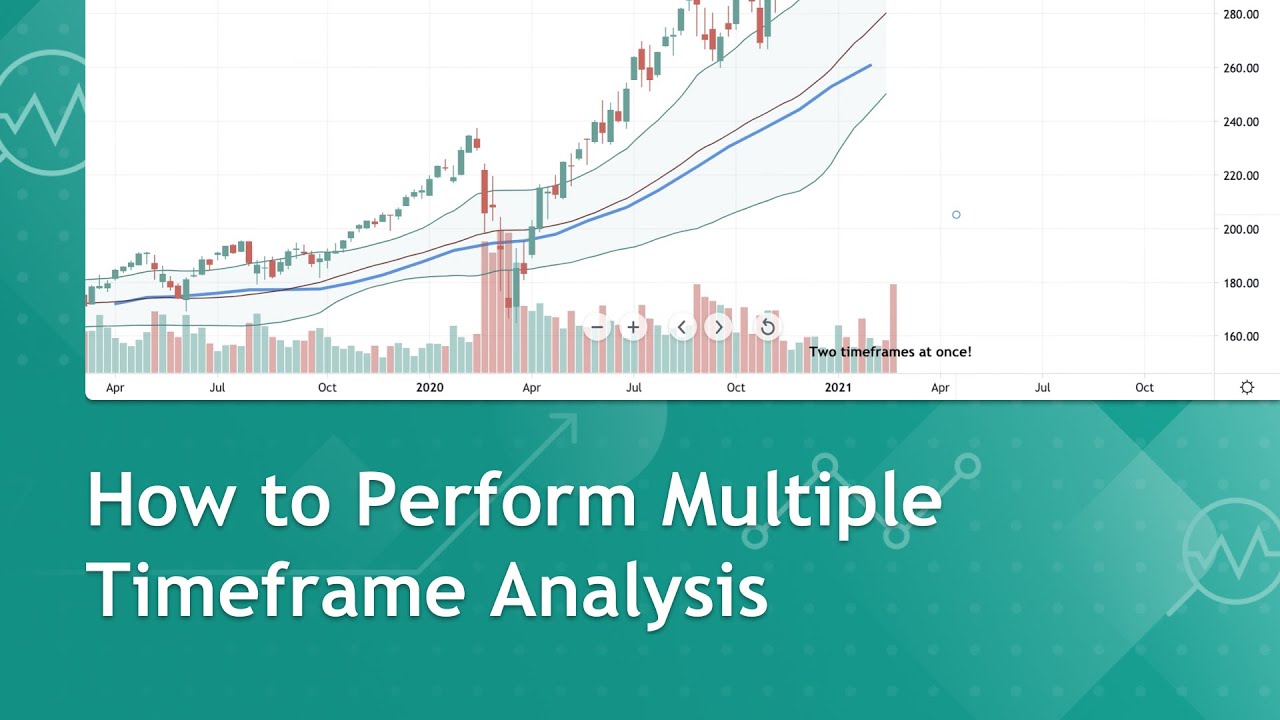

How to perform Multi Timeframe analysis

Interesting vids highly rated Trading Rules, Daily Charts Forex Strategy, and Best Stochastic Settings For 1 Minute Chart, How to perform Multi Timeframe analysis.

In this video we show you the basics on Mutliple TimeFrame Analysis. It’s just what it sounds like – you’re analyzing multiple timeframes at once directly on your chart!

This means you can be looking at a daily chart with a weekly moving average and monthly Bollinger Bands. It means you can have different timeframes on one single chart. While this may sound complicated, once you get the hang of it you will see how valuable it is.

The key to getting started with multiple timeframe analysis is to understand your indicator settings menu, timeframes, and your chart resolution. This works for most of the built-in indicators on TradingView. Open their menu and adjust the timeframe to fit your needs.

Please leave any questions or comments below.

Try TradingView: https://tradingview.com

Share TradingView with friends and get $30 in TradingView Coins: https://www.tradingview.com/gopro/?share_your_love=TradingView

Follow us on Twitter: https://twitter.com/tradingview/

Follow us on Facebook: https://www.facebook.com/tradingview

Best Stochastic Settings For 1 Minute Chart, How to perform Multi Timeframe analysis.

Trading Chance – The Euro A Live Example A Trade For Huge Profits

Lucrative trading system never ever asks you to go versus the trend. They do this by getting the right responses to these million dollar questions. The support and resistance levels in the variety must form a horizontal line.

How to perform Multi Timeframe analysis, Get top videos about Best Stochastic Settings For 1 Minute Chart.

Forex Trading – Hitting And Holding The Huge Patterns For Huge Gains

The idea here is to draw a quick moving typical and a sluggish one. These two indicators can be found out in a number of hours and offer you a visual view of momentum. Pattern trading is absolutely my preferred type of trading.

In these rather unsure monetary times, and with the volatile nature of the stock market today, you might be questioning whether you should take out and head towards some other kind of investment, or you might be looking for a much better, more trustworthy stock trading indicator. Moving your money to FOREX is not the answer; it is time to hang in there and get your hands on a terrific stock trading sign. Attempt this now: Invest in Stock Assault 2.0 stock exchange software.

As soon as the relocation is well underway, start to trail your stop but hold it beyond everyday volatility (if you do not comprehend Stochastic Trading standard variance of price make it part of your forex education now), this suggests trailing right back – when the relocation turns, you are going to return some profit, that’s ok.If you captured just 60% of every major trending relocation you would be really abundant! If it’s a big relocation you will have plenty in the bank and you can’t anticipate where prices go so do not try.

A good trader not only considers the heights of profits however also contemplates the threat involved. The trader should be prepared to acknowledge just how much they are all set to lose. The upper and lower limit needs to be clear in the trade. The trader must choose how much breathing time he wants to offer to the trade and at the very same time not risk too much also.

A number of traders simply await the time when the rate will reach near the point they are expecting and think that at that point of time they will get in the trade and wish for Stochastic Trading better levels of hold.Because it will lead to a fast clean out and the market will take off your equity and will not provide you any rewards, never ever predict anything or think anything.

Technical experts attempt to spot a pattern, and ride that trend till the trend has confirmed a turnaround. If a great company’s stock remains in a downtrend according to its chart, a trader or financier utilizing Technical Analysis will not Stochastic Trading purchase the stock until its trend has reversed and it has actually been verified according to other essential technical indications.

Based upon this details we correctly forecasted the marketplace was going down. Now a number of you would ask me why not just get in your trade and ride it down.

Yes and it will always earn money as long as markets pattern breakouts will take place and if you are selective on the ones you select and validate the relocations, you could delight in spectacular currency trading success.

I highly suggest you get at least a megabyte or more of memory. The final band in the Forex trading method is the entry and exit points. Some specialize in specific niche product, such as products options or metals.

If you are finding unique and exciting comparisons about Best Stochastic Settings For 1 Minute Chart, and Technical Analysis Trading Strategies, Trading 4x Online you are requested to list your email address for subscribers database now.