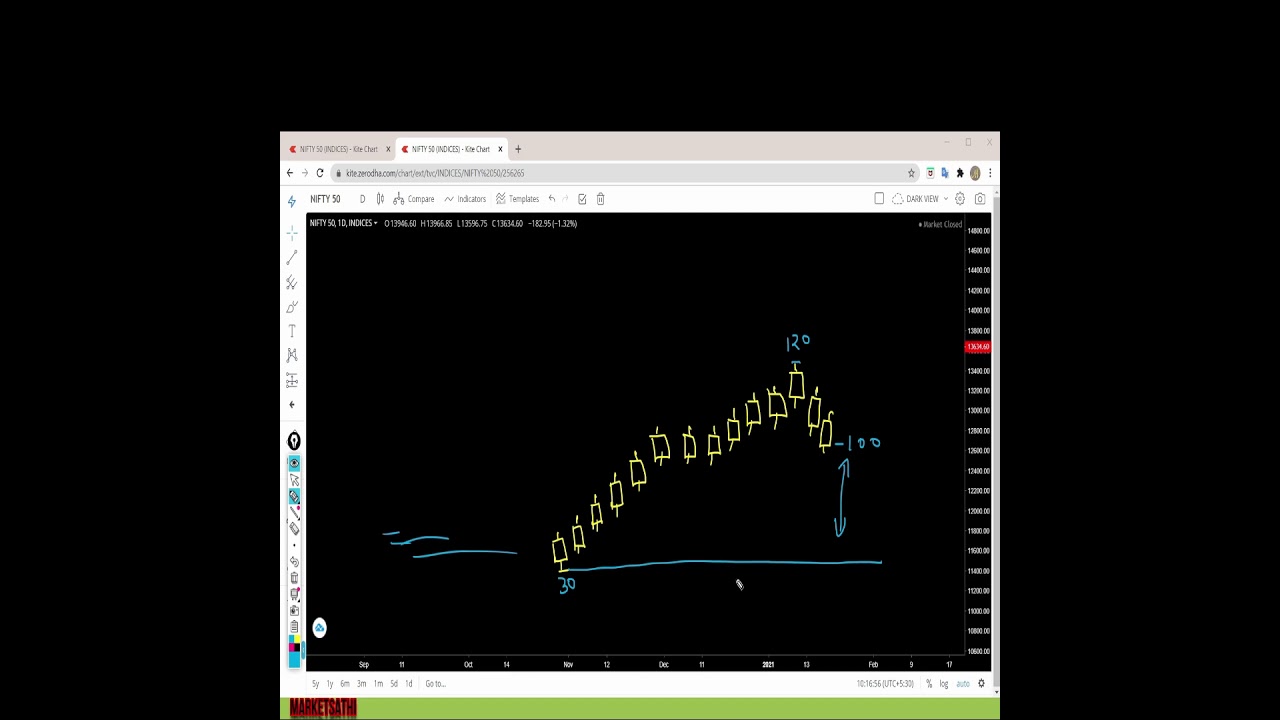

How to calculate stochastic indicators by MarketSathi || #shorts

New guide about Turtle Trading, Commodity Markets, Trading Rules, Trading 4x Online, and Using Stochastics For Day Trading, How to calculate stochastic indicators by MarketSathi || #shorts.

Full Video Link- https://youtu.be/zD8ifJazuK8 our Other Video – How to see investing.com part 1 -https://youtu.be/Lskv15JG0Hc …

Using Stochastics For Day Trading, How to calculate stochastic indicators by MarketSathi || #shorts.

Forex Swing Trading – An Easy Classic Way To Make Triple Digit Profits!

The simpler your system is, the more earnings it will create on a long term. When the quick one crosses the sluggish one, this will suggest a pattern. A basic product trading system like the above, traded with discipline is all you need.

How to calculate stochastic indicators by MarketSathi || #shorts, Explore more replays related to Using Stochastics For Day Trading.

Stock Market Trading Systems – Part 2

There are several meanings to the terms vary trading. The ones you select refer personal preference but I like the ADX, RSI and stochastic. However how to anticipate that the existing trend is ending or is about to end?

Trading on the daily charts is a a lot easier method as compared to trading intraday. This everyday charts strategy can make you 100-500 pips per trade. You do not require to being in front of your computer for hours when trading with this daily charts technique.

If you purchase and offer these breaks, you can participate and stick with every significant trend. Breakout Stochastic Trading is an easy, proven way to earn money – but most traders can’t do it and the factor is easy.

You need less discipline than pattern following, since you don’t have to hold positions for weeks on end which can be difficult. Rather, your losses and profits come rapidly and you get plenty of action.

Now I’m not going to get into the information as to why cycles exist and how they belong to price action. There is much written on this to fill all your peaceful nights in checking out for decades. If you invest simply a bit of time watching a MACD or Stochastic Trading indication on a price chart, you ought to currently be persuaded that cycles are at work behind the scenes. Simply view as they swing up and down between extremes (overbought and oversold zones) to get a ‘feel’ for the cycle ups and downs of rate action.

In summary – they are leading indications, to evaluate the strength and momentum of cost. You desire momentum to support any break prior to performing your Stochastic Trading signal as the chances of continuation of the trend are greater.

To see how overbought the currency is you can use some momentum indications which will give you this info. We do not have time to describe them here however there all easy to apply and learn. We like the MACD, the stochastic and the RSI but there are a lot more, just select a couple you like and utilize them.

I call swing trading “hit and run trading” which’s what your doing – getting high chances set ups, hitting them and after that banking profits, before the position can turn back on you. You will soon be confident adequate to applly it for long term currency trading success if you find out and practice the above method for a week or so.

I utilize the moving averages to specify exit points in the list below way. In summary – they are leading signs, to determine the strength and momentum of rate. It is one of the simplest tools utilized in TA.

If you are searching instant exciting comparisons about Using Stochastics For Day Trading, and Forex Trading Tips, Currency Trading, Online Trading, Thinslice Trading dont forget to signup in a valuable complementary news alert service for free.