How to easily find swing trade opportunities

Latest clips relevant with Trading With Stochastics, Currency Trading Education, Range Trading Winning, Effectively Trade Forex, and What’s Swing Trading, How to easily find swing trade opportunities.

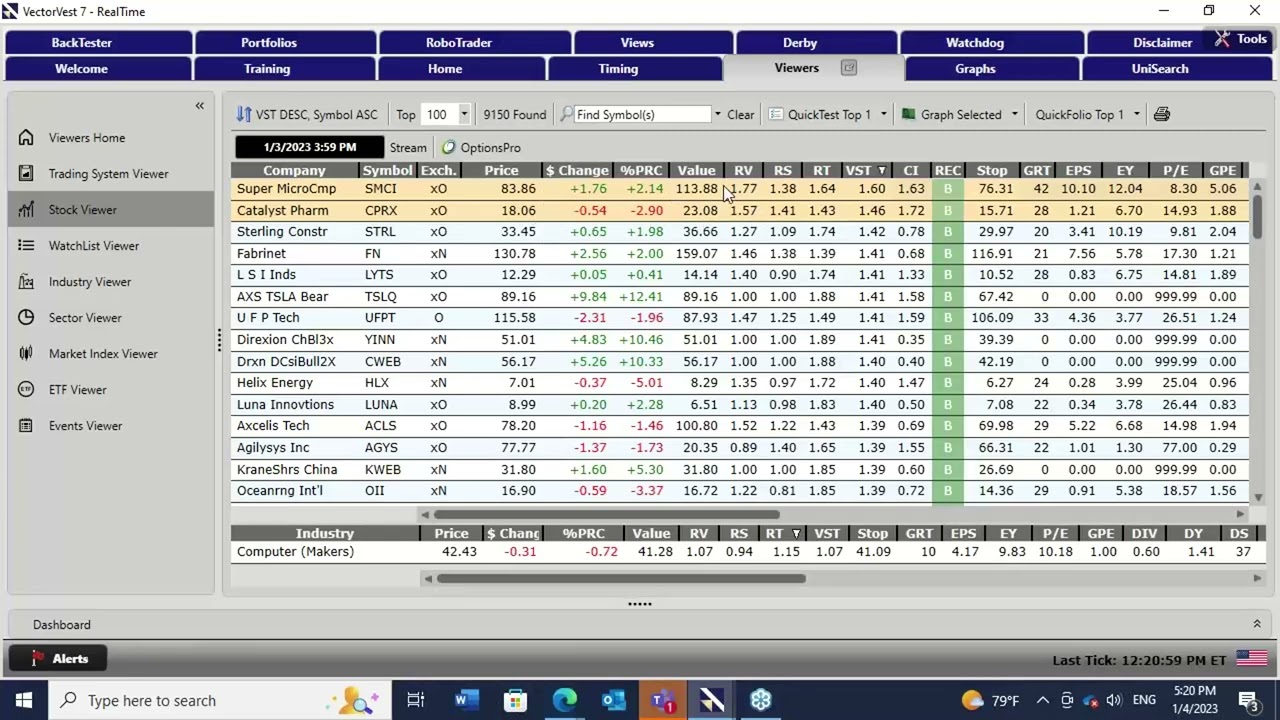

In the video David discusses Market Timing in the USA stock market where only the shortest duration measure is positive for buying stocks. He will wait for a medium term Market Timing system to turn up before buying any stocks. In the remainder of the video he shows how the power of VectorVest can pinpoint swing trading opportunities with little fuss and effort.

What’s Swing Trading, How to easily find swing trade opportunities.

Forex Divergences – The Key To Generating Income Everyday In The Currency Markets

And if this is the circumstance, you will not have the ability to presume that the rate will turn as soon as more. Utilize the technical indicators you discover and evaluate them with historic data.

How to easily find swing trade opportunities, Enjoy trending replays related to What’s Swing Trading.

3 Things You Require To Understand About Variety Trading

Forex trading can be learned by anyone and easy forex trading systems are best. The easier your system is, the more revenues it will create on a long run. Do not ever purchase any forex robotic that does not have a money-back guarantee.

If you want to win at forex trading and enjoy currency trading success possibly one of the easiest ways to achieve it is to trade high chances breakouts. Here we will take a look at how you can do this and make big profits.

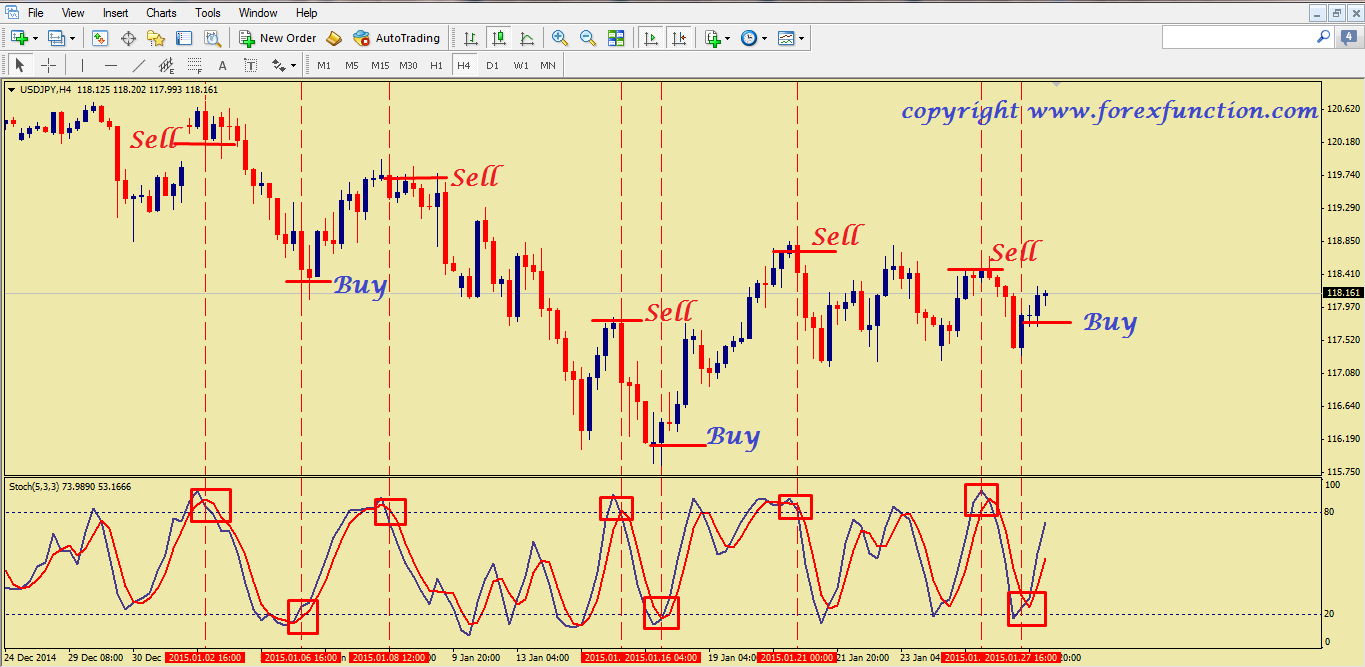

The trader can keep track of at which pivot level the price has reached. if it goes at higher level, this can be presumed as extreme point for the rate, the trader then needs to check the Stochastic Trading value. This will be indication that the currency is overbought and the trader can go short if it is greater than 80 percent for long time. the currency will go short to much at this case.

The fact is you do not need to be daunted with the concept of day trading. The appeal of day trading is that you don’t need to have a Masters degree in Service from Harvard to earn money doing this. Successful day traders comprise of a great deal of “Typical Joes” like you and me. There are lots of effective day traders out there who had a truly bumpy ride simply finishing high school.

Resistance is the location of the chart where the rate stops increasing. No brand-new highs have been satisfied in the last few Stochastic Trading sessions and the rate remains in a sideways direction.

MACD Crossover. After you have looked into a stocks chart to see if the stock is trending, you ought to now take a look at its MACD graph. MACD-stands for Moving Typical Convergence-Divergence. This graph has 2 lines, the crossing of the two lines is a signal of a brand-new trend. The 2 lines include a slow line and a fast line. Where the crossover takes place tells you if there is Stochastic Trading a pattern. The quick line has to cross above the sluggish line, or above the 0 line. The higher it ascends above the 0 line the more powerful the uptrend. The lower it descends below the 0 line the stronger the downtrend. A trader or financier wishes to catch stocks that are trending big time, that is how it is possible to make great cash!

How do you draw trendlines? In an up pattern, connect two lower highs with a line. That’s it! And in a downtrend, link 2 greater lows with a straight line. Now, the slope of a trendline can tell you a lot about the strength of a pattern. For example, a steep trendline shows extreme bullish mindset of the buyers.

Is it really that easy? We believe so. We were right last week on all our trades, (and we did even better in energies check out our reports) naturally we could have been incorrect, but our entries were timed well and had close stops for risk control.

Also, check the copyright at the bottom of the page to see how frequently the page is updated. I strongly recommend you get at least a megabyte or more of memory. This depends on how frequently one refers the trade charts.

If you are looking more exciting reviews relevant with What’s Swing Trading, and Automatic Trading System, Effectively Trade you are requested to list your email address for a valuable complementary news alert service for free.