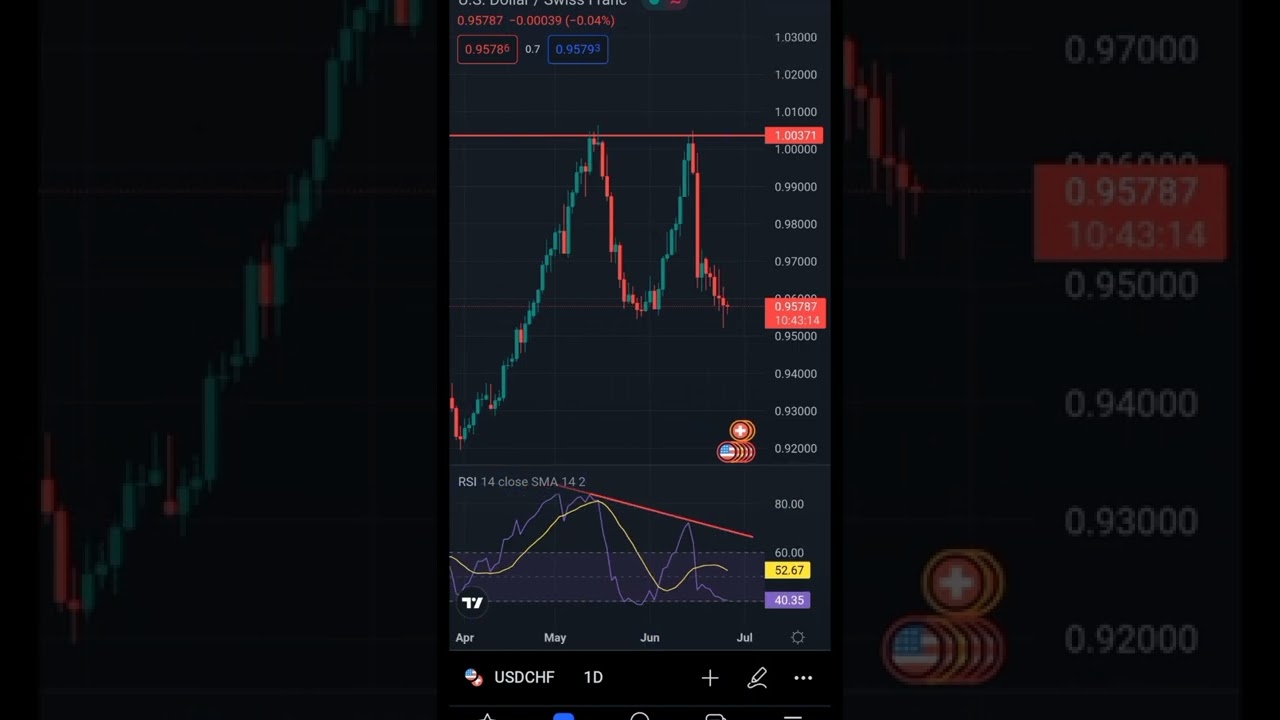

How to use RSI indicators For Trading||Bearish Divergence #tradinganalyst #stockmarket #rsi#shots

Top YouTube videos related to How to Trade Support and Resistance, Forex Trading Course, Stock Signals, and Bearish Divergence Stochastic, How to use RSI indicators For Trading||Bearish Divergence #tradinganalyst #stockmarket #rsi#shots.

Bearish Divergence Stochastic, How to use RSI indicators For Trading||Bearish Divergence #tradinganalyst #stockmarket #rsi#shots.

Using The Very Best Forex Chart Indicator To Your Advantage

This Daily Timeframe strategy uses only 2 indicators. I highly recommend you get at least a megabyte or more of memory. It reveals you the crossovers of bearish and bullish divergence of oversold and overbought levels.

How to use RSI indicators For Trading||Bearish Divergence #tradinganalyst #stockmarket #rsi#shots, Play most searched full length videos about Bearish Divergence Stochastic.

How To Use Stochastics To Discover Incredible Forex Trades

It is a software, which studies and analysis and allows newbies to leap in and make profits. Trading is always short term while investing is long term. The charts reveal that the marketplace is moving up again.

Today numerous traders buy commodity trading systems and invested cash on costly software application when really all they require is to do a little bit of research study on the net and build their own.

It is this if one should know anything about the stock market. It is ruled by feelings. Feelings resemble springs, they stretch and contract, both for only so long. BB’s procedure this like no other indication. A stock, especially commonly traded large caps, with all the basic research in the world already done, will only lie inactive for so long, and after that they will move. The relocation after such inactive durations will often be in the instructions of the general pattern. And the next Stochastic Trading move will likely be up as well if a stock is above it’s 200 day moving average then it is in an uptrend.

An excellent trader not only thinks about the heights of earnings but also contemplates the danger included. The trader should be ready to acknowledge how much they are prepared to lose. The upper and lower limit should be clear in the trade. The trader needs to decide how much breathing room he is ready to provide to the trade and at the same time not risk too much likewise.

Discipline is the most vital part of Stochastic Trading. A trader needs to establish guidelines for their own selves and STAY WITH them. This is the vital secret to a successful system and disciplining yourself to stay with the system is the primary step towards an effective trading.

Stochastic Trading If the break occurs you go with it, you require to have the state of mind that. Sure, you have missed out on the very first little bit of profit however history reveals there is normally plenty more to follow.

The simpler your system is, the more earnings it will produce on a long run. It is proven that traders operate in an optimal state when their trading system is simple to comprehend and follow.

If the price goes to a higher pivot level (which can be assistance or resistance) and the stochastic is high or low for a big time, then a reversal will occur. Then a new trade can be gotten in appropriately. Hence, in this forex trading method, w wait up until the market saturate to high or low and then offer or buy depending upon the situation.

I strongly suggest you get at least a megabyte or more of memory. I do the same thing with my existing customers. I utilize the moving averages to define exit points in the list below way.

If you are searching more engaging videos about Bearish Divergence Stochastic, and Forex Day, Forex Professional System Trading, Stochastic Line, Forex Trading Platform you are requested to subscribe in email subscription DB for free.