How To Use The MACD! EXPLAINED For Traders📊 #shorts

Latest full videos relevant with Technical Analysis, Trading Forex Online, and Best Stochastic Setting For Divergence, How To Use The MACD! EXPLAINED For Traders📊 #shorts.

The MACD Explained For Traders📊

📈 Live Sessions & Trading Guidance: https://upgrade.chat/mattfxs

📲 Public Telegram: https://t.me/fxs_trading

Follow Me On:

☑️TikTok: https://vm.tiktok.com/ZM8Lrn6bv/

☑️Instagram: https://instagram.com/fxstrading

☑️Twitter: https://twitter.com/matt_fxs

📩Contact: matt@fxstrading.com

#priceaction #forex #macd

Best Stochastic Setting For Divergence, How To Use The MACD! EXPLAINED For Traders📊 #shorts.

Online Currency Trading – A Simple Way To Construct Big Profits

This is to validate that the price trend holds true. There are two ways to identify which currency to trade and whether to go long (buy), or go short (sell). These are the long term investments that you do not hurry into.

How To Use The MACD! EXPLAINED For Traders📊 #shorts, Get trending explained videos related to Best Stochastic Setting For Divergence.

Forex Online Trading – Making Money In A Week Or Two

It appears that we now only put worth on intricacy or what we often label as “sophisticated”. It is very important to search for confirmation that the price momentum is about to turn. Do you have a stop loss or target to leave a trade?

Among the aspects that you require to find out in Forex trading is understand the significance of currency trading charts. The primary function of Forex charts is to assist making assumptions that will cause much better decision. However before you can make great one, you first should find out to understand how to use them.

Forex is an acronym of foreign exchange and it is a 24hr market that opens from Sunday night to Friday night. It is one of the most traded market worldwide with about $3 trillion being traded every day. With this plan, you can trade by yourself schedule and exploit cost Stochastic Trading variations in the market.

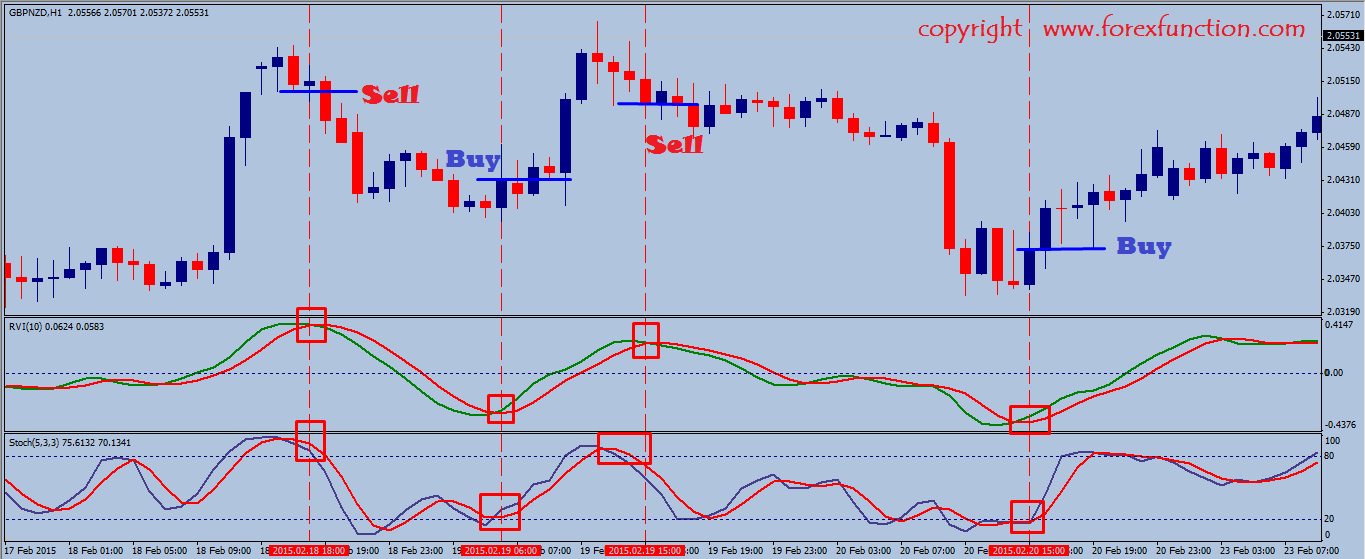

Try to find divergences, it tells you that the price is going to reverse. , if price makes a brand-new high and at the very same time that the stochastic makes lower high.. This is called a “bearish divergence”. The “bullish divergence” is when the price makes a brand-new low while the stochastic makes greater low.

Many indications are offered in order to identify Stochastic Trading the patterns of the market. The most efficient indicator is the ‘moving average’. Two moving average indicators must be utilised one fast and another sluggish. Traders wait until the quick one crosses over or listed below the slower one. This system is also known as the “moving average crossover” system.

MACD Crossover. After you have actually researched a stocks chart to see if the stock is trending, you should now take a look at its MACD graph. MACD-stands for Moving Average Convergence-Divergence. This chart has 2 lines, the crossing of the two lines is a signal of a new pattern. The two lines include a quick line and a slow line. Where the crossover occurs informs you if there is Stochastic Trading a trend. The fast line needs to cross above the slow line, or above the 0 line. The greater it rises above the 0 line the more powerful the uptrend. The lower it descends listed below the 0 line the stronger the sag. A trader or financier wishes to capture stocks that are trending big time, that is how it is possible to make great money!

Technical Analysis is based on the Dow Theory. Dow theory in nutshell states that you can use the previous price action to predict the future cost action. These costs are expected to include all the publicly available details about that market.

This is a simple Forex trading technique which is rational, east to find out and is an ageless method to earn money. You can easily learn a swing trading technique in a week or to and then, your all set to achieve trading success in less than an hour a day and earn yourself some fantastic Forex profits.

They do this by getting the right responses to these million dollar concerns. This analysis technique depends on determining numerous levels on the chart. This is something that you are not going to see on an easy backtest.

If you are looking rare and engaging comparisons about Best Stochastic Setting For Divergence, and Stock Prices, Forex Indicators please list your email address for email alerts service now.