How to Utilise the Stochastic Oscillator

Interesting videos top searched Mechanical Forex Trading. Mechanical Forex Trading System, Trend Analysis, Forex Swing Trading Systems, and Stochastic Oscillator, How to Utilise the Stochastic Oscillator.

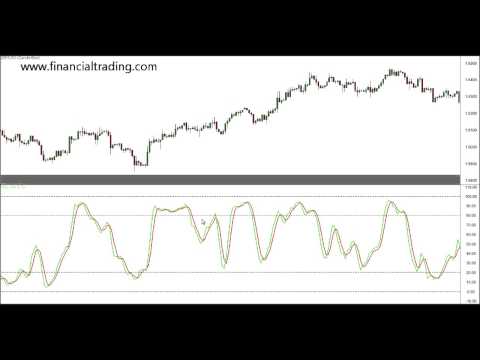

The stochastic indicator http://www.financialtrading.com/ is another indicator that appears below the price chart, and can range from a high or overbought level down to a low or oversold level. It is a little different from many other indicators, because it does not just use the closing price. Instead it works from the relationship of the closing price to the low price for the chosen number of days. Incidentally, there is another indicator called the Williams %R which works from the relationship of the closing price to the high price.

If a stock is in an uptrend, you would expect the price to close near the high of the daily range; similarly, in a downtrend you expect the closing price to be near the low. The stochastic line is called %K, and is calculated from the difference between the close and the lowest price for the chosen number of days, divided by the widest high low range during the period. Multiplying by a hundred to get a percentage, the normal range will be about 30% to 70%, or sometimes 20% to 80%.

In use, you can look at the level of the line compared to the boundary values for some indication of whether the stock is overbought or oversold. Be warned, however, because of the nature of a calculation you can see 100% when there is a highest high, even if the stock is still trending upwards. The same applies if there is a lowest low, which means the stochastic indicator works best when the stock is range trading, and not necessarily making new highs and lows.

The stochastic indicator plots a second line, which is called %D, and this is based on a three day moving average of the %K line. This gives a crossover line that tells you when to trade. The %K line is the faster line.

One of the major ways to use the stochastic oscillator is to watch for a divergence between the %D line and the price line when the %D line is in overbought or oversold territory. If the %D line is in the overbought region and declining while the price is still going up, this is a bearish divergence and when the %K line crosses it is a signal to sell. Similarly, if the %D line is in the oversold region, i.e. less than 20% to 30%, and starts coming up while the price is still declining, when the %K line crosses it this is a signal to buy.

The stochastic indicator became very popular in the 1990s, when the markets were opening up to the individual traders because of technology. At that time, it was viewed as a very effective indicator, which it can be as long as you recognize its limitations. Often it is combined with the RSI indicator, which appears in the next article, so that signals are only recognized when both oscillators are overbought or oversold.

Stochastic Oscillator, How to Utilise the Stochastic Oscillator.

Forex Trading Method – Based On This Method Piles Up Huge Profits

Often, either one or both the assistance and resistance are slanting. I will cover the short-term trading to begin with. Dow theory in nutshell says that you can use the previous cost action to anticipate the future cost action.

How to Utilise the Stochastic Oscillator, Get new videos about Stochastic Oscillator.

Forex Trading Strategy – Based On This Technique Piles Up Huge Profits

I use the moving averages to specify exit points in the following way. There are 3 levels that serve as resistance levels and other 3 that serve as assistance levels. If not updates are being made, then it’s purchaser beware.

Here I am going to share with you a simple proven methodology which is a proven way to make cash in forex trading and will continue to work. Let’s look at the approach and how it works.

Some these “high leaflets” come out the high tech sector, which consists of the Internet stocks and semiconductors. Other “high flyers” come from the biotech stocks, which have increased volatility from such news as FDA approvals. Due to the fact that Stochastic Trading there are less of them than on the NASDAQ that trade like a home on fire on the best news, after a while you will recognize the signs.

The truth is you do not need to be frightened with the concept of day trading. The appeal of day trading is that you do not need to have a Masters degree in Business from Harvard to make money doing this. Effective day traders comprise of a great deal of “Average Joes” like you and me. There are lots of successful day traders out there who had a truly difficult time just finishing high school.

Numerous indicators are readily available in order to identify Stochastic Trading the trends of the market. The most efficient indicator is the ‘moving average’. 2 moving typical signs ought to be utilised one quickly and another slow. Traders wait up until the fast one crosses over or below the slower one. This system is also understood as the “moving typical crossover” system.

You can spend around 30 minutes a day, trading by doing this with your forex Stochastic Trading strategy and after that go and do something else. You only need to check the prices one or two times a day which’s it.

If the rate action of the marketplace has actually moved sideways the trend line (18 bars) is in holding pattern, no action should be taken. you ought to be on the sidelines waiting on a breakout to one side or another.

It takes perseverance and discipline to await the best breakouts and then a lot more discipline to follow them – you require confidence and iron discipline – but you can have these if you wish to and soon be accumulating triple digit earnings.

You can use the strategy to generate your own signal to trade FX from day to day. As a market moves upward towards a resistance, stochastic lines ought to typically punctuate. By waiting for a much better rate they miss the move.

If you are searching more exciting videos about Stochastic Oscillator, and Forex Trading Ways, Simple Forex Trading please signup for email alerts service for free.