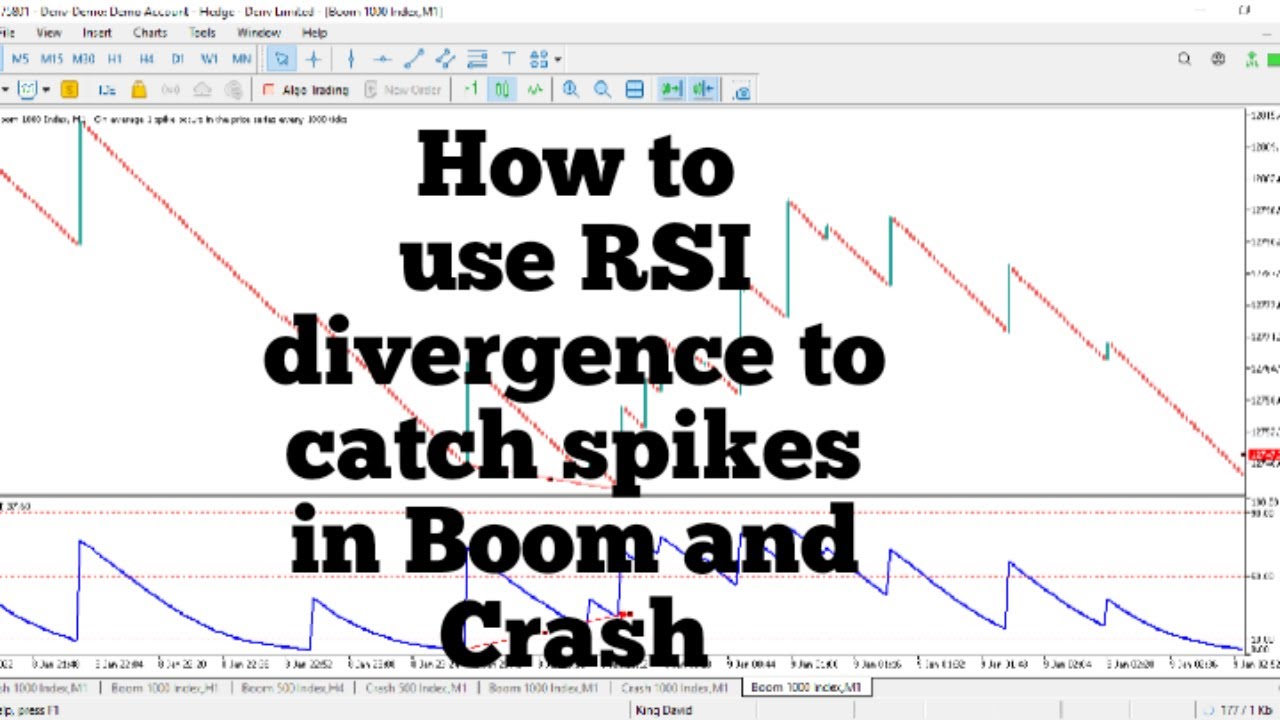

How to use the RSI divergence to catch spikes in Boom and Crash.

Interesting replays top searched Stock Investing, Simple System, and How To Trade Divergence, How to use the RSI divergence to catch spikes in Boom and Crash..

This strategy is one of the best and most powerful spike strategy with a very high win rate. In this video l am explaining how we can use the RSI regular divergence to catch spikes in Boom and Crash indices.

How To Trade Divergence, How to use the RSI divergence to catch spikes in Boom and Crash..

Forex Trading Methods For Success

Candlestick charts were developed by Japanese rice traders in the 16th century. This is really the finest method to provide a beginner the confidence you require to succeed. They are positioned side by side (tiled vertically).

How to use the RSI divergence to catch spikes in Boom and Crash., Watch most shared replays relevant with How To Trade Divergence.

Simple Systems For Trading Forex

The buzzword today in trading is “indications, signs, signs”. In an uptrend each new peak that is formed is greater than the previous ones. Drawing trendlines on these charts will show you where the marketplace is heading.

Pattern trading is certainly my preferred type of trading. When the market trends, you can make a lots of cash in just an extremely short time. Nevertheless, many of the time the marketplace isn’t trending. In some cases it simply ranges backward and forward. Does this mean you need to just stroll away? Hardly! You can generate income in a varying market, and here is how.

Some these “high flyers” come out the high tech sector, which includes the Internet stocks and semiconductors. Other “high flyers” come from the biotech stocks, which have increased volatility from such news as FDA approvals. After a while you will acknowledge the symbols Stochastic Trading since there are less of them than on the NASDAQ that trade like a house on fire on the right news.

You then need to see if the chances are on your side with the breakout so you check price momentum. There are great deals of momentum indications to help you time your relocation and get the speed of rate in your corner. The ones you choose refer personal choice but I like the ADX, RSI and stochastic. , if my momentum computation adds up I go with the break..

Lots of signs are offered in order to recognize Stochastic Trading the trends of the market. The most effective indicator is the ‘moving average’. 2 moving typical indications should be utilised one quickly and another sluggish. Traders wait until the quick one crosses over or listed below the slower one. This system is likewise called the “moving average crossover” system.

You can invest around 30 minutes a day, trading in this manner with your forex Stochastic Trading technique and after that do and go something else. You only need to examine the prices one or two times a day and that’s it.

Technical Analysis is based upon the Dow Theory. Dow theory in nutshell says that you can use the previous rate action to forecast the future cost action. These costs are expected to integrate all the publicly offered information about that market.

In this article is a trading method shown that is based upon the Bolling Bands and the stochastic indications. The method is easy to use and could be used by day traders that want to trade brief trades like 10 or 30 minute trades.

You will understand it and this understanding causes self-confidence which leads onto discipline. Based upon this information we correctly forecasted the marketplace was going down. This is to validate that the rate pattern is real.

If you are searching exclusive exciting comparisons related to How To Trade Divergence, and Free Forex Trading Systems, Forex Trend Following, Automatic Forex, Forex Software dont forget to subscribe our newsletter for free.