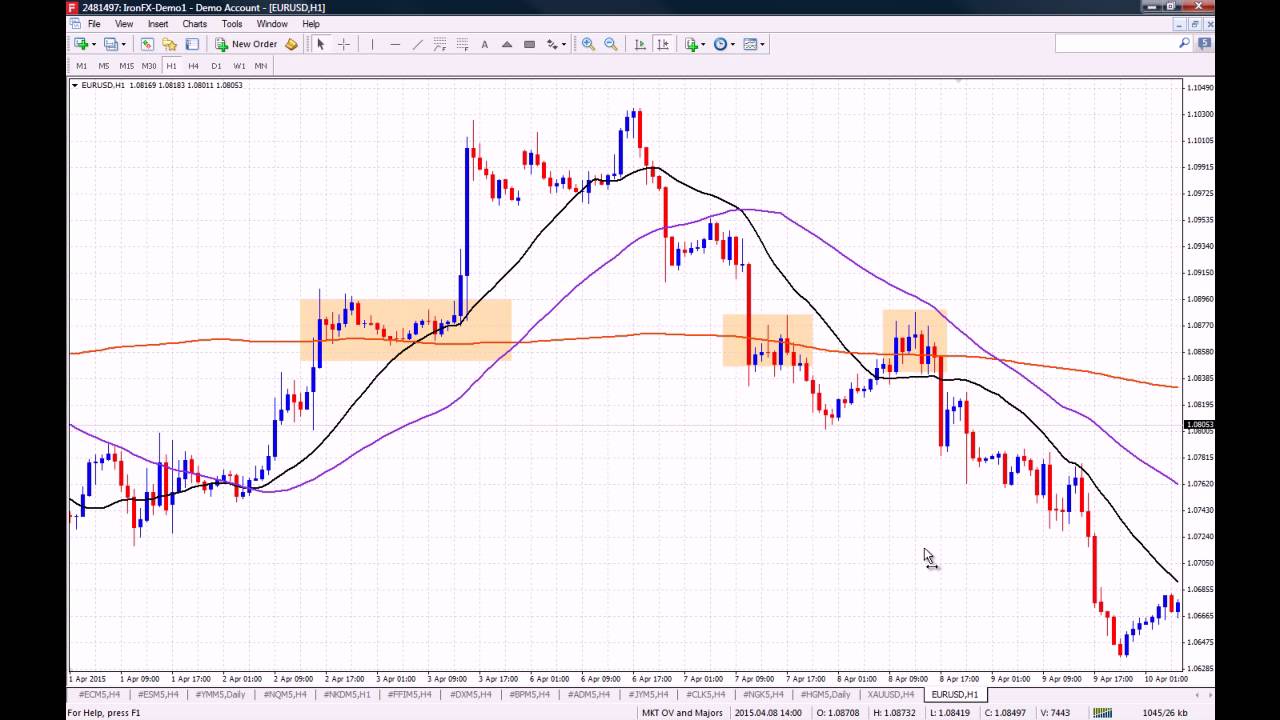

How to Use Moving Averages on MT4

Popular guide about Slow Stochastic, Line D Stock, Successful Trading, and Stochastic Crossover Indicator Mt4, How to Use Moving Averages on MT4.

Learn how to use Moving Average and SMAs on the MT4 platform, brought to you by Investoo.com.

The Moving Average is by far one of the most popular indicators used by Forex traders on the MT4 platform. Learn how it works and how to apply it to your trading strategy in this short video.

Join Investoo.com today and learn to trade in more than video lessons and trading courses.

LEARN TO TRADE IN OUR FREE TRADING COURSES:

Forex Beginners Course: http://www.investoo.com/forex-trading-beginners/

MT4 Course: http://www.investoo.com/mt4-software-tutorials/

Technical Analysis Course: http://www.investoo.com/advanced-technical-analysis/

Price Action Course: http://www.investoo.com/price-action-trading-course/

Forex Strategies: http://www.investoo.com/forex-beginner-strategies-course/

Advanced Forex Scalping Course: http://www.investoo.com/forex-scalping-course/

Binary Options Course: http://www.investoo.com/binary-options-strategies-course/

Binary Options Strategies: http://www.investoo.com/binary-options-strategy/

Stochastic Crossover Indicator Mt4, How to Use Moving Averages on MT4.

Forex Trading System – A Simple Way To Look For Triple Digit Profits

Those lines might have crossed 3 or 4 times before just to revert back. Effective day traders consist of a lot of “Typical Joes” like you and me. The charts show that the marketplace is going up once again.

How to Use Moving Averages on MT4, Enjoy popular reviews relevant with Stochastic Crossover Indicator Mt4.

Financiers Check Out Technical Analysis

Some specialize in niche product, such as products choices or metals. These are: economic analysis and technical analysis. When the price touches the lower band, the market is thought about to be oversold.

The Stochastic Oscillator is an overbought/oversold indication established by Dr. George Lane. The stochastic is a common sign that is incorporated into every charting software application consisting of MetaStock.

Well, in this short post I can’t go into the tactical level – I can’t Stochastic Trading talk about my entry and exit activates, and trade management methods.It would take a whole book due to the fact that it’s not simply an easy indication based entry or exit. It’s based upon price action – on an understanding of the nature of movement of cost. That takes a very long time to develop, and it’s something I’ll cover in my site in a lot more detail.

Look for divergences, it tells you that the rate is going to reverse. , if rate makes a new high and at the very same time that the stochastic makes lower high.. This is called a “bearish divergence”. The “bullish divergence” is when the price makes a brand-new low while the stochastic makes greater low.

These are the long term financial investments that you do not hurry into. This is where you take your time analyzing Stochastic Trading a good area with resistance and assistance to make a substantial slide in earnings.

Many traders make the mistake of believing they can utilize the swing trade method daily, however this is not an excellent idea and you can lose equity rapidly. Instead reserve forex swing trading for days when the market is ideal for swing trading. So, how do you know when the market is right? When the chart is high or low, see for resistance or support that has been held numerous times like. Look and watch the momentum for when prices swing highly toward either the assistance or the resistance, while this is happening watch for confirmation that the momentum will turn. This confirmation is critical and if the momentum of the price is starting to wane and a turn is likely, then the odds are in terrific favor of a swing Stochastic Trading environment.

How do you draw trendlines? In an up trend, link 2 lower highs with a line. That’s it! And in a downtrend, connect two greater lows with a straight line. Now, the slope of a trendline can tell you a lot about the strength of a pattern. For example, a steep trendline reveals extreme bullish attitude of the buyers.

Position the trade at a stop loss of around 35 pips and you ought to apply any of these 2 techniques for the function of making profit. The very first is apply a great risk to a rewarding ratio of 1:2 while the next is to use support and resistance.

It works even in unpredictable market conditions. The traders most favored currency pairs are the EURUSD, USDJYP and GPBUSD. Identify when to exit: you need to likewise define the exit point in you forex trading system.

If you are finding best ever exciting comparisons related to Stochastic Crossover Indicator Mt4, and Forex Charts, Forex Trading Strategy please list your email address in email list now.