Gold Technical Analysis May 11 2023

Best clips relevant with Forex Day Trading, Simple System, and Day Trading With Stochastic, Gold Technical Analysis May 11 2023.

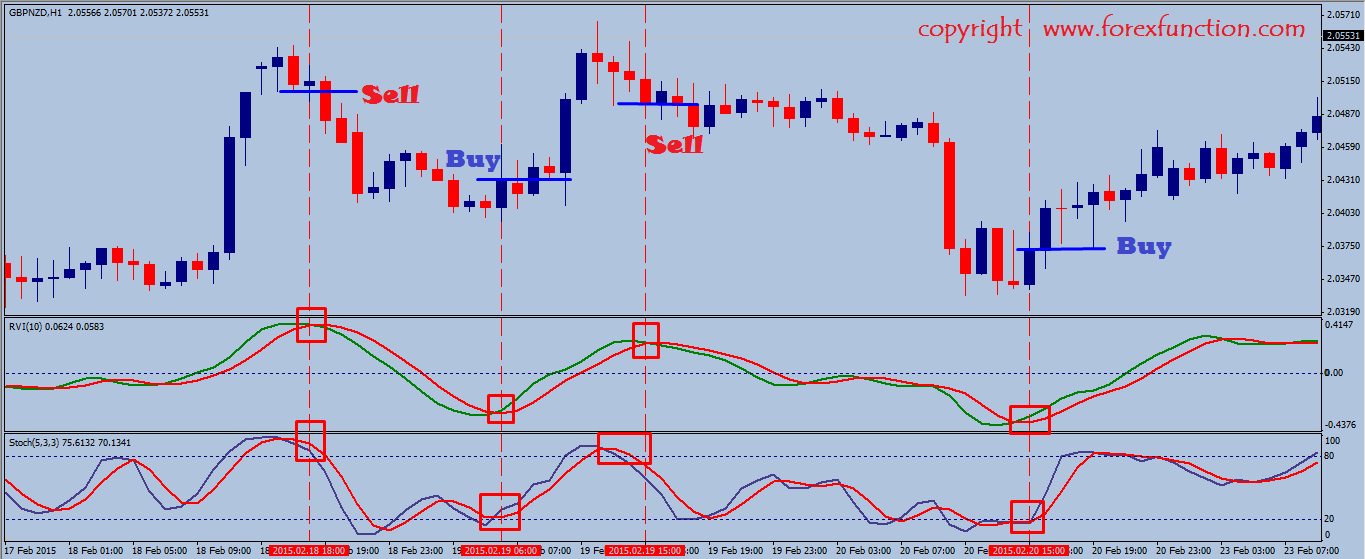

Gold Technical Analysis May 11, 2023 using Stochastic and Commodity Channel Index.

Welcome to Pete’s investing updates

in this strategy edition we will be talking about trading using the Commodity Channel Index Indicator with a weighted moving average, and applying a % Gain and Average Down approach.

#Gold #sharetrading #averagedown #MovingAverage #CCI #CommodityChannelIndex

Become a PetesInvesting Patreon member with same day updates on

https://www.patreon.com/petesinvesting

Average Down Trading Recap

CCI1500 and MA400 with Moving Average Difference

PART 2 CCI1500 and MA400 with Moving Average Difference

CCI350 Commodity Channel Index strategy

A Very Simple Moving Average (EMA9 MA20)

Stochastic trading strategy quickie

Don’t forget…

First always remember to review petesinvesting channel playlists

Updated every weekend I look at the charts of some select blue chip shares as well as some key world sharemarket indices.

As always click on the SUBSCRIBE button as well as the NOTIFICATION bell and LIKE this video to support this channel.

If you want me to review an Index a share, a commodity or a FOREX pair, put it in the comments and I’ll cover it in a future video

Things

to consider:

•We track and trade on a Daily chart since we want to back test and see results of trades back during the GFC as well as Covid effects.

•We track and back test Revenue over Drawdown requirements

(as a %) to optimize our returns with less exposure.

•Brokerage is included in our back testing. I use $8 per transaction each time we buy or sell. Revenue shown may change slightly depending on your brokerage costs.

•Our Back testing transacts with $2,000 per trade. ie everytime you purchase $2k worth of shares in the instrument you want to invest.

To increase Revenue (ie returns) simply increase this. But beware this will also increase your Drawdown, so ensure you factor in this with your money management strategy.

Lets get started

Remember…

Don’t forget to subscribe / LIKE and hit the notification bell and review the PETESINVESTING channel playlists for further reference.

Supporting videos:

Become a PetesInvesting Patreon member with same day updates on

https://www.patreon.com/petesinvesting

Alligator strategy explained:

Bitchute updates:

https://www.bitchute.com/channel/pTjWs2A7K9Br/

Money Management:

Average Down Do’s and Don’ts

Simple Trading Strategy with CCI and Avg Down technique

Simple trading strategy https://youtu.be/ibVzRwCX-3Q

Average Down Strategy https://youtu.be/RFCb5S78D8o

Day Trading With Stochastic, Gold Technical Analysis May 11 2023.

Forex Trading Strategy – A Basic System For Triple Digit Gains

This preparation could mean the distinction between great earnings and excellent loss. Do not listen to traders who try and tell you trading product systems requires to be made complex, it does not.

Gold Technical Analysis May 11 2023, Explore popular updated videos relevant with Day Trading With Stochastic.

Trading Chance – The Euro A Live Example A Trade For Big Profits

Numerous individuals do not recognize that the forex trading robotic software will assist handle charting. The software the traders utilize at the online trading platforms is more easy to use than it was years back.

You can so this by utilizing the stochastic momentum indication (we have written regularly on this and it’s the very best indication to time any trade and if you are not farmiliar with it discover it now) look for the stochastic lines to decline and cross with bearish divergence and go short.

Forex is an acronym of forex and it is a 24hr market that opens from Sunday evening to Friday evening. It is the most traded market worldwide with about $3 trillion being traded every day. With this plan, you can trade on your own schedule and exploit rate Stochastic Trading changes in the market.

You then require to see if the chances are on your side with the breakout so you inspect rate momentum. There are lots of momentum indications to help you time your relocation and get the velocity of price on your side. The ones you choose refer personal choice but I like the ADX, RSI and stochastic. If my momentum estimation includes up I opt for the break.

No issue you state. Next time when you see the earnings, you are going to click out which is what you do. You were in a long position, a red candle light shows up and you click out. Whoops. The marketplace continues in your instructions. You stand there with 15 pips and now the marketplace is up 60. Frustrated, you choose you are going to either let the trade play out to your Stochastic Trading profit target or let your stop get activated. You do your research. You go into the trade. Boom. Stopped out. Bruised, damaged and deflated.

If you captured just 50% of every major pattern, you would be extremely abundant; accept short-term dips versus Stochastic Trading you and keep your eyes on the larger long term reward.

While these breaks can often be tough to take, if the assistance or resistance is legitimate, the odds favour a big move – but not all breakouts are developed equivalent.

Yes and it will constantly earn money as long as markets trend breakouts will take place and if you are selective on the ones you choose and confirm the moves, you could enjoy spectacular currency trading success.

No matter whether the trend of a stock is going up or down, it will constantly relocate waves. Besides, dealing with a lot of different currency sets is complicated and confusion causes errors.

If you are looking instant exciting comparisons about Day Trading With Stochastic, and Swing Trading Forex, Online Currrency Trading, Effectively Trade, Free Forex Buy and Sell Signals you are requested to subscribe in email list now.

![[LIVE] Day Trading | Losing $1,100 on My First Trade (day trader life…) [LIVE] Day Trading | Losing $1,100 on My First Trade (day trader life…)](https://Stochastictrader.com/wp-content/uploads/1639153290_LIVE-Day-Trading-Losing-1100-on-My-First-Trade-200x137.jpg)