascends above the 0 line the more powerful the uptrend. The lower it descends listed below the 0 line the stronger the sag. A trader or investor wishes to capture stocks that are trending big time, that is how it is possible to make great money!

When a cost is rising strongly. momentum will be increasing. What you need to try to find is a divergence of momentum from price i.e. costs continue to increase while momentum is rejecting. This is called divergence and trading it, is among the very best currency trading methods of all, as it’s cautioning you the pattern will reverse and prices will fall.

Remember you will always offer bit back at the end of a trend but the huge trends can last lots of weeks or months and if you get simply 70% of these trends, you will make a great deal of money.

You can utilize the method to generate your own signal to trade FX from day to day. As a market moves up towards a resistance, stochastic lines should generally punctuate. By awaiting a much better price they miss the relocation.

If you are searching updated and engaging comparisons about Stochastic Indicator Pdf, and Technical Indicators, Forex Online, Currency Trading Basics, Successful Trading you should list your email address in newsletter now.

![Super Easy Trend Trading Forex Strategy [FREE Trend Dashboard MT4 Indicator] Super Easy Trend Trading Forex Strategy [FREE Trend Dashboard MT4 Indicator]](https://Stochastictrader.com/wp-content/uploads/1698485527_Super-Easy-Trend-Trading-Forex-Strategy-FREE-Trend-Dashboard-MT4-200x137.jpg)