How to Use the Relative Strength index (RSI) | Day-Trading | RSI Intraday strategy

Interesting guide top searched Trading Tool, Stock Market Trading, Currency Trading Tutorial, Simple Forex Trading, and How To Use Stochastic Indicator Day Trading, How to Use the Relative Strength index (RSI) | Day-Trading | RSI Intraday strategy.

#bse #nifty #nse #tarzanbaba #rsi #RSI #forex

RSI Intraday Strategy | Most Simple way | Best Indicator for Intraday | new RSI | RSI

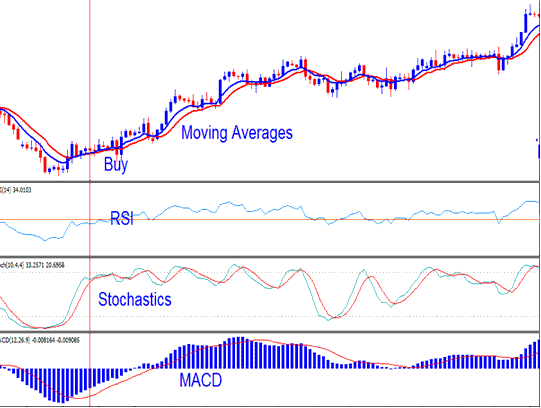

RSI indicator of the best indicator for over sold and bought you can easily identify which zone is the buy and sell zone ,best for beginners

pprsi link- https://in.tradingview.com/script/X72m4Hqh-PpSignal-RSI-Haiken-ashi/

How To Use Stochastic Indicator Day Trading, How to Use the Relative Strength index (RSI) | Day-Trading | RSI Intraday strategy.

Online Currency Trading – An Easy Method To Build Big Profits

Feelings are like springs, they extend and agreement, both for only so long. Forex swing trading is one of the best ways for amateurs to look for huge gains. The outer bands can be used for contrary positions or to bank profits.

How to Use the Relative Strength index (RSI) | Day-Trading | RSI Intraday strategy, Search most shared full length videos about How To Use Stochastic Indicator Day Trading.

Learn Forex Utilizing Pivot Points

Lots of people have considered purchasing a forex robot too assist them begin trading forex. There are lots of types of charts that a person can use in TA. I will cover the short term trading first up.

In these rather unsure monetary times, and with the volatile nature of the stock exchange today, you may be wondering whether you ought to pull out and head toward some other type of investment, or you might be seeking a much better, more trusted stock trading indicator. Moving your cash to FOREX is not the answer; it is time to hang in there and get your hands on an excellent stock trading indication. Attempt this now: Purchase Stock Attack 2.0 stock market software application.

Usage another indication to confirm your conclusions. If the resistance and the supportlines are touching, then, there is most likely to have a breakout. And if this is the Stochastic Trading scenario, you will not have the ability to presume that the rate will turn once more. So, you may simply desire to set your orders beyond the stretch ofthe resistance and the assistance lines in order for you to capture a taking place breakout. However, you should utilize another sign so you can validate your conclusions.

2 of the finest are the stochastic indication and Bollinger band. Utilize these with a breakout technique and they offer you an effective mix for looking for huge gains.

While the rules offer you factors to enter trades, it does not suggest that the cost will go in your wanted direction. The idea is “Do not anticipate the marketplace”. Instead, you need to let the cost motion lead your way, knowing at anytime price could alter and go in a various instructions. Stochastic Trading You have to provide up and stop out if the rate does not move in your favor.

You can spend around thirty minutes a day, trading in this manner with your forex Stochastic Trading technique and after that do and go something else. When or twice a day and that’s it, you just need to check the costs.

Breakouts to new market highs or lows and this is the method, we desire to use and it will always work as most traders can not buy or offer breakouts. Most traders have the concept they desire to buy low sell high, so when a break happens they desire to get in at a better price on a pullback however of course, on the huge breaks the price does NOT pullback and the trader is left believing what might have been.

In this short article is a trading method revealed that is based on the Bolling Bands and the stochastic signs. The method is easy to utilize and could be used by day traders that wish to trade short trades like 10 or thirty minutes trades.

You will understand it and this understanding causes confidence which leads onto discipline. Based upon this details we correctly anticipated the market was going down. This is to confirm that the rate trend holds true.

If you are searching rare and exciting comparisons related to How To Use Stochastic Indicator Day Trading, and Advantages of Technical Analysis, How to Trade Options, Traders Think, Automatic Trading System you are requested to join in email subscription DB totally free.