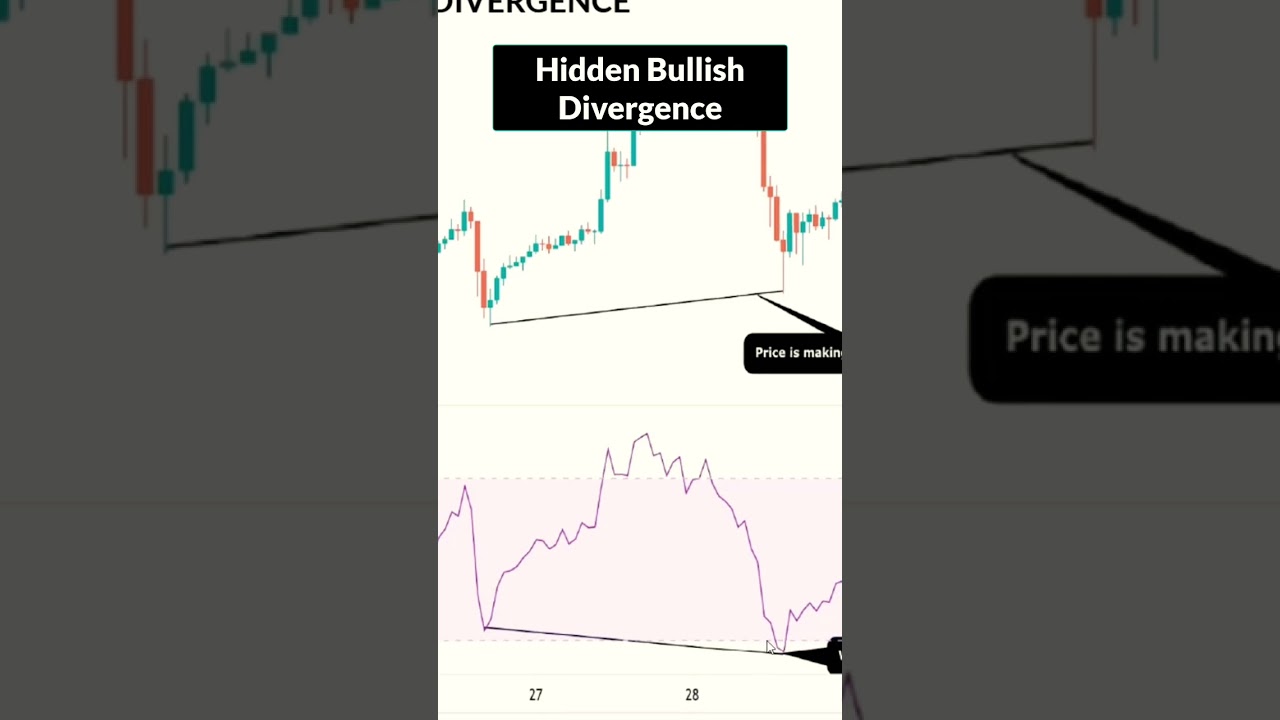

Hidden Bullish Divergence | RSI Divergence | RSI Divergence Trading Strategy #shorts #rsidivergence

Top videos highly rated Learn Forex Trading, Daily Timeframe Strategy, Trading Strategies, and How To Trade Divergence, Hidden Bullish Divergence | RSI Divergence | RSI Divergence Trading Strategy #shorts #rsidivergence.

In this video, I’m going to share what is RSI Divergence and how you can use RSI Divergence trading strategy in your day trading either you trade in crypto, forex or stock. This RSI divergence strategy is one of the best trading strategy day traders use for trading.

An RSI divergence occurs when price moves in the opposite direction of the RSI. In other words, a chart might display a change in momentum before a corresponding change in price.

A bullish divergence occurs when the RSI displays an oversold reading followed by a higher low that appears with lower lows in the price. This may indicate rising bullish momentum, and a break above oversold territory could be used to trigger a new long position.

A bearish divergence occurs when the RSI creates an overbought reading followed by a lower high that appears with higher highs on the price.

___________________________________________________

💰 Open an account with Best Broker using this link: https://one.exness-track.com/a/s8lrhfkg2n

📈 Create PRO Tradingview Account: https://www.tradingview.com/?aff_id=108810

💹 Lux Algo Premium Buy/Sell Indicator: https://bit.ly/3Q14WCC

___________________________________________________

How To Trade Divergence, Hidden Bullish Divergence | RSI Divergence | RSI Divergence Trading Strategy #shorts #rsidivergence.

5 Actions To Trading Success Utilizing Technical Analysis

Among the most significant mistakes that forex traders made is trading without a stop loss. This is Bill William’s Accelerator Oscillator (Air Conditioner) and the Stochastic Oscillator. The majority of traders can’t purchase these breaks.

Hidden Bullish Divergence | RSI Divergence | RSI Divergence Trading Strategy #shorts #rsidivergence, Explore trending high definition online streaming videos relevant with How To Trade Divergence.

3 Ways To Use Technical Analysis As Part Of Your Trading Technique.

A vital starting point is adequate cash to make it through the initial stages. The most risky period are the durations at which economy brand-new are occurred. Then a new trade can be entered accordingly.

One of the aspects that you require to discover in Forex trading is understand the importance of currency trading charts. The primary function of Forex charts is to assist making assumptions that will cause much better decision. But before you can make great one, you initially need to discover to understand how to utilize them.

Excellent ones to look at are Relative Strength Index (RSI) Stochastic Trading, Typical Directional Motion (ADX) – There are others – but these are a great location to begin.

Try to find divergences, it tells you that the cost is going to reverse. If rate makes a brand-new high and at the same time that the stochastic makes lower high. This is called a “bearish divergence”. The “bullish divergence” is when the rate makes a new low while the stochastic makes higher low.

Numerous traders simply await the time when the rate will reach near the point they are anticipating and believe that at that point of time they will get in the trade and hope for Stochastic Trading much better levels of hold.Due to the fact that it will lead to a quick wipe out and the market will take off your equity and will not give you any rewards, never anticipate anything or guess anything.

Numerous traders make the error of thinking they can use the swing trade technique daily, however this is not a great concept and you can lose equity rapidly. Instead reserve forex swing trading for days when the market is ideal for swing trading. So, how do you know when the marketplace is right? See for resistance or assistance that has actually been held a number of times like when the chart is high or low. See the momentum and look for when prices swing highly towards either the assistance or the resistance, while this is happening watch for confirmation that the momentum will turn. This confirmation is critical and if the momentum of the price is beginning to subside and a turn is likely, then the chances remain in great favor of a swing Stochastic Trading environment.

Check some momentum signs, to see how overbought momentum is and a great one is the stochastic. We do not have time to discuss it in full information here so look it up, its a visual sign and will only take 30 minutes approximately to find out. Try to find it to end up being overbought and after that. merely look for the stochastic lines to turn and cross down and get short.

So get learn Forex swing trading systems and choose one you like and you could soon be making big routine profits and delighting in currency trading success.

Utilize these with a breakout approach and they give you an effective combination for looking for huge gains. This suggests reducing your prospective loses on each trade using a stop loss.

If you are finding exclusive exciting reviews relevant with How To Trade Divergence, and Momentum Trading, Automatic Forex you should join for email list now.